After the release of optimistic sentiment, how high and how long can the related concept stocks rebound, ultimately may still need to see the 'face' of performance.

Miniso (09896) news of a whopping 6.3 billion RMB takeover of Yonghui Superstores not only caused Yonghui's stock price to hit the limit up, but also spread market optimism to the Hong Kong stock market's supermarket retail sector.

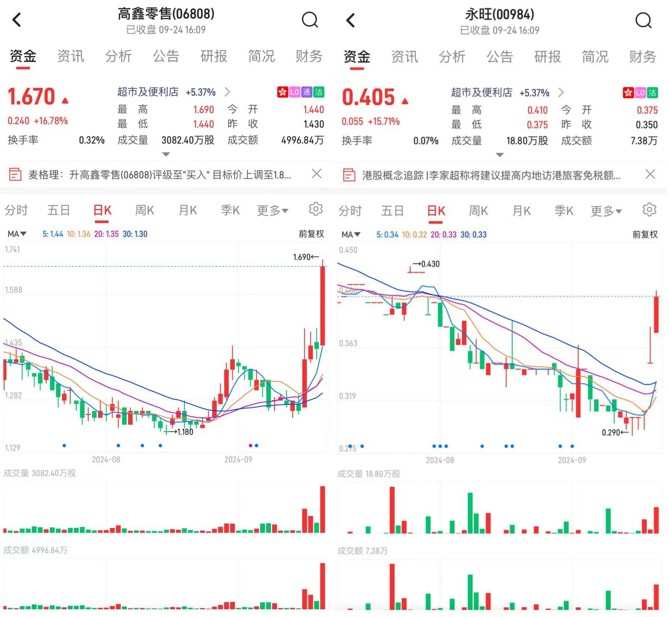

On September 24th, Hong Kong supermarket retail stocks representatives Sunart Retail (06808) and Aeon Stores (00984) opened high with a gap up, and both symbols remained strong throughout the day. As of the close, Sunart Retail closed at 1.67 Hong Kong dollars, up 16.78%; Aeon Stores closed at 0.405 Hong Kong dollars, up 15.71%.

It is worth mentioning that one of the protagonists of this acquisition, Miniso, saw its stock price plummet after the announcement, but the company's founder, chairman and CEO Ye Guofu seemed unperturbed by this, stating in his circle of friends, 'If everyone doesn't understand, then it's right. If everyone understands, then I have no chance.'

It is worth mentioning that one of the protagonists of this acquisition, Miniso, saw its stock price plummet after the announcement, but the company's founder, chairman and CEO Ye Guofu seemed unperturbed by this, stating in his circle of friends, 'If everyone doesn't understand, then it's right. If everyone understands, then I have no chance.'

So, what hidden business values does the businessman Ye Guofu, who is said to have a 'unique insight', see in supermarket retail? Taking Hong Kong stock related concept stocks as the observation objects, is it time to reevaluate the values of companies like Sunart Retail and Aeon Stores?

Will Yonghui's change of ownership drive the rebound of Sunart Retail and Aeon Stores?

Since joining hands with jd.com, yonghui superstores have been repeatedly discussed in the public opinion field. At the end of May this year, jd.com officially initiated the closure and renovation of Yonghui Superstores Zhengzhou Xinwan Plaza store. 19 days later, the transformed Yonghui Xinwan Plaza store reopened and achieved a first-day sales of 1.88 million yuan, which is 13.9 times the average daily sales before the transformation; with 12,926 customers on the reopening day, which is 5.3 times the average daily customer traffic before the transformation.

As the clock struck September, the heat generated by jd.com's 'super transformation' has not completely subsided. On September 23, Yonghui superstores released another heavy news: the company's shareholders Milk Company, jd.com World Trade, and Suqian Hanbang (jd.com consistent actors) plan to transfer their 29.4% stake in Yonghui Superstores to Juncai International. After the transfer, Miniso (Guangzhou) Co., Ltd., the controlling shareholder of Juncai International, will become Yonghui's largest shareholder.

