The market pulled back Friday after the S&P 500 and Dow hit record closes Thursday. Nine out of 11 sectors of the S&P 500 were falling, but energy stocks climbed: in the pursuit of AGI, Microsoft and OpenAI are planning to revive Three Mile Island.

Just past 1:50 pm ET the $S&P 500 Index (.SPX.US)$ fell 0.13%, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.22%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.31%.

The Federal Open Market Committee lowered the target Federal Funds rate by 50 basis points, citing the progress in inflation and slowing job gains. Policymakers took the rate to a range of 4.75 to 5%, noting that the committee has gained greater confidence that inflation is moving sustainably toward 2%.

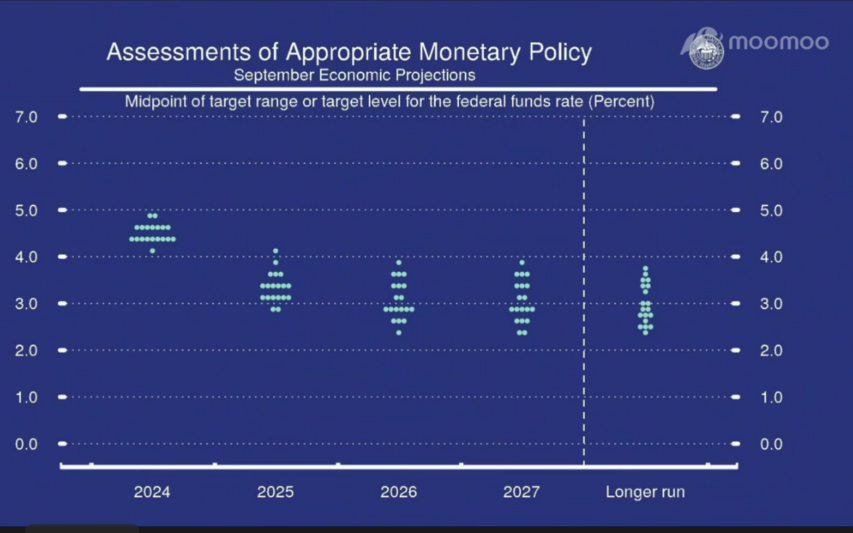

Futures numbers tracked by CME FedWatch tool expected a 50 bp cut. Based on the Fed's dot plot of rate expectations, they put a midpoint rate target at about 4.4% by the end of 2024, meaning a range of about 4.20%-4.60%, or two 25 bps cuts at each of the next two meetings.

Futures numbers tracked by CME FedWatch tool expected a 50 bp cut. Based on the Fed's dot plot of rate expectations, they put a midpoint rate target at about 4.4% by the end of 2024, meaning a range of about 4.20%-4.60%, or two 25 bps cuts at each of the next two meetings.

Fed Press Conference Broadcast, Reposted by moomoo

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

Yesterday, users said the market finally looked healthy again.

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.