Smith Micro Software, Inc. (NASDAQ:SMSI) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 90% share price decline over the last year.

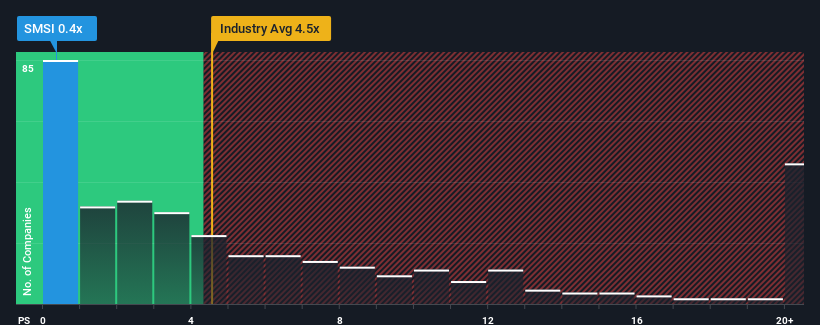

Although its price has surged higher, Smith Micro Software may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.5x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Smith Micro Software's Recent Performance Look Like?

Smith Micro Software could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Smith Micro Software's future stacks up against the industry? In that case, our free report is a great place to start.How Is Smith Micro Software's Revenue Growth Trending?

In order to justify its P/S ratio, Smith Micro Software would need to produce anemic growth that's substantially trailing the industry.

In order to justify its P/S ratio, Smith Micro Software would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 31%. The last three years don't look nice either as the company has shrunk revenue by 42% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Smith Micro Software's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Smith Micro Software's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Smith Micro Software's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 3 warning signs for Smith Micro Software (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Smith Micro Software, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.