As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Jiangxi Special Electric Motor Co.,Ltd (SZSE:002176); the share price is down a whopping 71% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 21% lower in that time. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. But this could be related to the weak market, which is down 8.4% in the same period.

The recent uptick of 5.1% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Because Jiangxi Special Electric MotorLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Jiangxi Special Electric MotorLtd grew revenue at 0.2% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 20% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

Over three years, Jiangxi Special Electric MotorLtd grew revenue at 0.2% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 20% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

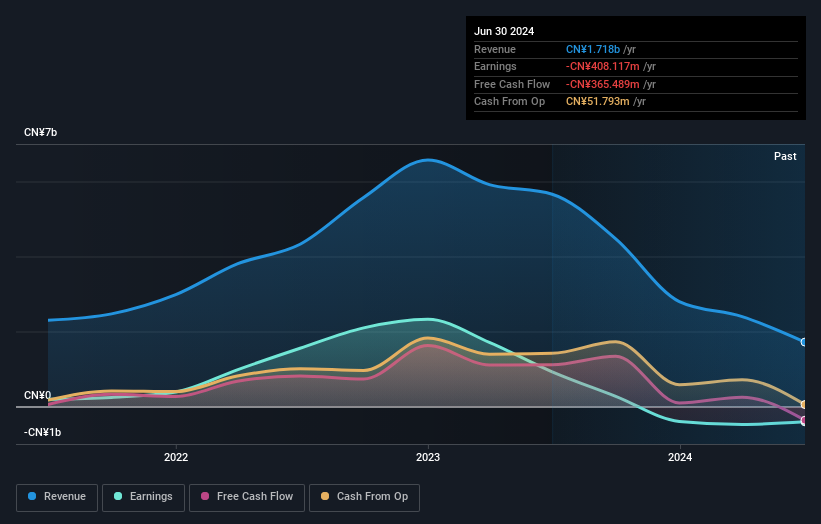

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Jiangxi Special Electric MotorLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The total return of 21% received by Jiangxi Special Electric MotorLtd shareholders over the last year isn't far from the market return of -19%. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.