Morgan Stanley stated that the 'macro overall fundamentals in emerging markets look good', the Fed rate cut and the weakening of the US dollar have opened the door for emerging market stocks to outperform US stocks.

Morgan Stanley remains bullish on emerging markets, stating that the Fed rate cuts and a weaker dollar have opened the door for emerging market stocks to outperform US stocks.

According to Bloomberg's report on Wednesday, Jitania Kandhari, Deputy Chief Investment Officer for Morgan Stanley's Emerging Markets and Head of Macroeconomic Research, stated that the US economic growth and high interest rates were previously favorable for the dollar, but now these two factors have peaked, starting to favor markets outside the US, and the "macro overall fundamentals of emerging markets look good."

Kandhari firmly believes that this decade is the "decade of emerging markets," even if the performance is sometimes not as satisfactory.

Kandhari firmly believes that this decade is the "decade of emerging markets," even if the performance is sometimes not as satisfactory.

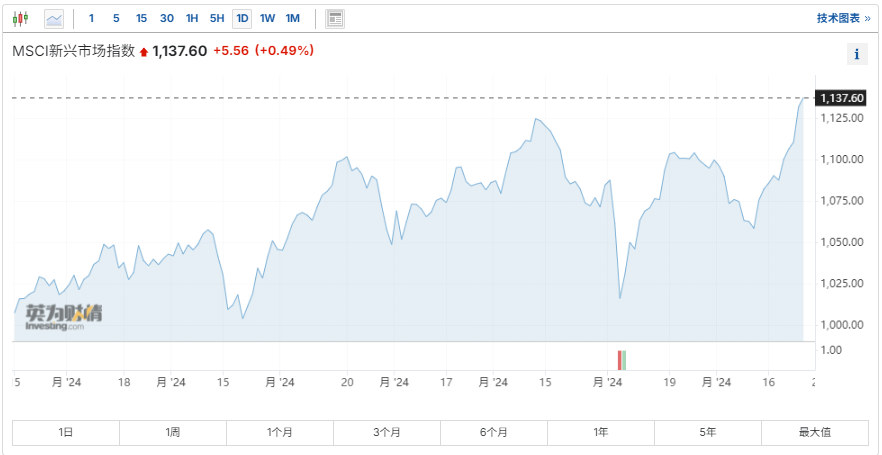

As of September 23, the MSCI Emerging Markets Index has risen by 11% year-to-date, lagging behind the S&P 500 Index for the sixth consecutive year, the latter having risen by over 20% this year.

"I remain constructive," Kandhari said, "I believe that emerging markets will be the best-performing asset class of this decade."

Kandhari stated that previously, due to the Fed's faster policy tightening, interest rate differentials between the US and other countries were favorable for the dollar. A series of fiscal policies introduced by the federal government stimulated rapid economic growth in the US, also benefiting the dollar. Kandhari believes that a 10-year US Treasury yield of 4% is a reasonable level, which is "a fairly good environment for emerging market assets."

Kandhari also mentioned that after the Fed's rate cut, emerging market central banks that have been on the sidelines so far will have less constraints on cutting rates.

Previously, Wall Street News mentioned that the Fed's first significant rate cut in four years released a dovish signal to emerging market central banks, with an optimistic outlook for Southeast Asian markets. Over the past two months, fund managers have consistently increased their holdings of sovereign bonds in Thailand, Indonesia, and Malaysia. And in the past three months, they have been net buyers of stocks in Indonesia, Malaysia, and the Philippines.

Meanwhile, driven by optimistic economic prospects and the Fed's rate cut, foreign inflows into the Indian stock market have been continuous, with the benchmark Nifty 50 index breaking through the 26,000 mark on Tuesday, reaching a new historical high.

Kandhari坚持认为这十年是“新兴市场的十年”,即便有时表现不太如意。

Kandhari坚持认为这十年是“新兴市场的十年”,即便有时表现不太如意。