According to relevant media reports, Ye Guofu stated in a telephone conference on the same day that one of the core reasons for Miniso to acquire Yonghui Superstores is that Miniso believes that China's offline supermarkets are facing a once-in-twenty-years structural opportunity, and Yonghui has great potential.

Ye Guofu introduced that his memorable experience of buying roasted sweet potatoes from jd.com and subsequent on-site experiences in several transformed Yonghui stores further strengthened his conviction in offline retail. Ye Guofu believes that it's not that offline retail is unworkable, but that traditional retail and traditional supermarket business models have problems. Currently, a group of domestic supermarkets led by Yonghui has initiated a reform, reshaping the landscape of China's offline supermarkets. Being handcrafted by jd.com, Yonghui has huge potential to stand out in this transformation.

The actual effects of Miniso's acquisition of Yonghui Superstores may take a long time to manifest, but a stone has stirred up waves, igniting the concept of commercial super retail stocks in the Hong Kong and A-share markets.

Take the example of Sunart Retail, mainly operating hypermarkets under the brand of RT-Mart and Auchan. After a surge on September 24th, the company's market cap increased by a whopping 2.29 billion Hong Kong dollars in just one day. However, quite dramatically, Ye Guofu publicly declared at an industry conference five years ago that RT-Mart had lost its value.

Although not previously favored by Ye Guofu, the recent trend of Sunart Retail's stock price shows that investors seem to be optimistic about this actively changing retail industry giant. In the past four trading days, Sunart Retail's stock price has risen by 33.6%. As of the close on September 24th, the stock price has rebounded by a significant 83.5% from the low point of the year.

Sunart Retail is not the only example, another retail chain enterprise in the Hong Kong stock market, Aeon Stores, also experienced a long-awaited surge on September 24th. Public information shows that Aeon Stores is a Japanese comprehensive retail and service company, starting its business in Hong Kong since 1985 and expanding to Guangzhou in 1996. According to the official website, Aeon Stores operates more than 400 different types of stores in China, covering multiple areas including department stores, food supermarkets, and comprehensive finance.

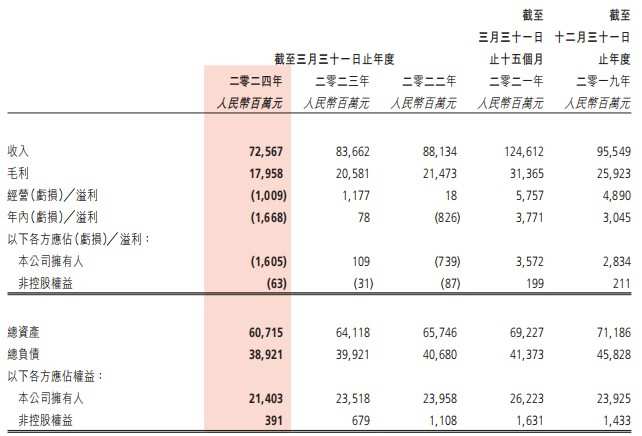

Zhijing Finance APP noticed that recently, the performance of Sunart Retail and Aeon stores has been less than ideal. Both companies are currently focusing on 'transformation'. In the 2024 fiscal year, Sunart Retail's revenue was 72.57 billion yuan, a 13.3% decrease year-on-year; net income attributable to the parent company was -1.605 billion yuan, a significant increase in losses. On the other hand, Aeon stores recorded revenue of 4.052 billion Hong Kong dollars in the first half of this year, a 10.4% decrease year-on-year; net income attributable to the parent company was -0.171 billion yuan, also showing increased losses compared to the same period last year.

In the previously disclosed annual report, Sunart Retail admitted to taking a wrong turn in the 2024 fiscal year, but they will welcome the 2025 fiscal year with a new management team and new strategies. Similarly, Aeon stores also stated in their semi-annual report that they will actively adjust their business strategies, strengthen digital transformation, in order to seize new business opportunities.

