Delivery has entered the peak season, and the performance of the power grid enterprises is expected to be further unleashed.

On September 23, benefiting from the morning bullish, the Hong Kong and A-share electricity sector showed active performance.

As of the time of publication, in the Hong Kong stock market, CGN Power surged over 5%, BJ Energy Intl, Huadian Power International Corporation rose over 4%, Huaneng Power International, China Res Power rose over 3%, Datang International Power Generation, China Longyuan, Power Assets all rose one after another.

In the A-share market, Shenergy, Zhejiang Zheneng Electric Power rose over 4%, An Hui Wenergy, Huadian Power International Corporation, Shaanxi Energy rose over 3%, Huaneng Power International, Datang International Power Generation, Sichuan Chuantou Energy followed the uptrend.

In the A-share market, Shenergy, Zhejiang Zheneng Electric Power rose over 4%, An Hui Wenergy, Huadian Power International Corporation, Shaanxi Energy rose over 3%, Huaneng Power International, Datang International Power Generation, Sichuan Chuantou Energy followed the uptrend.

Electricity demand continues to grow rapidly.

Since the introduction of China's 'dual-carbon' goals, the construction of a new type of power system in our country has accelerated, leading to a profound change in the power production structure.

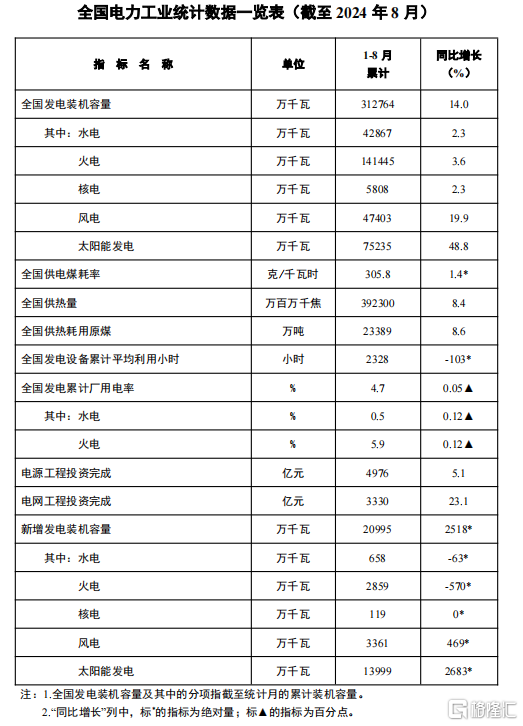

The statistics of the national electricity industry from January to August released by the National Energy Administration show that as of the end of August, the national cumulative installed capacity of electricity generation is about 3.13 billion kilowatts, a year-on-year increase of 14%. Among them, the installed capacity of solar power generation is about 0.75 billion kilowatts, a year-on-year increase of 48.8%; and the installed capacity of wind power is about 0.47 billion kilowatts, a year-on-year increase of 19.9%.

From January to August, the average utilization of power generation equipment in the country was 2,328 hours, a decrease of 103 hours compared to the same period last year. From January to August, the completed investment in power generation projects by major power generation enterprises nationwide was 497.6 billion yuan, a year-on-year increase of 5.1%. The completed investment in grid projects was 333 billion yuan, a year-on-year increase of 23.1%.

At the same time, China's electricity demand continues to grow rapidly. Data shows that in August, the total electricity consumption of society was 964.9 billion kilowatt-hours, an 8.9% year-on-year increase.

Looking at electricity consumption by different industries, the electricity consumption of the primary industry was 14.9 billion kilowatt-hours, a 4.6% year-on-year increase; the electricity consumption of the secondary industry was 567.9 billion kilowatt-hours, a 4.0% year-on-year increase; the electricity consumption of the tertiary industry was 190.3 billion kilowatt-hours, an 11.2% year-on-year increase; and the electricity consumption for urban and rural residents' daily life was 191.8 billion kilowatt-hours, a 23.7% year-on-year increase.

Industry experts point out that in the next 5-10 years, China's annual incremental electricity consumption will be maintained at 500-600 billion kilowatt-hours, equivalent to Germany's current one-year electricity consumption level. Unlike developed countries' concept of reaching a natural peak in electricity consumption, China's carbon peak will involve a significant increase in electricity consumption during the "peak increment" phase.

Performance is expected to further release.

Recently, several power companies including State Grid Corporation and China Southern Power Grid announced their financial reports for the first half of 2024.

Among them, State Grid's revenue in the first half of the year was 1876.1 billion yuan, compared to 1792.3 billion yuan in the same period last year, a year-on-year increase of 4.68%, with a net income of 39.2 billion yuan, compared to 37.5 billion yuan in the same period last year, a year-on-year increase of 4.53%; Southern Power Grid's revenue in the first half of the year was 398.4 billion yuan, compared to 380 billion yuan in the same period last year, a year-on-year increase of 4.84%, with a net income of 10.6 billion yuan, compared to 7.4 billion yuan in the same period last year, a year-on-year increase of 43.24%.

Of particular note, the substantial increase in revenue and profits is mainly due to the growth in electricity demand, steady development of core business, and the improvement in cost control and operational efficiency. State Grid stated that with the further opening up of the power market and the rapid development of clean energy, it is expected to continue to maintain a steady growth trend.

Looking ahead, Guosen Securities pointed out that in the first half of 2024, the performance of power grid companies has generally shown a stable growth trend, with performance elasticity expected to further increase in the second half of the year as deliveries enter the peak season. Against the backdrop of the development of the new electricity system in China, the urgency for the upgrading and transformation of distribution networks and rural networks is increasing. Overseas, with the development of new energy, growth in electricity consumption, and the renovation of aged power grids, the investment cycle of power grids is lengthy with significant room for improvement in Chinese companies' overseas penetration.

China Securities also believes that based on the fitting of the fixed asset growth rates for various sectors in the next year according to newly added construction projects, it is found that the supply growth rate in the power equipment sector, especially in the ultra high pressure direction, is relatively low. In a situation of high certainty about high industry demand growth, it is expected that the power equipment sector will continue to remain in a high prosperity cycle, and will enter a phase of resonating performance and orders in the second half of this year.

A股市场中,申能股份、

A股市场中,申能股份、