Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

High-rolling investors have positioned themselves bearish on GameStop (NYSE:GME), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GME often signals that someone has privileged information.

高风险投资者已经对游戏驿站(GME)持看淡态度,对零售交易者来说这是非常重要的。\ 今天通过Benzinga追踪公开的期权数据,我们注意到了这一活动。尽管这些投资者的身份尚不明确,但GME发生如此重大的变动通常意味着某人掌握了内幕消息。

Today, Benzinga's options scanner spotted 8 options trades for GameStop. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了8笔游戏驿站的期权交易。 这并不是一个典型的模式。

The sentiment among these major traders is split, with 25% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $41,700, and 7 calls, totaling $518,300.

这些主要交易者中的情绪分歧,25%持看好态度,37%持看淡态度。 在我们确认的所有期权中,有一个看跌期权,金额为41,700美元,以及7个看涨期权,总额为518,300美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $125.0 for GameStop over the last 3 months.

考虑到这些合约的成交量和持仓量,看起来鲸鱼们在过去3个月中一直在以20.0至125.0美元的价格区间内目标游戏驿站。

Volume & Open Interest Trends

成交量和未平仓量趋势

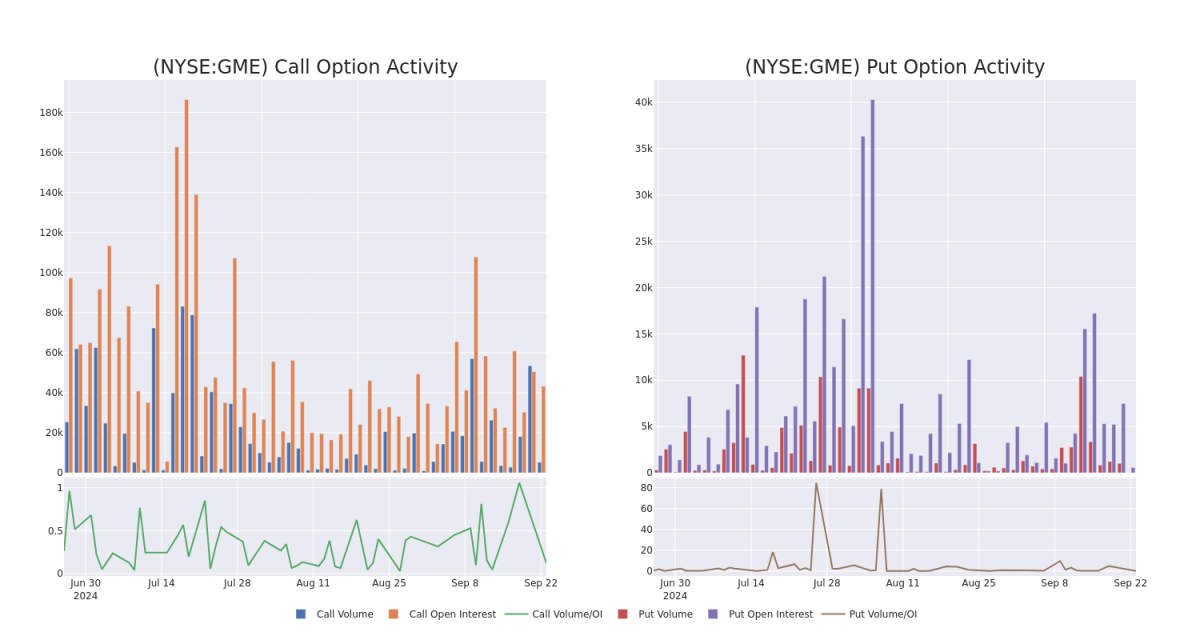

In today's trading context, the average open interest for options of GameStop stands at 8758.4, with a total volume reaching 5,267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in GameStop, situated within the strike price corridor from $20.0 to $125.0, throughout the last 30 days.

在今天的交易环境中,游戏驿站期权的平均持仓量为8758.4,总成交量达到5,267.00。 附图描述了过去30天中游戏驿站高价值交易的看涨和看跌期权成交量和持仓量的进展,这些交易位于20.0至125.0美元的行权价格走廊内。

GameStop Call and Put Volume: 30-Day Overview

GameStop看涨和看跌期权成交量:30天综合概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | TRADE | BEARISH | 01/16/26 | $2.74 | $2.05 | $2.2 | $125.00 | $187.0K | 9.8K | 859 |

| GME | CALL | TRADE | NEUTRAL | 10/18/24 | $2.59 | $2.5 | $2.55 | $20.00 | $127.5K | 13.7K | 1.3K |

| GME | CALL | TRADE | BEARISH | 06/20/25 | $7.0 | $6.8 | $6.8 | $20.00 | $54.4K | 2.2K | 127 |

| GME | CALL | TRADE | NEUTRAL | 10/18/24 | $2.51 | $2.44 | $2.48 | $20.00 | $49.6K | 13.7K | 815 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $4.65 | $4.55 | $4.65 | $20.00 | $46.5K | 17.3K | 26 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看涨 | 交易 | 看淡 | 01/16/26 | $2.74 | $2.05 | $2.2 | $125.00 | $187.0K | 9.8千 | 859 |

| GME | 看涨 | 交易 | 中立 | 10/18/24 | $2.59 | $2.5 | $2.55 | $20.00 | $127.5K | 13.7K | 1.3K |

| GME | 看涨 | 交易 | 看淡 | 06/20/25 | $7.0 | $6.8 | $6.8 | $20.00 | $54.4K | 2.2K | 127 |

| GME | 看涨 | 交易 | 中立 | 10/18/24 | $2.51 | $2.44 | $2.48 | $20.00 | 49.6K美元 | 13.7K | 815 |

| GME | 看涨 | 交易 | 看好 | 01/17/25 | $4.65 | 4.55 | $4.65 | $20.00 | $46.5K | 17.3K | 26 |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美国的一家多渠道视频游戏、消费电子和服务零售商。该公司在欧洲、加拿大、澳洲和美国等地区运营。GameStop主要通过GameStop、Eb Games和Micromania商店以及国际电子商务网站销售新和二手视频游戏硬件、实体和数字视频游戏软件和视频游戏配件。销售收入的大部分来自美国。

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在彻底审查了围绕GameStop的期权交易后,我们进一步研究该公司。这包括评估其当前市场地位和表现。

Present Market Standing of GameStop

游戏驿站现在的市场地位

- With a volume of 3,761,340, the price of GME is down -1.57% at $21.51.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 72 days.

- 游戏驿站的成交量为3,761,340,价格下跌了-1.57%,报价为$21.51。

- RSI指标暗示该股票可能要超买了。

- 下一次收益预期将在72天内发布。

Expert Opinions on GameStop

分析师对游戏驿站的看法

In the last month, 1 experts released ratings on this stock with an average target price of $10.0.

在过去一个月中,有1名专家发布了对该股票的评级,平均目标价为$10.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Wedbush persists with their Underperform rating on GameStop, maintaining a target price of $10.

20年期期权交易专家揭示了他的单行图技巧,显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处进行访问。*Wedbush的分析师坚持对游戏驿站给予表现不佳的评级,并保持$10的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GameStop with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也可能带来更高利润的机会。精明的交易者通过持续教育、战略性交易调整、利用各种因子和保持对市场动态的敏锐感来缓解这些风险。通过Benzinga Pro及时接收关于游戏驿站的最新期权交易警报。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $125.0 for GameStop over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $125.0 for GameStop over the last 3 months.