With the high-profile acquisition of Yonghui Superstores by Miniso, will the active funds in the Hong Kong stock market reverse the logic of trading Sunart Retail and Aeon stores, among other retail stocks, in difficulty?

Is it time to reassess the value of Hong Kong stock supermarket and retail stocks again?

When extending the candlestick chart of Sunart Retail, it can be seen that the company has been on a bearish path for a full four years, with a drop of about ninety percent during this period.

Despite the fluctuating stock prices in recent years, the performance of Sunart Retail is indeed lackluster. From fiscal year 2022 to 2024, the company's revenue shrank from 88.134 billion yuan to 72.567 billion yuan, accumulating total losses of over 2.4 billion yuan in three years.

Although looking back, the past few years have been full of challenges, yet the future may still be worth looking forward to. At the start of the 2025 fiscal year, Sunart Retail adjusted its management team, appointing former Auchan executive Shen Hui as the company's CEO, while refocusing on revenue growth and planning to reshape price advantages.

Specific operational measures show that Sunart Retail is currently focusing on building the "second growth curve", including refocusing and improving the CR Vanguard model (Auchan super), as well as developing M member stores. As of March 31, 2024, Sunart Retail has 472 large stores, 32 CR Vanguards, and 3 member stores. Recently, the speed of opening M member stores by the company seems to be further accelerating, with the appearance of Jiaxing M member store and Wuxi M member store.

In response, Macquarie recently released research reports stating that with Sunart Retail's same-store sales turning positive from April to August, combined with management's cost control target, the bank expects Sunart Retail to return to profit in the first half of the 25 fiscal year; based on the company's optimistic development expectations, Macquarie has raised Sunart Retail's target price by 22% to 1.83 Hong Kong dollars.

Coincidentally, Aeon Stores, a veteran retail chain, is also adjusting its strategic layout in the Chinese market. Public information shows that Aeon has been in continuous losses in its mainland business for 8 years. Despite this, at the group level, it still plans to continue opening stores in an enterprising manner. Recently, Aeon's first shopping center in Changsha, Hunan, Aeon Dream Mall (AEON Mall), opened. It is understood that in addition to Aeon Supermarket, it has introduced 250 specialty stores, as well as entertainment facilities with a total area of approximately 0.015 million square meters for consumers to enjoy.

On the opening day of the above-mentioned shopping mall, the President of Aeon Dream Mall, Takeshi Ohno, publicly announced that the company "will accelerate the opening of stores in the high-growth potential inland areas of China". By 2030, the company aims to increase the number of shopping centers in Hunan Province to 5 and in Hubei Province to 7.

While expanding its business into the Chu region, Aeon Stores has even more aggressive expansion goals in its traditional stronghold regions of Hong Kong and the Greater Bay Area. According to the company's semi-annual report, Aeon plans to complete the upgrade and renovation of AEON STYLE Tsuen Wan in the Hong Kong region within the year, and respectively open a new AEON STYLE store, a "Mono Mono", a KOMEDA'S Coffee, a JELYCO By KOMEDA, and several Daiso Japan stores; in the Greater Bay Area, Aeon will also open two AEON supermarkets.

In adversity breeds innovation, it is not difficult to see that in the face of their respective operational challenges, veteran retail giants are actively seeking new ways to "solve the problem". At present, as Miniso invests heavily in Yonghui, investors may wish to re-evaluate the value and future of key retail companies. However, switching back to the stock price perspective, after the concentration of optimism is released, how high and how long the rebound of related concept stocks can be ultimately depends on the "performance".

值得一提的是,这场收购的主角之一名创优品在宣布消息后股价狂泻,但公司的创始人、主席兼首席执行官叶国富对此不以为然,其在朋友圈宣称:“大家都看不懂就对了,如果都看得懂我就没有机会了。”

值得一提的是,这场收购的主角之一名创优品在宣布消息后股价狂泻,但公司的创始人、主席兼首席执行官叶国富对此不以为然,其在朋友圈宣称:“大家都看不懂就对了,如果都看得懂我就没有机会了。”