China National Software & Service Company Limited (SHSE:600536) shareholders have had their patience rewarded with a 25% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.5% over the last year.

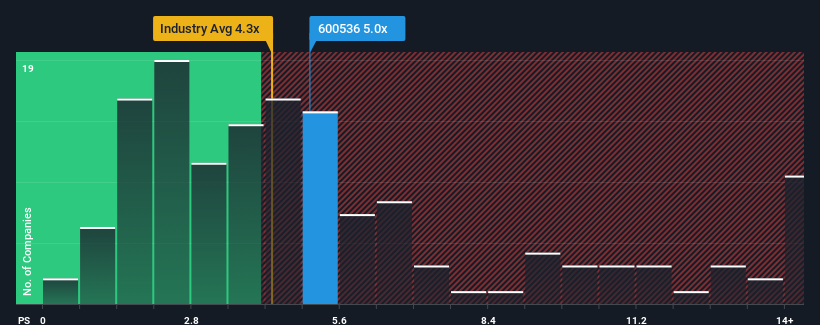

Even after such a large jump in price, it's still not a stretch to say that China National Software & Service's price-to-sales (or "P/S") ratio of 5x right now seems quite "middle-of-the-road" compared to the Software industry in China, where the median P/S ratio is around 4.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does China National Software & Service's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, China National Software & Service's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China National Software & Service will help you uncover what's on the horizon.How Is China National Software & Service's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like China National Software & Service's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like China National Software & Service's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 24% over the next year. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that China National Software & Service's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On China National Software & Service's P/S

Its shares have lifted substantially and now China National Software & Service's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that China National Software & Service maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for China National Software & Service with six simple checks.

If these risks are making you reconsider your opinion on China National Software & Service, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.