Information explosion chart

On Tuesday, “One Bank, One Meeting, One Game” made a big statement about financial support for high-quality economic development. After opening sharply higher, the Hong Kong A market declined, and soared in a straight line near midday trading.

Boosted by several major benefits, as of press release, the Hang Seng Index, Hengke Index, China Index, and GEM Index rebounded violently and rose more than 3%, the Shanghai Composite Index recovered the 2,800 mark, and the FTSE China A50 Index futures increase also increased to 3%.

Up to now, the turnover of the Shanghai and Shenzhen markets has exceeded 500 billion yuan, an increase of nearly 140 billion yuan compared to yesterday at this time.

Up to now, the turnover of the Shanghai and Shenzhen markets has exceeded 500 billion yuan, an increase of nearly 140 billion yuan compared to yesterday at this time.

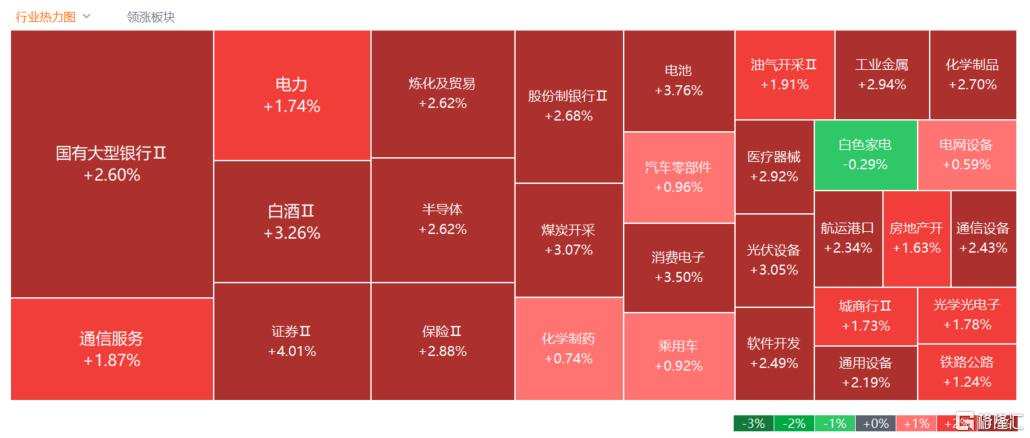

On the market, in addition to real estate, the big financial sector was also moved by the news, with securities, insurance, brokerage, and diversified finance surging across the board.

Hong Kong stocks, China Taibao, rose more than 8%, and China's Ping An H rose more than 6%. The stock price hit a new high since the end of May; many stocks such as A-share Jinlong shares, Tianfeng Securities, Yinzhijie, China Aviation Finance, COFCO Capital, and Hongye Futures rose and stopped.

Super King bombings

Today, at the press conference of the State Information Office, the Central Bank, the Financial Services Administration, and the Securities Regulatory Commission made a series of big moves.

Central Bank Governor Pan Gongsheng announced thatwillDowngrading, cutting interest rates, reducing stock and mortgage interest rates, and creating new monetary instruments to support the development of the stock market.

Among them, he pointed out that it will create exchange facilities for securities, funds, and insurance companies to support eligible securities, funds, and insurance companies to obtain liquidity from the central bank through asset pledges, which will greatly enhance their ability to obtain capital and increase their stock holdings.

He also revealed that the exchange of securities funds and insurance companies facilitates the size of the first installment500 billionThe funds obtained can only be used to invest in the stock market. Also,The Equalization Fund is being studied.

Li Yunze, director of the General Administration of Financial Supervision, said that with regard to the pilot equity investment project for financial asset investment companies, the next step will beExpand the scope of pilot cities, relax equity investment amount and ratio restrictions as appropriate, and optimize the assessment mechanism.

The plan to increase core Tier 1 capital for the six large commercial banks will be implemented in an orderly manner in accordance with the ideas of integrated promotion, phased batching, and one-in-a-bank policy.

Wu Qing, chairman of the Securities Regulatory Commission, pointed out that the market ecology has further improved since the new “National Nine Rules.” The Securities Regulatory Commission willSupport Huijin to increase investmentto promote long-term capital investment in the stock market.

In addition, more measures will also be taken to revitalize the M&A and restructuring market, promote mergers, acquisitions and restructuring measures, and work with all parties to smooth out all aspects of private equity venture capital fund raising, management, and withdrawal.

How will the market go?

After “One Bank, One Meeting, One Game” teamed up to deliver a policy package, how will the market go next?

Recently, the Hong Kong stock market has rebounded for many consecutive days. As of today, the Hang Seng Index and China Index have achieved nine consecutive days, and the Shanghai Index has also returned to 2,800 points, which is expected to hit five times.

Regarding the policy package introduced today, various agencies have commented that the easing measures are bolder than expected.

Liu Jie, head of China's macroeconomic strategy at Standard Chartered Bank, said that monetary policy easing measures were bolder than expected, and interest rate cuts were announced at the same time; after the Federal Reserve cut interest rates on a large scale, there is room to introduce bolder easing policies in the next few quarters.

Jing Liu, chief economist at HSBC Greater China, believes that China announced that it will cut interest rates in order to support the 5% economic growth target, and that the deposit reserve ratio may be lowered again in the future; attention should be paid to whether the central government will directly invest capital to stabilize the real estate market, and whether China can quickly return PPI to a positive value.

OCBC economist Xie Dongming pointed out that what is remarkable this time is the introduction of new policy tools to support the stock market, which may have a wider impact, because if these tools can successfully boost investor sentiment, they may have a positive medium-term impact on the economy; increased activity and confidence in the stock market can stimulate economic growth, and eventually, as the economy strengthens, it will drive bond interest rates to rise and the RMB to strengthen.

As for the market's future performance, Hualong Securities believes that after the Fed cuts interest rates, it may improve global liquidity expectations, thereby supporting the growth of external demand. From a medium- to long-term perspective, it is still necessary for A-shares themselves to have continuous positive conditions. The current valuation of A-shares is low enough, and economic fundamentals are gradually improving, leading to improved profit expectations of listed companies, and the A-share market is expected to change positively.

Cathay Pacific Jun An pointed out earlier that the Hang Seng Index broke through the 18,000 integer mark last week, and there is a tendency to think that Hong Kong stocks will perform well in the fourth quarter.

Since February of this year, the Hang Seng Index has performed at almost the same rate as the NASDAQ. Currently, the technical trend of the Hang Seng Index has improved. The US interest rate cut will improve the macro environment facing Hong Kong stocks. At the same time, the appreciation of the RMB will drive market interest in RMB assets.

截至目前,沪深两市成交额突破5000亿元,较昨日此时放量近1400亿元。

截至目前,沪深两市成交额突破5000亿元,较昨日此时放量近1400亿元。