Why Hidden Debt Matters

Investors often focus on basic financial figures, but it's essential to consider hidden debt when evaluating a company's true worth.

Insights from Viridian Capital Advisors reveal that overlooked liabilities can significantly change how we view a company's value, making it crucial to dig deeper.

- Get Benzinga's exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can't afford to miss out if you're serious about the business.

Viridian's Approach To Valuation

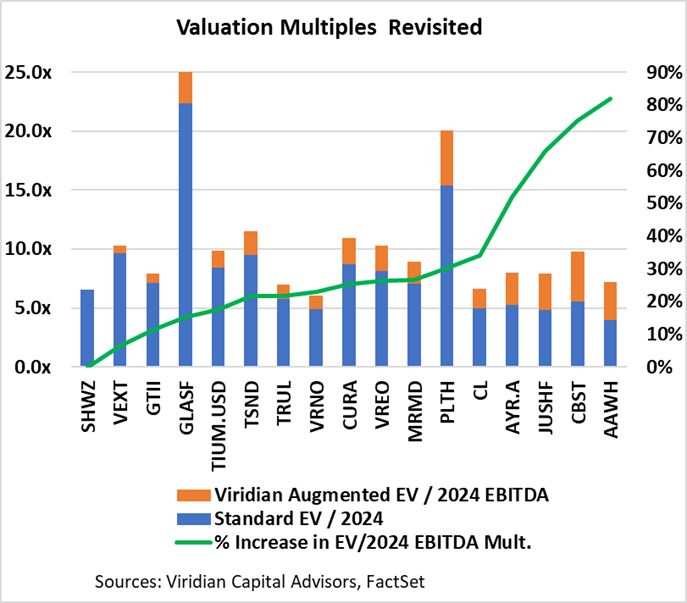

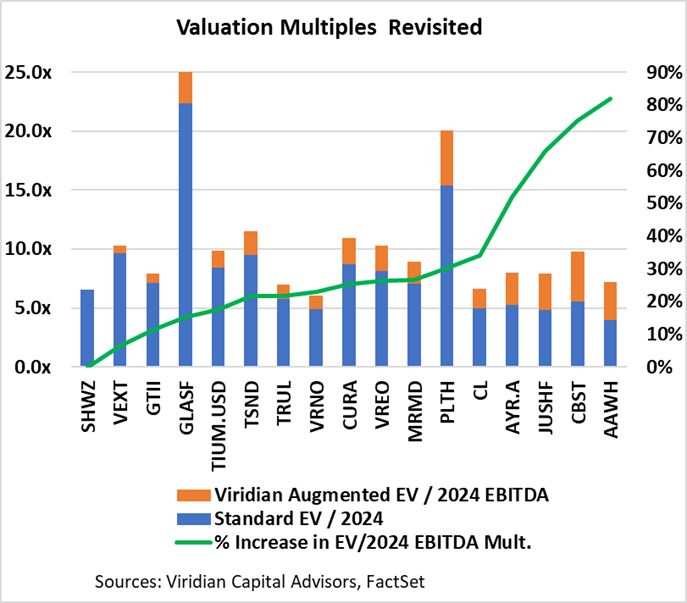

Typically, enterprise value (EV) is calculated using standard methods. However, Viridian takes a more thorough approach by including lease obligations and overdue tax payments.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

The Impact On Investor Decisions

A recent graph compares traditional valuation methods with Viridian's updated figures. Companies that appeared cheap may be less undervalued than previously believed, particularly those burdened by significant lease or tax liabilities.

Courtesy of Viridian Capital Advisors

Courtesy of Viridian Capital Advisors Market Perception of Undervalued Cannabis Stocks

Companies like Planet 13 Holdings (OTC:PLNH) and MariMed (OTC:MRMD), which initially appeared undervalued based on traditional EV/EBITDA multiples, saw significant valuation increases when Viridian Capital's augmented EV calculations factored in hidden debt. This reveals that investors who overlook these liabilities might mistakenly view these companies as more attractive investments than they truly are.

Impact of Debt on Investor Sentiment

In contrast, companies such as Schwazze (OTC:SHWZ), Vext Science (OTC:VEXTF), and Green Thumb Industries (OTC:GTII) show minimal changes in valuation, suggesting cleaner balance sheets that could strengthen investor confidence.

为什么隐藏债务很重要

投资者经常关注基本财务数据,但在评估公司真实价值时考虑隐藏债务是至关重要的。

Viridian Capital Advisors的见解显示,被忽视的负债可能会显著改变我们对公司价值的看法,因此深入挖掘至关重要。

- 在Benzinga获取独家分析,并每天免费获得关于大麻业务和市场的头条新闻。立即订阅我们的通讯,认真对待业务,您不容错过。

Viridian的估值方法

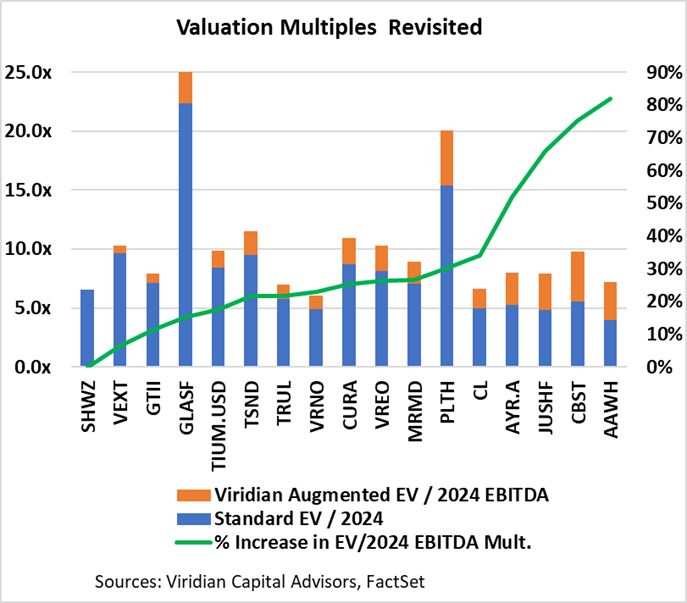

通常,企业价值(EV)是使用标准方法计算的。然而,Viridian采用更全面的方法,包括租赁义务和逾期税款。

他们还考虑公司尚未解决的长期税务责任。这导致债务数字更高,进而导致修正后的计算显示公司可能比最初想象的有更高的价值。

他们还考虑公司尚未解决的长期税务责任。这导致债务数字更高,进而导致修正后的计算显示公司可能比最初想象的有更高的价值。

对投资者决策的影响

最近的图表将传统估值方法与Viridian的更新数据进行了比较。那些似乎便宜的公司可能比之前认为的被低估得少,尤其是那些负担重大租赁或税务责任的公司。

由Viridian Capital Advisors 提供

由Viridian Capital Advisors 提供 大麻股被低估的市场认知

像Planet 13 Holdings(场外交易:PLNH)和MariMed(场外交易:MRMD)这样的公司,最初基于传统的EV/EBITDA倍数看似被低估,但当Viridian Capital的增强型EV计算考虑到隐藏债务时,它们的估值出现了显著增长。这表明忽略这些责任的投资者可能错误地将这些公司视为比它们实际更具吸引力的投资。

债务对投资者情绪的影响

相比之下,像Schwazze(场外交易:SHWZ)、Vext Science(场外交易:VEXTF)和Green Thumb Industries(场外交易:GTII)这样的公司估值变化很小,表明资产负债表较为清晰,能够增强投资者信心。

他们还考虑公司尚未解决的长期税务责任。这导致债务数字更高,进而导致修正后的计算显示公司可能比最初想象的有更高的价值。

他们还考虑公司尚未解决的长期税务责任。这导致债务数字更高,进而导致修正后的计算显示公司可能比最初想象的有更高的价值。

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.