Under multiple squeezes, a 'life and death struggle' is staged.

As the China Automobile Dealers Association (referred to as the Dealers Association) officially submits the 'Urgent Report on the Current Capital Difficulties and Shutdown Risks Faced by Auto Dealers' to relevant government departments, the survival difficulties of traditional dealers are once again brought to light.

The 'Report' shows that according to the Dealers Association's 'Market Pulse' monitoring data, from January to August this year, the 'price war' has led to an overall retail loss of 138 billion yuan in the new car market, significantly impacting the healthy development of the industry.

In fact, since the beginning of this year, dealers who have been overwhelmed by the 'price war' and subsequently mired in difficulties are not uncommon. In September alone, there were reports of two car dealerships facing situations where either new cars could not be licensed or dealership agreements were terminated by the brand. The plight of these two dealerships is not an isolated incident, but a reflection of the current real difficulties faced by the entire auto retail industry.

In fact, since the beginning of this year, dealers who have been overwhelmed by the 'price war' and subsequently mired in difficulties are not uncommon. In September alone, there were reports of two car dealerships facing situations where either new cars could not be licensed or dealership agreements were terminated by the brand. The plight of these two dealerships is not an isolated incident, but a reflection of the current real difficulties faced by the entire auto retail industry.

While the Dealers Association calls for the introduction of phased financial relief policies, institutions also expect sales performance during the traditionally strong 'Golden September and Silver October' to exceed expectations this year. The positive news resonates, leading to a substantial increase in auto dealer stock prices. On September 24, Zhongsheng Hldg (00881) and Meidong Auto (01268) surged 9.85% and 17.68% respectively.

According to Zhongtong Finance APP, the hardship faced by auto dealers as they carry the burden is a tangible manifestation of their transition period pains. And at this critical moment of life and death, leading dealers are beginning to explore ways to break free from the crisis.

The 'darkest moment' of domestic auto dealers

The 'golden age' of car dealers lying down and making money in the face of the end consumer market has disappeared, with the overall sector facing tremendous survival pressure.

The 'Report' believes that currently, the automotive dealer industry is facing two major issues: firstly, the dual pressure of weak consumption and high manufacturer wholesale volumes has kept dealer inventory at high levels, forcing dealers to sell at low prices in order to reduce financial pressure and financing costs to survive; secondly, the 'price war' has led to severe overstocking, with the more dealers sell, the more losses they incur, while also facing pressure from difficult financing due dates, causing cash flow interruptions and an abrupt increase in the risk of funding chain failures. At present, the existing working capital of dealers has been compressed to the limit.

According to the Association's 'Market Pulse' monitoring data, as of August this year, the highest negative dealer inventory data has reached -22.8%, expanding by a further 10.7 percentage points compared to the same period last year. According to expert analysis related to the Association, in August, the overall discount rate in the new car market was 17.4%. From January to August this year, the 'price war' has led to a cumulative retail loss of 138 billion yuan in the overall new car market, significantly impacting the industry's healthy development.

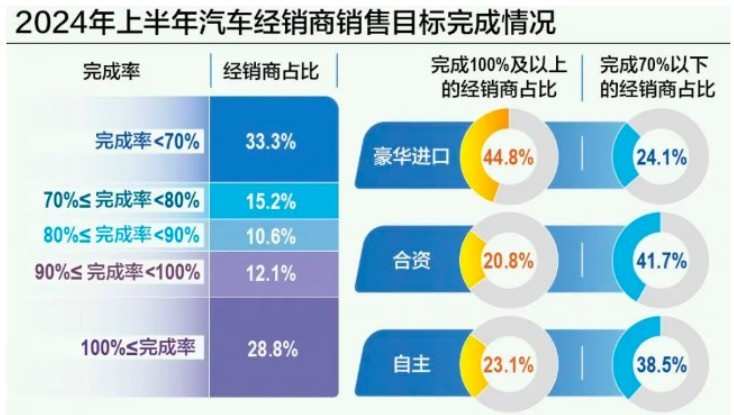

The results of 'volume for price' are also not ideal. In the first half of this year, only close to thirty percent of dealers exceeded their semi-annual sales targets, with over fifty percent of dealers achieving over 80% of their targets, while dealers with target completion rates below 70% still accounted for a third. Luxury/import brands had a higher completion rate, with over 40% of dealers meeting their semi-annual targets; joint venture brands had the lowest completion rate (only 20.8%), with over 40% of dealers having a completion rate below 70%; independent brands stood at 23.1%.

Even top companies find it hard to escape from the industry shadow. Among the 8 car dealer groups listed on the Hong Kong Stock Exchange, only Zhongsheng Hldg and Harmony Auto (03836) achieved new car sales growth, with the remaining 6 car dealer groups experiencing sales declines ranging from 4% to 17%, with Meidong Auto having the largest decline.

More crucially, behind 'volume for price' is the continuous contraction of profit margins, as while dealer losses expanded in the first half of this year, profit margins narrowed.

Based on the financial reports of Zhongsheng Hldg, Harmony Auto, Grand Baoxin, and Yongda Auto in the first half of 2024, the net income margins of all companies decreased, showcasing a decline in profitability. Among them, Zhongsheng Hldg's net income decreased by 50.3% year-on-year, Yongda Auto's net income decreased by 76.1% year-on-year, while Sunfonda gp (01771) and Grand Baoxin and other dealers are still 'struggling' in losses.

(Unit: ten thousand yuan)

In addition, public data shows that in the first half of this year, nearly 2000 4S stores nationwide have closed or withdrawn from the market, almost reaching the total number of closures for the entire previous year. Domestic car dealerships are experiencing their darkest moment.

