科济薬品-B(02171)にとって、2024年の最も重要なマイルストーンイベントは、今年3月にコア製品CT053が商業化に成功したことでした。しかし、初の製品の商業化が会社にもたらしたものは、二次市場でのさらなる時価総額の飛躍ではなく、かえって股価の下落を招いた。

科济薬品-B(02171)にとって、2024年の最も重要なマイルストーンイベントは、今年3月にコア製品CT053が商業化に成功したことでした。しかし、初の製品の商業化が会社にもたらしたものは、二次市場でのさらなる時価総額の飛躍ではなく、かえって股価の下落を招いた。

Smart Finance APPによると、9月5日の取引中に、科济薬品の株価は最低2.48香港ドルに達し、新規上場安値を記録しました。製品の承認日である3月1日の最高株価7.53香港ドルを基準にして半年間の繰り返しの落ち込みの中で、科济薬品の株価の範囲での最大下落率はすでに67.07%に達しました。

底値を記録した後、科济薬品の株価はゆっくりと回復し、9月24日の取引終了時点で、企業の株価は3.13香港ドルに回復し、時価総額も17.89億香港ドルに戻りました。

底値を記録した後、科济薬品の株価はゆっくりと回復し、9月24日の取引終了時点で、企業の株価は3.13香港ドルに回復し、時価総額も17.89億香港ドルに戻りました。

ところが、香港株としての科济薬品は明らかに「保つ」の限界に達しているようです。来年2月25日に予定されている次回の定例検討結果が出る前に、科济薬品はこの「香港株市場の防衛戦」を勝利できるでしょうか?

株価が新規上場安値に達した後、「保つ」戦いはすでに始まっています

科济薬品にとって、今年以来、会社の株価は急落し、年初から50%以上下落しました。現在、企業の時価総額はわずか17.89億香港ドルであり、「保つ」プレッシャーは明らかです。

智通財経アプリによると、香港株ストックアウトの状況は、関連指数の成分株の調整により、恒生総合指数の成分株でなくなった香港株の調整期間の考査結果中は、恒生総合小型株指数の成分株を含んでおらず、香港金融市場で上場していないH株のA+H株を含まない香港株が該当します。

科济薬業は、恒生総合小型株指数の成分株であり、現在の規則によると、検討期間中、香港株の平均月末市場価値が香港ドル40億未満の基準に該当します。恒生指数社は、2024年12月31日までの恒生指数クオータリー・レビュー結果を来年2月下旬に公表し、それに関連する変更が2025年3月初旬に有効となる見込みです。

科济薬業にとって、現在の市場価値は「保証閾値」よりも遥かに低くなっています。智通財経アプリによると、科济薬業の検討期間中の月平均市場価値は、今年1月から現在までで294.8億香港ドルであり、40億香港ドルの保障閾値から105.2億香港ドル低いです。

つまり、科济薬業が次の見直し期間中に、今年12月末までの検討期内に香港株トランスポートの地位を維持したい場合、企業は市場価値を61.15億香港ドル近くに戻す必要があり、つまり、10.69香港ドルの株価に達しました。

現在の株価を考慮すると、科济薬業は株価を2.5倍近く上げる必要があり、なるべく安定して高値を維持する必要があります。そのため、科济薬業が検討期内に株価と市場価値を急速に引き上げない場合、香港株トランスポートから除外される可能性が高くなります。

規則によると、企業が香港株トランスポートから除外された場合、中国本土の投資家は株式を買うことができず、保有している株を売るしかありません。つまり、企業が香港株トランスポートから除外されると、中国本土の投資家は流動性を継続することができず、むしろ売り圧力となります。2023年9月23日時点で、科济薬業の香港株トランスポート保有率は21.07%に達しています。企業が香港株トランスポートから除外されると、20%を超える株の売り圧力が株価にさらなる否定的な影響を与える可能性があります。

核心銘柄が単独で支え切れず、中間報告後に「5連続下落」を引き起こしました。

8月28日の取引終了後、科济薬業は2024年上半期決算を公開しました。その後、企業株価は8月29日から9月4日までの5営業日で「5連続下落」し、このような株価動向は、科济薬業に対する投資家の業績見通しが楽観的ではないことを示しています。

データによると、報告期間中、科济医薬は約6000万人民元の収入を達成しました。主要な収入源は、同社の主力製品であるサイカゼ(ゼボジオルンセー注射液,CT053)の販売です。ただし、この収入は工場出荷価格に基づいて計算されており、最終市場価格ではありません。報告期間中、科济は合計で華東医薬から52の注文を受けましたが、CAR-T製造には時間のかかる周期があり、華東医薬からの注文数と出荷台数には違いがあります。

しかしながら、6000万の収入は一つのバイオテック企業としての膨大な支出をカバーするのは明らかに困難であり、前年同期の40億4000万元の純損失に比べて減少しましたが、当期の純損失は35億2000万元です。

現金フローから見ると、科济医薬の今年上半期の現金及び銀行の残高は165.3億元であり、前期比約1970万元減少しました。今年末の現金及び現金同等物及び預金の残高は135億元以上を下回る見込みで、後続の現金流入を考慮しない場合、現状の資金は科济医薬の研究開発とビジネス運営を2027年までサポートするのに十分です。

