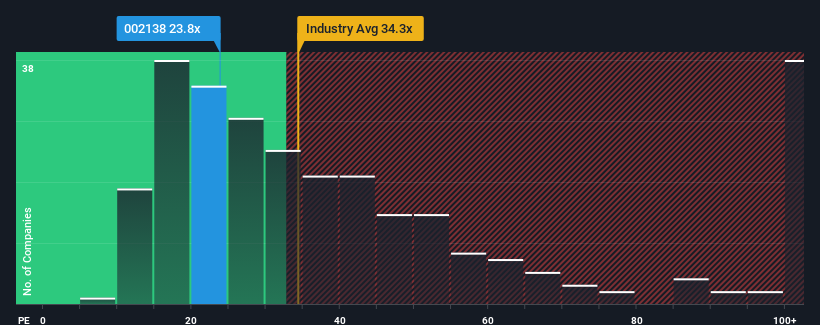

With a median price-to-earnings (or "P/E") ratio of close to 26x in China, you could be forgiven for feeling indifferent about Shenzhen Sunlord Electronics Co.,Ltd.'s (SZSE:002138) P/E ratio of 23.8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shenzhen Sunlord ElectronicsLtd has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

How Is Shenzhen Sunlord ElectronicsLtd's Growth Trending?

In order to justify its P/E ratio, Shenzhen Sunlord ElectronicsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 95% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Retrospectively, the last year delivered an exceptional 95% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the eleven analysts watching the company. With the market predicted to deliver 19% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Shenzhen Sunlord ElectronicsLtd's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Shenzhen Sunlord ElectronicsLtd's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shenzhen Sunlord ElectronicsLtd's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shenzhen Sunlord ElectronicsLtd you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.