Front-end operations are facing obstacles, and the capital markets have also begun to react. Last year, China's first IPO car dealer, Pangda Group, began its path to delisting. At its peak, its revenue exceeded 70 billion, with partnerships with nearly a hundred car brands and over 1400 4S stores under its name. In addition, on August 28, the once prominent car dealership giant, Guanghui Auto, officially delisted. Over its 9 years of being listed, Guanghui Auto's market cap plummeted from hundreds of billions in a straight line, eventually triggering a face value delisting.

Currently, the car dealership companies that have not yet been delisted, including Zhengtong Auto, Sunfonda Group, Harmony Auto, and Cent Unit Hldg (01959), have been trading below 0.5 Hong Kong dollars for several consecutive days, indicating the attitude of the capital markets.

Accelerating transformation to seek opportunities for survival

It is not difficult to see that at the current stage, the dilemma of the traditional dealership system, or 4S stores, is indeed closely related to the prevailing 'price wars' throughout the year. However, the deeper reason lies in the rapid rise of electric vehicles and the introduction of direct sales models, making traditional car 4S stores seem 'no longer needed'.

It should be pointed out that the painful period of industry transformation is inevitable, but it is in every change, under the new market selection mechanism, that the industry's appearance can ultimately be rejuvenated.

According to the Zhixun Financial APP, car dealers have already begun to take targeted measures, either strengthening after-sales service, adding used cars and new energy car business, or expanding overseas markets, even though some dealers are struggling to withstand operational pressures amid the transformation wave, there are still players who remain at the table relying on the transformation.

In the first half of 2024, Zhongsheng Hldg, Yongda Auto, Zhengtongauto, and Century United Holding maintained a growth trend in after-sales, with revenues of 10.96 billion yuan, 4.65 billion yuan, 1.7 billion yuan, and 0.11 billion yuan respectively, with year-on-year growth rates of 13.8%, 0.2%, 19.2%, and 15.1%.

Especially for Zhongsheng Hldg, the main source of income is from after-sales. In terms of gross profit, Zhongsheng Hldg's total gross profit reached 4.93 billion yuan in the first half of the year. While the gross profit from new car sales declined significantly to -1.99 billion yuan, the after-sales business gross profit reached 5 billion yuan, a substantial increase of 12.7% year-on-year, completely covering the group's total gross profit.

After-sales sector has always been a high-profit business for dealer groups. With players continuously deepening their layout in this track, the improvement of this business will gradually enhance their overall profit.

(Unit: 10,000 yuan)

In terms of used cars and new energy cars, only 5 car dealer groups disclosed their used car transaction volumes in the first half of the year. Among them, the leading player Zhongsheng Hldg saw a 53.9% year-on-year growth in used car transaction volume; while Yongda Auto, the overall used car transaction volume (dealer + brokerage) was 35,236 units, a decrease of 14.2% year-on-year, with a dealer used car volume of 17,025 units, a decrease of 14.5%. In addition, facing the trend of new energy, dealers have generally increased efforts in the layout of new energy car brands this year, with over thirty percent believing that the penetration rate of new energy vehicles will exceed 50% for the whole year.

It is undeniable that when the development of new energy brands requires a broader market coverage, a faster response mechanism, and a more diverse sales strategy, the role of distribution agents will be highlighted, and dealers' attribute of 'existence is reasonable' becomes more evident.

On the other hand, since 2021, the Chinese automotive export market has shown super strong growth. According to the export data from the General Administration of Customs, in 2023, China has exported 5.221 million vehicles (3.317 million vehicles in the same period of 2022), with an export growth rate of 57.4%. It is currently the world's largest automotive exporter and has enormous future potential.

As independent brands expand overseas markets, car dealers are following closely behind the automotive companies to embark on their journey abroad. The first to venture into this territory was Harmony Auto. In November 2023, the first AiPump fuel cell vehicle showroom jointly established by GAC Aion and Harmony Auto opened in Bangkok, Thailand. On January 9 this year, Thailand's largest AiPump new energy vehicle experience center - Harmony Aion Samui Experience Center opened. Harmony Auto's goal is to establish at least 10 Aion sales outlets in Thailand and become the largest distributor of Aion in Thailand. It can be anticipated that when GAC Aion's factory in Thailand starts production, Harmony Auto will become its most important partner.

However, going abroad presents high demands for overseas customer resources, understanding of local markets, etc., posing a big challenge for car dealers as well. Currently, automotive companies often choose to cooperate with local overseas dealers. For example, Xiaopeng has signed a strategic cooperation agreement with leading European dealers Emil Frey NV Group of the Netherlands and Bilia Group of Sweden, implementing a 'direct + authorized' retail model. Therefore, the overseas expansion of domestic car dealers may be a breakthrough route, but this path is still full of challenges.

In the intensifying 'price war', domestic dealers are experiencing a 'crisis' moment where operational and profit capabilities are declining. In this context, how dealers innovate has become a crucial weapon for breaking through. For instance, Zhongsheng Holdings has already shifted its profit focus to after-sales services, and Harmony Auto has also increased its presence in the overseas market. The road is long and arduous, but we still believe that dealers who rely on their own efforts will remain at the table in this survival of the fittest.

事实上,今年以来,因“价格战”而不堪重负,进而深陷泥潭的经销商并不鲜见。仅在9月,就有两家汽车经销商被传出或新车无法上牌、或遭品牌方解除经销商协议的消息。这两家经销商的境遇并非偶发性事件,而是整个汽车经销商目前所面临的现实困境的折射。

事实上,今年以来,因“价格战”而不堪重负,进而深陷泥潭的经销商并不鲜见。仅在9月,就有两家汽车经销商被传出或新车无法上牌、或遭品牌方解除经销商协议的消息。这两家经销商的境遇并非偶发性事件,而是整个汽车经销商目前所面临的现实困境的折射。