絕地反攻時刻開啓?

絕地反擊!暴漲!

今天真的是活久見啊!多久沒有看過這種全面紅彤彤的市場了。

今天市場全線飆升,滬指漲超2%,創業板指數更是漲超5%!市場成交量一舉放大4000億至9700億,兩市超4900只個股上漲。港股表現也十分搶眼,恒指漲超3%,恒生科技漲超4%。

今天市場全線飆升,滬指漲超2%,創業板指數更是漲超5%!市場成交量一舉放大4000億至9700億,兩市超4900只個股上漲。港股表現也十分搶眼,恒指漲超3%,恒生科技漲超4%。

消息面上,今天上午國新辦就金融支持經濟高質量發展有關情況舉行新聞發佈會,釋放了一系列王炸利好!

1

王炸利好連環釋放

降準、減息、降存量房貸利率、平準基金正在研究……被一個又一個連環利好消息轟炸的早上:

1.降低存款準備金率50bps,釋放10000億流動性;降低7天OMO利率20bps;

2.降低存量房貸利率降至新發房貸利率附近(預計50bps)、降二套房最低首付比例(25%到15%);

3 .優化保障性住房再貸款政策;

4.創設基金、保險公司互換便利;

5.股票回購增持專項債貸款;

多支穿雲箭射出後,某賣方首席都興奮到馬上改群名爲:

反攻!

衆多利好政策之下,最引人註明的莫過於央行宣佈創設兩項結構性貨幣政策工具,支持資本市場穩定發展!

人民銀行潘功勝表示:「這是人民銀行第一次創設結構性貨幣政策工具支持資本市場。」

第一項工具是證券、基金、保險公司互換便利。支持符合條件的證券、基金、保險公司使用他們持有的債券、股票ETF、滬深300成分股等資產作爲抵押,從中央銀行換入國債、央行票據等高流動性資產。

央行行長解釋道:「很多機構手上有資產,但是在現在的情況下流動性比較差,通過與央行置換可以獲得比較高質量、高流動性的資產,將會大幅提升相關機構的資金獲取能力和股票增持能力。」

這項政策首期互換便利操作規模5000億元,機構通過這個工具獲取的資金只能用於投資股票市場,後續將大幅提升相關機構的資金獲取和股票增持。

潘功勝透露,「我跟(證監會)吳清主席說了,只要這個事情做得好,未來可以再來5000億元,或者第三個5000億元,我們(的態度)是開放的。」

民生宏觀團隊認爲,雖然央行的資產負債表並不直接承接股票資產,但股票資產已實質上成爲央行流動性投放、銀行信用擴張的抵押品,這在中國貨幣政策的歷史上還是首次,其對股票市場的意義重大。

第二項工具是股票回購、增持再貸款。這個工具引導商業銀行向上市公司和主要股東提供貸款,用於回購和增持上市公司股票,適用於國有企業、民營企業、混合所有制企業等不同所有制的上市公司、首期額度是3000億元。

潘功勝透露:「如果這項工具用得好,我和吳清主席也講過,可以再來3000億元,甚至可以再搞第三個3000億元,都是可以的。」

此外,潘功勝在回應平準基金創設的提問時表示,平準基金正在研究。

2

增量資金真的來了

ETF進化論以往的文章就一直在探討A股的增量資金來自什麼哪?投向哪?

毋庸置疑,A股有望迎來新一批增量資金。前述的兩大創新工具的首期規模來看,有望帶來不超過8000億增量資金,具體落地效果尚待後續跟進觀察。

中信建投陳果認爲,以當前A股的資金面情況,(新的創新工具使用規模)如果能超過5000億將形成重磅利好,推動A股大幅反彈。

就本次央行推出的兩大創新工具來看,一項是讓符合條件的金融機構可以上槓杆投資權益市場,另一項是讓有意願的上市企業加大股票回購規模。

這就需要我們去辨析兩個問題:金融機構拿到資金後,會投向什麼樣的權益資產?什麼樣的上市企業有動力去借錢回購股票?

一方面,證券、基金、保險公司互換便利工具有望提高市場的風險偏好。目前低風險偏好的投資者持有的資金相對較多,鑑於國債利率已經下降到較低水平,十年期國債活躍券收益率已經觸及2%關口,後續長債下行空間有限。而高風險偏好的投資者處於被套牢的狀態,資金相對不足。

如今通過新設的工具來投放貨幣,賣債買股,不僅可以存量債市的錢擠出來,還可以把擠出來的增量資金投向股市,一舉兩得。

此時需要進一步考慮的問題是:借貸的金融機構會投向什麼權益資產?優先選擇高分紅的資產?還是跌幅足夠大的成長類資產?

