Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Bestechnic (Shanghai) Co., Ltd. (SHSE:688608) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Bestechnic (Shanghai)'s Debt?

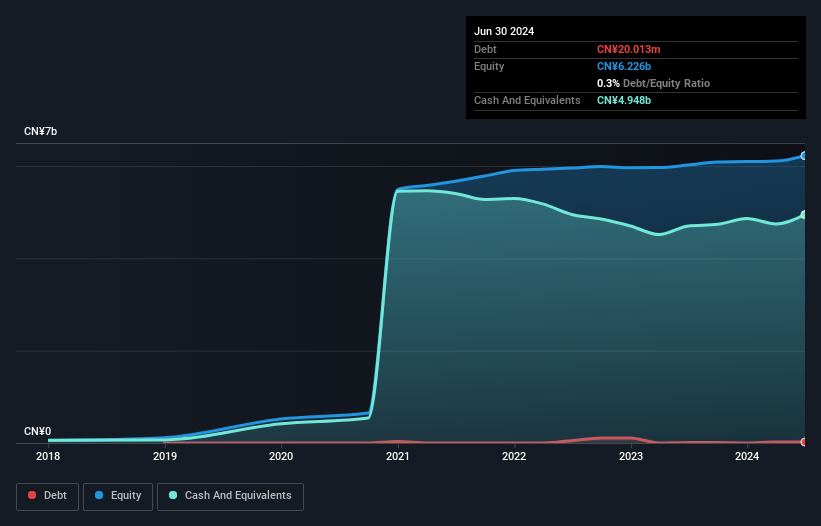

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Bestechnic (Shanghai) had CN¥20.0m of debt, an increase on CN¥10.0m, over one year. However, its balance sheet shows it holds CN¥4.95b in cash, so it actually has CN¥4.93b net cash.

How Strong Is Bestechnic (Shanghai)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bestechnic (Shanghai) had liabilities of CN¥566.4m due within 12 months and liabilities of CN¥11.9m due beyond that. Offsetting this, it had CN¥4.95b in cash and CN¥539.9m in receivables that were due within 12 months. So it can boast CN¥4.91b more liquid assets than total liabilities.

Zooming in on the latest balance sheet data, we can see that Bestechnic (Shanghai) had liabilities of CN¥566.4m due within 12 months and liabilities of CN¥11.9m due beyond that. Offsetting this, it had CN¥4.95b in cash and CN¥539.9m in receivables that were due within 12 months. So it can boast CN¥4.91b more liquid assets than total liabilities.

It's good to see that Bestechnic (Shanghai) has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that Bestechnic (Shanghai) has more cash than debt is arguably a good indication that it can manage its debt safely.

Although Bestechnic (Shanghai) made a loss at the EBIT level, last year, it was also good to see that it generated CN¥97m in EBIT over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Bestechnic (Shanghai) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Bestechnic (Shanghai) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, Bestechnic (Shanghai) actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While it is always sensible to investigate a company's debt, in this case Bestechnic (Shanghai) has CN¥4.93b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of CN¥302m, being 312% of its EBIT. So we don't think Bestechnic (Shanghai)'s use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in Bestechnic (Shanghai), you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.