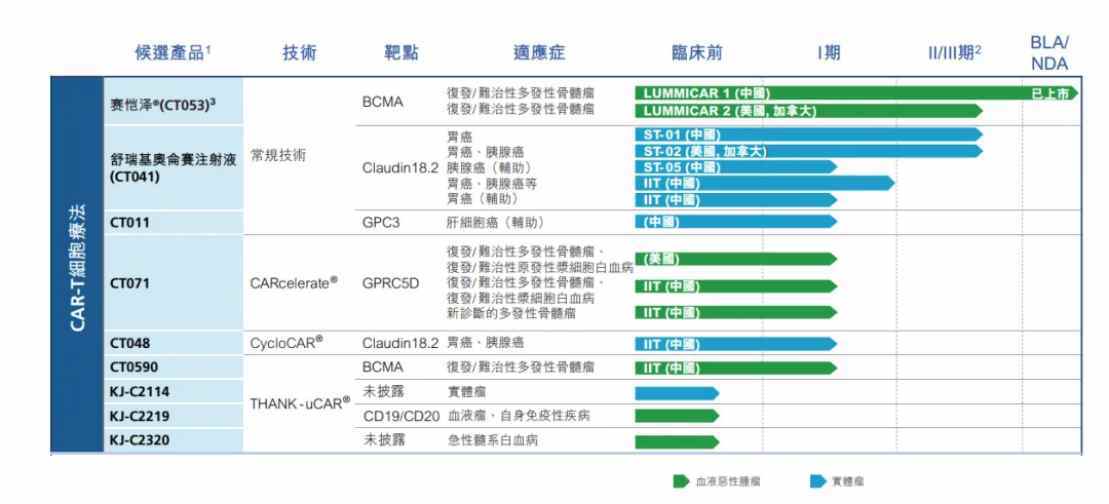

製品開発パイプラインに関して、現在、同社は9種類の差別化候補製品を自主開発しており、BCMA、Claudin18.2、GPC3などの複数の人気標的を対象としており、適応症は血液腫瘍および固形腫瘍を含んでおり、主力製品であるサイカゼは中国で承認されており、適応症は再発または難治性多発性骨髄腫です。さらに、12本のパイプラインが臨床段階にあります。

しかしながら、上記の製品のビジネス化の進捗状況は異なり、現時点で科济医薬に短期間で売上収益をもたらすことができるのは、すでに上市されているサイカゼと予想される今年のNDAのCT041だけです。"保通"の見込みを加えると、短期間で株価を支えるのはサイカゼだけです。ただし、市場は一四半期6000万の収入には納得していないようです。

実際、この製品の臨床効果は注目に値します。ゼボジオルンセーは再発または難治性多発性骨髄腫のII期臨床試験(LUMMICAR-1)の結果が2024年EHAで口頭発表されました。結果は、102人の患者で、ORRが92.2%、VGPR以上の緩和率が91.2%、CR/sCR率が71.6%であり、フォローアップ期間が延びるにつれて、反応が深まっていく傾向が観察されました。

国産CAR-Tは良好な臨床パフォーマンスを持ち、広範なビジネスプロモーションと組み合わせることで製造業者にかなりの収入をもたらすことができます。レジェンドバイオテックとそのCarvyktiはこの点を証明し、今年の上半期に総収入が2.81億ドルに達し、前年比155.8%増加しました。

不過、レジェンドバイオテックとジョンソンエンドジョンソンの国際的な事業組合に比べて、科济薬業と華東医薬の国内事業組合は製品配置で急速に推進されていますが、販売レベルでは明らかに大きな差があるようです。財務報告によると、商業化が実現しており、7月31日には20以上の省や市に医療機関が認定され、また全国19の省市をカバーし、100以上の施設があることが裏付けられた中国の保険料と商業保険が含まれています。同社は華東医薬から合計52件の注文を受けています。一方、海外展開に関して、科济薬業の主力製品2つは米国の臨床試験で停滞状態にあるため、短期間内に商業的な価値を具現化するのは難しい状況です。

明らかに、急激な利好が株価の大幅上昇をもたらさない限り、科济薬業はこれらの流入の波から逃れることができず、この時期に香港株から追放される運命に瀕しています。ただし、指摘すべき点は、香港株の流出が科济薬業に具体的な影響を与えるものである一方、企業が商業化の段階に入っており、近年内に2つの主力製品が商業化に向けて猛進する可能性が高いことなど、内生的な成長能力や財務の持続的な最適化の可能性があり、企業自体の価値再評価の時期に来ていることから、科济薬業はこれらの段階で自身の価値再評価を迎える可能性があります。その際、科济薬業が再び香港株に参入する可能性も否定できません。

在触及底价后,科济药业股价缓慢回升,时至9月24日收盘,公司股价已回升至3.13港元,市值也回到17.89亿港元。

在触及底价后,科济药业股价缓慢回升,时至9月24日收盘,公司股价已回升至3.13港元,市值也回到17.89亿港元。