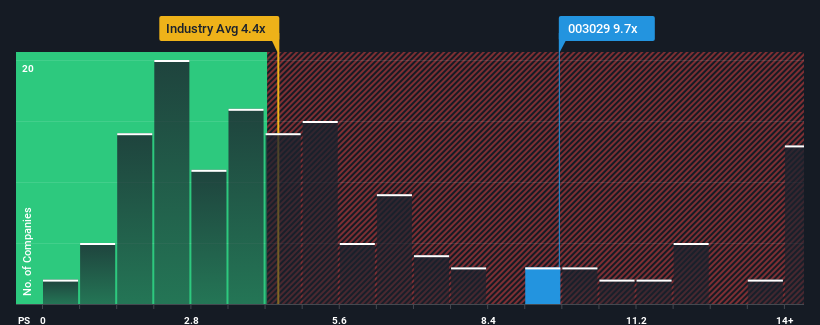

Jilin University Zhengyuan Information Technologies Co., Ltd.'s (SZSE:003029) price-to-sales (or "P/S") ratio of 9.7x might make it look like a strong sell right now compared to the Software industry in China, where around half of the companies have P/S ratios below 4.4x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Jilin University Zhengyuan Information Technologies Has Been Performing

Jilin University Zhengyuan Information Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jilin University Zhengyuan Information Technologies.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jilin University Zhengyuan Information Technologies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. As a result, revenue from three years ago have also fallen 47% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. As a result, revenue from three years ago have also fallen 47% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 230% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we can see why Jilin University Zhengyuan Information Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Jilin University Zhengyuan Information Technologies' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Jilin University Zhengyuan Information Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Jilin University Zhengyuan Information Technologies that you need to take into consideration.

If you're unsure about the strength of Jilin University Zhengyuan Information Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.