On September 24, “One Bank, One Game, One Meeting” jointly released a policy package, and major A-share indices collectively boosted.

By the close, the Shanghai index rose 4.15% to 2,863 points, recording 5 consecutive positives and the biggest one-day increase in more than four years; the GEM index rose 5.54%, and the Shenzhen Stock Exchange Index rose 4.36%, the biggest one-day increase since February 6 this year. More than 5,100 shares rose, and the number of individual shares fell by less than 200. They traded 971.3 billion yuan throughout the day, a significant increase of 420.3 billion yuan compared to the previous trading day.

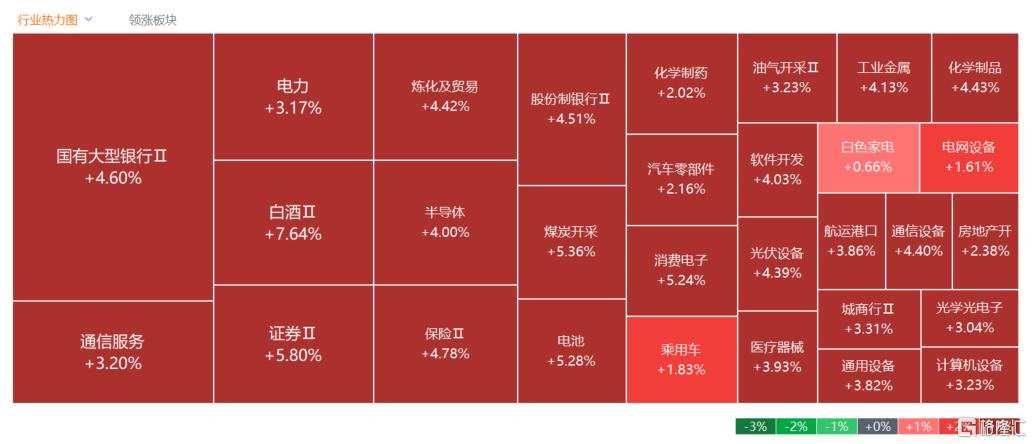

On the market, large financial sectors exploded collectively, leading in the direction of brokerage concepts, insurance, etc.; more than 10 stocks such as Pacific, Tianmao Group, and Compass rose; the steel sector surged, the lithium sector strengthened, the coal sector was active, the battery sector generally rose, the cement and building materials sector rallied in the afternoon, and sectors such as automobile dismantling, wind power equipment, and fluorine chemicals rose the most.

Let's take a look specifically:

Let's take a look specifically:

Big finance broke out, and banks, insurance, brokerage firms, and diversified financial sectors collectively surged, and many stocks such as Pioneer Securities, Guohai Securities, Jianyuan Trust, and Hyde Co., Ltd. rose and stopped. Today, the Central Bank, the Securities Regulatory Commission, and the General Financial Supervisory Authority made big statements about leveling funds, downgrading, cutting interest rates, and reducing interest rates on stock mortgages. Agencies generally believe that with interest rate cuts in line with interest rate cuts and the implementation of stock mortgage interest rate adjustments, and the introduction of new policy tools to support the stock market, the strength and pace of the policy has exceeded expectations.

Real estate stocks soared, and Sunshine Shares, Shirong Zhaoye, and Jiuding Investment rose and stopped. Today, the central bank will step up measures. In terms of mortgages, it will reduce interest rates on existing mortgages and unify the minimum down payment ratio for mortgages. Specifically: Guide commercial banks to lower interest rates on existing mortgages to close to interest rates on newly issued mortgages. The average decline is expected to be about 0.5 percentage points. Reduce the minimum down payment ratio for a two-home loan at the national level from 25% to 15%, and unify the minimum down payment ratio for first and second home mortgages.

Liquor stocks had the highest gains. Liquor leader Maotai closed up 8.8%, Luzhou Laojiao rose more than 8%, and Wuliangye rose more than 7%. Minsheng Securities said that during the peak consumption season, attention is paid to scenario-based performance. Under the current system, liquor still maintains strong social and necessary means of production attributes, and will also be adjusted and upgraded along with the industrial structure. The Mid-Autumn Festival gift scenario is weak, pessimistic consumer demand expectations have been fulfilled, and overall channel marketing feedback is poor; the terminal inventory level is good; looking ahead to the National Day, mainly banquets, volume and price pressure, the size of the event has become smaller, and banquet policies and prices have remained stable; it is still a time for regional brands and strong energy brands.

Energy metals strengthened, Shengxin Lithium Energy and Tianqi Lithium went up and down, Yongxing Materials rose more than 8%, and Ganfeng Lithium rose more than 7%. Some agencies pointed out that the peak season for the downstream NEV market was concentrated in the third quarter (“gold nine silver ten”), which spread to the middle and upstream lithium battery market, and the peak stocking season was concentrated in the second and third quarter. Compared with the same period last year, the recovery trend of the lithium battery industry in 2024 was significantly better than in 2023, and lithium battery manufacturers' production schedules in the second quarter were significantly better than in the first quarter. Overall, due to the decline in upstream resources such as lithium carbonate over the past year, increased competition, and inventory removal, the profitability of lithium battery material companies bottomed out and stabilized. In the second half of 2024, the lithium battery industry may further stabilize or even exceed expectations.

Steel stocks surged, and Shengde Xintai, Zhongnan shares, Linggang shares, and Anyang Iron and Steel rose and stopped. Galaxy Securities pointed out that the Ministry of Industry and Information Technology has suspended steel production capacity replacement, positive policy changes are expected to drive improvements in market expectations, long-term supply-side constraints are expected to appear, and steel profits may gradually rise steadily. Steel core assets, which have strong profitability and steady high dividends in the bottom cycle, are expected to usher in a valuation repair.

Coal stocks strengthened, with energy rising and falling, with power investment and Haohua Energy rising more than 8%. Debon Securities said that daily consumption remained high and fluctuated. Under the weakening of hydropower, the thermal power compensation effect was evident. Short-term coal prices are supported by the elimination of terminal inventories, and coal prices are expected to begin to fluctuate and rebound. The “gold nine silver ten” peak season is approaching. Although overall consumption of building materials is lower than in previous years, the consumption of building materials is likely to increase marginally in September-October. As major initiatives such as “dual” and “two new” will be accelerated, physical workload is expected to be formed at an accelerated pace, and demand for coal use in the non-electricity industry may be marginally restored.

Looking ahead, Dongguan Securities said that new developments are currently taking place at the macroeconomic level. The National Development and Reform Commission announced that 300 billion yuan of treasury bond funds to support the “two new” efforts have been fully disbursed, boosting action at the entity level or showing signs of catching up.

Furthermore, the US dollar has entered a cycle of interest rate cuts, falling 50 basis points more than market expectations for the first time. This has not only improved expectations for the RMB exchange rate, but also enhanced the flexibility of domestic monetary policy.

The governor of the central bank said on September 23 that it will strengthen the regulation and accuracy of monetary policy to provide a favorable financial environment for the steady growth and high-quality development of the Chinese economy. It is expected that subsequent incremental policies will be strengthened to accelerate the process of refining A-shares.

具体来看:

具体来看: