株式市場指数は1.73%上昇し、2900ポイントを超え、深セン総合指数は2.36%上昇し、チャイネクストプライス指数は2.63%上昇した。個々の5000種類以上の株価が上昇し、金融セクターが急上昇した。

A株の主要指数は引き続き増加し、昼間の取引終了時点で、株式市場指数は1.73%上昇し、2900ポイントを超え、深セン総合指数は2.36%上昇し、チャイネクストプライス指数は2.63%上昇した。5000種類以上の株価が上昇し、取引額は前日の2767億元増の7984億元に達した。

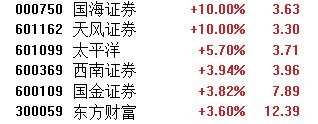

大規模金融セクターが急上昇し、天風証券、シーランド、中国食料資本、五矿資本など20社近くの株価が急上昇した。Soraテーマ株も引き続き上昇し、ハイリンクデジタルソリューション、テレビゾーンメディアの株価は制限まで上昇し、バイトダンス傘下の火山エンジンが2つのビデオ生成大型モデルをリリースした。貴金属株は強い動きを見せ、湖南の白銀は8%以上上昇し、中金黄金は6%超上昇し、現物金価格は1オンスあたり2670ドルを超え、最高値を続けた。不動産株は引き続き上昇し、金融街、CCCGリアルエステートなど複数の株価が制限まで上昇し、昨日の不動産市場も重要な政策パッケージを歓迎した。文化メディア、鉄鋼、インターネット電子商取引などのセクターが上昇率トップに。国営企業改革テーマ銘柄のDatang Telecomは初日直線ダイブし、上演中の「サーキットブレーカー」の相場。

大規模金融セクターが急上昇し、天風証券など20社近くの株価が制限まで上昇した

大規模金融セクターが急上昇し、天風証券など20社近くの株価が制限まで上昇した

天風証券、シーランド、Cofco Capital Holdings、五矿资本など多数の株価が制限まで上昇し、瑞達先物、SDIC Capital、The Pacificなどが追随した。ニュース面では、中央銀行が初めて資本市場を支援する構造的な金融政策を設定し、証券、ファンド、保険会社の間での利便性の交換を含め、最初の操作規模は5000億元であり、今後は状況に応じて規模を拡大することができる。

ソラテーマ株は引き続き上昇し、中金黄金はストップ高

ソラテーマ株は引き続き上昇し、中金黄金はストップ高FS Development Investment Holdings up by 20cm to limit up, Hylink Digital Solutions and TVZone Media hit limit up, Guangdong Insight Brand Marketing Group rose over 12%, Shanghai Anoky Group and Zhejiang Huace Film & TV rose over 7%. On the news front, on September 24, ByteDance's Volcano Engine held an AI Innovation Tour in Shenzhen, unveiling two large models, Douyin Video Generation-PixelDance and Douyin Video Generation-Seaweed, opening invite testing for the enterprise market. As of September, daily token usage of Douyin's language model exceeded 1.3 trillion, a tenfold increase from its initial release in May, with multimodal data processing reaching 50 million images and 850,000 hours of voice per day.

Gold hits new highs repeatedly, driving strong performance in precious metal stocks

Silver in Hunan rose over 8%, Shengda Resources, Inner Mongolia Xingye Silver&Tin Mining, Zhongjin Gold Corp., Ltd. rose over 6%, Leysen Jewellery Inc., Shangjin International, Zijin Mining Group and others took the lead in gains. In terms of news, spot gold rose above $2670 per ounce, hitting a historical new high, up 0.5% intraday. UBS Wealth Management Asia-Pacific Chief Investment Office stated that with the Fed's rate cut and escalating Middle East tensions, gold's appeal has increased. Driven by institutional and ETF demand, strong gold demand is expected to persist until next year. By mid-2025, the price of gold may reach $2700 per ounce. In addition to investing in physical gold, investors may consider exposure through structured strategies, ETFs, or gold mining stocks.

Real estate stocks continue to rise, with CCCG Real Estate Corporation and others hitting the limit up

Financial Street Holdings, Guangdong Shirongzhaoye, Yang Guang Co., Ltd., Vantone Neo Development Group, Hefei Urban Construction Development, Greenland Holdings Corporation, Shenzhen Overseas Chinese Town, and others rose over 6%. On the news side, various departments including the central bank yesterday unleashed a "big move," once again introducing a heavyweight policy combination for the real estate market, injecting a "tonic" into market confidence. People's Bank of China Governor Pan Gongsheng announced five new real estate finance policies in conjunction with the China Banking and Insurance Regulatory Commission: 1) Guiding banks to lower mortgage rates for existing homes, with an average expected reduction of around 0.5 percentage points; 2) Unifying the minimum down payment ratio for mortgages to 15%; 3) Extending the term of two real estate finance policy documents; 4) Optimizing the policy for re-lending of affordable housing; 5) Supporting the acquisition of existing land by real estate companies.