第二個需要考慮的問題就是,什麼類型的上市企業有意願貸款回購股票?目前來看是高分紅企業或者本身實力過硬的企業會有這個意願,例如茅台和寧德時代。

此前貴州茅台上市23年首次出手回購,擬投入30億元到60億元自有資金回購股份用於註銷。對於該回購計劃,段永平表示:「這也許會是個劃時代的事件。」

同理,股票回購增持專項債貸款的新政對A股來說也意義非凡,會鼓勵更多上市企業回購股票並註銷股票。若干年後回頭看,今日大概率也是值得載入A股史冊的一天。

A股今年一個意料之外的增量資金居然是分紅。Wind數據顯示,截至2024年8月,A股分紅總金額顯著高於募資總金額,可以說是A股歷史上第一次。如果這個趨勢可以繼續保持下去,意味着上市公司的分紅會慢慢成爲A股的資金來源。

500億險資的最新動態也來了。國家金融監督管理總局局長李雲澤表示,中國人壽、新華人壽共同發起的500億私募投資基金,已正式投資運作。

「國家隊」上半年通過股票型ETF入市資金累計超過4600億元,其中四大滬深300指數ETF增持金額超3100億元。證監會主席吳清吳清今日也表示進一步支持匯金公司加大增持力度,擴大投資範圍。

另外,9月23日,首批10只中證A500ETF均結募或提前結募,合計募集規模約220億,業內預計這批ETF將在10月中旬上市。

這意味着從昨日起,這220億已經開始開倉了。

站在當下時點,A股真的迎來了多方增量資金。

3

A股久違暴漲

看着A股今日的暴漲,真的有一種千帆過盡的感慨。

A股全天放量大漲,三大指數均漲超4%,滬指創2020年7月6日以來最大單日漲幅,兩市成交額9713億元,較上個交易日放量4203億。

港股也全線暴漲!截至收盤,恒生指數收漲4.13%,恒生科技指數收漲5.88%。截至發稿,富時中國A50指數期貨漲幅擴大至6%。

ETF方面,大金融板塊全天表現強勢,金融科技ETF華夏、博時基金金融科技ETF和華寶基金金融科技ETF分別漲8.5%、7.7%和7.44%。創業板領銜反攻,創業板100ETF華夏和創50ETF分別漲6.98%和6.21%。

ETF期權更是迎來引伸波幅和價格的飆升,截至收盤,共有4個合約漲幅超百倍,超30個合約漲超10倍,其中50ETF購9月2400合約大漲239倍,漲幅最大。

(本文內容均爲客觀數據信息羅列,不構成任何投資建議)

跌幅方面比較有意思,跨境ETF和超長期國債ETF全線下挫,隔夜美股上漲的情況下,美股相關ETF紛紛收綠。標普生物科技ETF、納指生物科技ETF分別跌2.14%和1.67%。

日經225指數今日收漲0.57%,日經ETF、日經225ETF易方達和日本東證指數ETF均跌1%,最新溢折率分別爲3.33%、-0.37%和0.3%。

超長期國債ETF今日全線收跌,30年國債指數ETF、30年國債ETF分別跌0.91%和0.86%。

超長期國債利率的衝高回落意味着後續需要觀察是否會出現股債蹺蹺板效應。今早長端利率債一度大漲,10Y國債利率一度下行3.45個點子至2%、30Y國債利率一度下行3.75個點子至2.1%,不過隨後長端利率債回吐漲幅,10Y利率未能突破2%整數關口。

對於9月24日的金融政策組合拳,中信建投策略最新點評指出,今日央行、證監會大招拉開了重磅政策出臺的序幕,吹響了A股反攻的號角。我們判斷政策:「先貨幣再財政」,市場:「先反彈後反轉」,底部已確立,回調就是給機會。

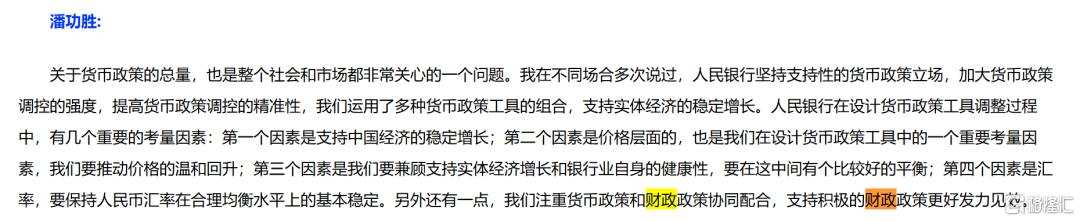

對於財政是否會接過貨幣的「接力棒」的問題,央行行長今日在會議上有提及:「我們注重貨幣政策和財政政策協同配合,支持積極的財政政策更好發力見效。」

民生證券宏觀團隊認爲,當前財政端考量的更多是如何用好存量政策。當然,貨幣政策已顯現出寬鬆態勢,待財政存量政策用好、用完後,財政寬鬆的接續或許也正在路上。

今天市场全线飙升,沪指涨超2%,创业板指数更是涨超5%!市场成交量一举放大4000亿至9700亿,两市超4900只个股上涨。港股表现也十分抢眼,恒指涨超3%,恒生科技涨超4%。

今天市场全线飙升,沪指涨超2%,创业板指数更是涨超5%!市场成交量一举放大4000亿至9700亿,两市超4900只个股上涨。港股表现也十分抢眼,恒指涨超3%,恒生科技涨超4%。