Analysts say that the potential deal to acquire Intel could accelerate Qualcomm's diversification, but it would bring a loss-making semiconductor manufacturing division to the smartphone chip maker, which may struggle to turn the department profitable or sell it.

The acquisition will also face strict global antitrust scrutiny, as it would bring together two major chip companies to create the largest deal in the industry's history, establishing a giant with significant market share in the smart phone, PC, and server markets.

Intel's stock price rose nearly 3% on Monday, amid reports that Qualcomm is in the early stages of acquiring this troubled chip manufacturer. Qualcomm's stock price fell 1.8%.

Bob O'Donnell, founder of TECHnalysis Research, said: "The rumors of a deal between Qualcomm and Intel are attractive on many levels, and from a pure product perspective, it also makes sense because they have many complementary product lines."

Bob O'Donnell, founder of TECHnalysis Research, said: "The rumors of a deal between Qualcomm and Intel are attractive on many levels, and from a pure product perspective, it also makes sense because they have many complementary product lines."

"However, the actual likelihood is very low." He said: "In addition, Qualcomm is unlikely to want all of Intel's business, and it is currently impossible to separate the product business from the foundry business."

Intel, with a fifty-year history, was once a dominant force in the semiconductor industry, but is now facing one of its worst periods as its contract manufacturing division continues to incur losses, aiming to challenge Taiwan Semiconductor 2330.TW.

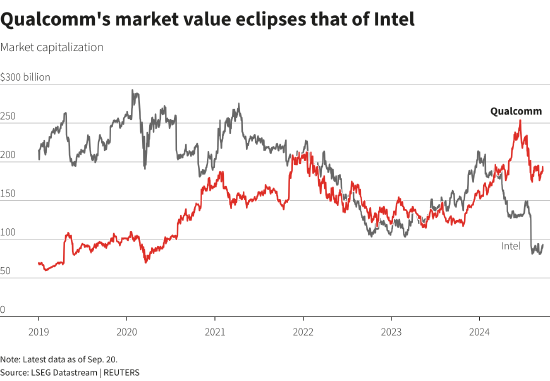

Intel's market cap fell below $100 billion for the first time in thirty years, as the company missed out on the artificial intelligence boom after giving up on OpenAI investment. At the last closing price, Intel's market cap was less than half of potential acquirer Qualcomm's market cap of around $190 billion.

As of June 23, Qualcomm has approximately $7.77 billion in cash and cash equivalents. Analysts expect this transaction to be primarily financed through stock financing, which could be highly dilutive for Qualcomm investors and may raise some concerns.

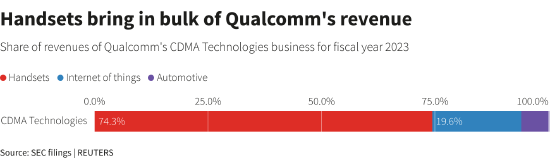

Qualcomm also supplies Apple, and under the leadership of CEO Cristiano Amon, Qualcomm has accelerated its pace of expansion into areas beyond its core smart phone business to provide chips for industries such as autos and personal computers. However, Intel still relies heavily on the mobile market, which has struggled in recent years due to reduced demand post-pandemic.

Sources said that Amon personally participated in Intel's negotiations and has been studying various scenarios for the company's transaction.

This is not the first time Qualcomm has sought a major acquisition. In 2016, Qualcomm proposed a $44 billion acquisition of rival NXP Semiconductors, but gave up two years later for failing to obtain approval from Chinese regulatory authorities.

Manufacturing Challenges

Intel designs and manufactures chips that power personal computers and datacenters, while Qualcomm has never operated chip factories. It uses contract manufacturers like Taiwan Semiconductor and designs provided by Arm Holdings and other technologies.

According to analysts, Qualcomm lacks the experience needed to enhance Intel's nascent manufacturing business, and recently Intel has listed Amazon.com as its largest customer.

Bernstein's Stacy Rasgon said: "We don't know why Qualcomm would be a better owner of these assets."

He added: "We haven't seen a scenario without these assets; we don't think anyone else would be willing to truly operate these assets, and we believe that canceling these assets politically is unlikely to be feasible."

Intel's foundry business is considered crucial to Washington's goal of developing domestic chip manufacturing. The company has received around $19.5 billion in federal grants and loans under the CHIPS Act to build and expand factories in four states in the USA.

Some analysts suggest that Intel is more inclined towards external investments rather than selling, pointing out the recent steps Intel has taken to make the foundry business more independent.

Apollo Global Management has become a partner of Intel's Ireland factory, proposing to invest up to $5 billion in Intel. Qualcomm may also decide to acquire parts of Intel's business rather than the entire company. Earlier this month, Qualcomm showed particular interest in Intel's PC design department.

TECHnalysis Research创始人鲍勃-奥唐纳(Bob O‘Donnell)说:”高通和英特尔之间的交易传闻在许多层面上都很吸引人,而且从纯产品的角度来看,也有一定的道理,因为它们有许多互补的产品线。”

TECHnalysis Research创始人鲍勃-奥唐纳(Bob O‘Donnell)说:”高通和英特尔之间的交易传闻在许多层面上都很吸引人,而且从纯产品的角度来看,也有一定的道理,因为它们有许多互补的产品线。”