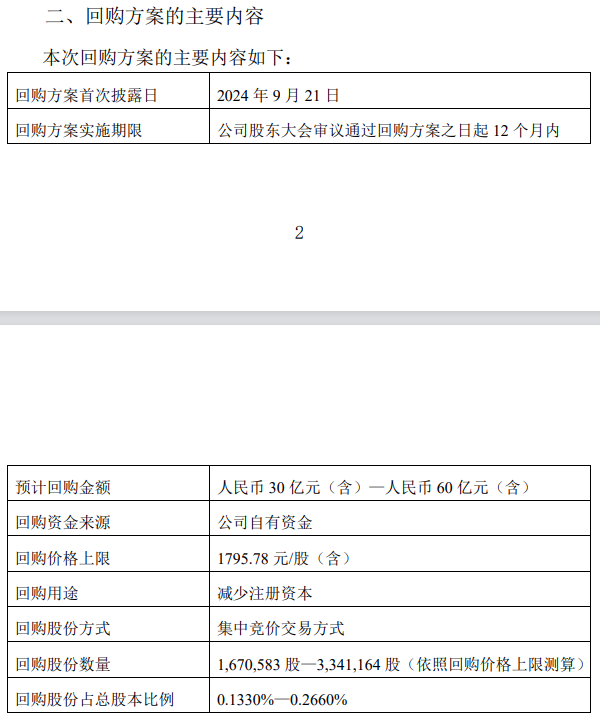

①回購股份用途爲註銷並減少公司註冊資本。②回購股份價格不超過1795.78元/股(含)。

財聯社9月20日訊,上市23年以來,分紅大戶貴州茅台首次宣佈回購股份。

今日晚間,貴州茅台發佈公告稱,公司擬以集中競價交易方式回購公司股份,回購金額爲30億元—60億元,資金來源爲公司自有資金,回購股份用途爲註銷並減少公司註冊資本,回購股份價格不超過1795.78元/股(含),回購股份期限爲自公司股東大會審議通過回購方案之日起12個月內。

公告顯示,以目前公司總股本12.56億股爲基礎,按照回購資金總額不低於人民幣30億元(含)且不超過人民幣60億元(含)、回購價格上限1795.78元/股進行測算,股本變動數量預計減少167.06萬股至334.12萬股,回購並註銷後,公司總股本預計將減少爲12.55億股至12.53億股。

公告顯示,以目前公司總股本12.56億股爲基礎,按照回購資金總額不低於人民幣30億元(含)且不超過人民幣60億元(含)、回購價格上限1795.78元/股進行測算,股本變動數量預計減少167.06萬股至334.12萬股,回購並註銷後,公司總股本預計將減少爲12.55億股至12.53億股。

根據公告,截至2024年6月30日,公司總資產爲人民幣2792.07億元,歸屬於上市公司股東的淨資產爲人民幣2185.76億元,現金和現金等價物爲人民幣1452.67億元。假設本次回購股份的資金上限人民幣60億元全部使用完畢,回購資金約佔公司截至2024年6月30日總資產的2.1489%、歸屬於上市公司股東淨資產的2.7450%、現金和現金等價物的4.1303%。

貴州茅台在公告中稱,本次回購股份的目的是爲維護公司及廣大投資者的利益,增強投資信心。

歷史上,貴州茅台主要以分紅的方式回饋投資者,是有名的分紅大戶。根據Wind數據,貴州茅台上市以來累計分紅金額爲2326億元。2024年8月8日,貴州茅台公佈了《2024—2026年度現金分紅回報規劃》,2024年至2026年度,公司每年度分配的現金紅利總額不低於當年實現歸母淨利潤的75%,原則上每年度進行兩次分紅。

此次回購也被視爲貴州茅台維護股價的一個重要手段,今年貴州茅台股價走勢疲軟,自5月以來,該股股價呈現明顯的下跌態勢,昨日最低價達到1245.83元/股,創出了近4年以來新低。截至今日收盤,貴州茅台股價報收1263.92元/股,今年該股股價跌幅超過25%。

除股價外,茅台酒價格也不再堅挺。今日酒價披露的最新批發參考價顯示,2024年飛天茅台散甁價格報2365元/瓶,與上一日持平;2024年飛天茅台原箱報2470元/瓶,較上一日再跌20元。

此外,據報道,北京多位黃牛透露,已經不再回收龍年生肖茅台,稱其批價已經跌破發售價(2499元/瓶),酒商對於茅台後續價格走勢感到擔憂。

酒業評論員表示,茅台市場價格的變化主要還是受市場和經濟環境變化影響,目前捨得、國窖1573、五糧液的回收價格也表現低迷,黃牛甚至開始拒收所有酒廠的文創產品。預計今年「十一」到春節前,白酒需求依然會較爲低迷,具體情況還要進一步觀望。

公告显示,以目前公司总股本12.56亿股为基础,按照回购资金总额不低于人民币30亿元(含)且不超过人民币60亿元(含)、回购价格上限1795.78元/股进行测算,股本变动数量预计减少167.06万股至334.12万股,回购并注销后,公司总股本预计将减少为12.55亿股至12.53亿股。

公告显示,以目前公司总股本12.56亿股为基础,按照回购资金总额不低于人民币30亿元(含)且不超过人民币60亿元(含)、回购价格上限1795.78元/股进行测算,股本变动数量预计减少167.06万股至334.12万股,回购并注销后,公司总股本预计将减少为12.55亿股至12.53亿股。