It can certainly be frustrating when a stock does not perform as hoped. But when the market is down, you're bound to have some losers. While the Guangdong Tapai Group Co., Ltd. (SZSE:002233) share price is down 35% in the last three years, the total return to shareholders (which includes dividends) was -25%. That's better than the market which declined 26% over the last three years. On the other hand the share price has bounced 9.5% over the last week. The buoyant market could have helped drive the share price pop, since stocks are up 6.7% in the same period.

While the stock has risen 9.5% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

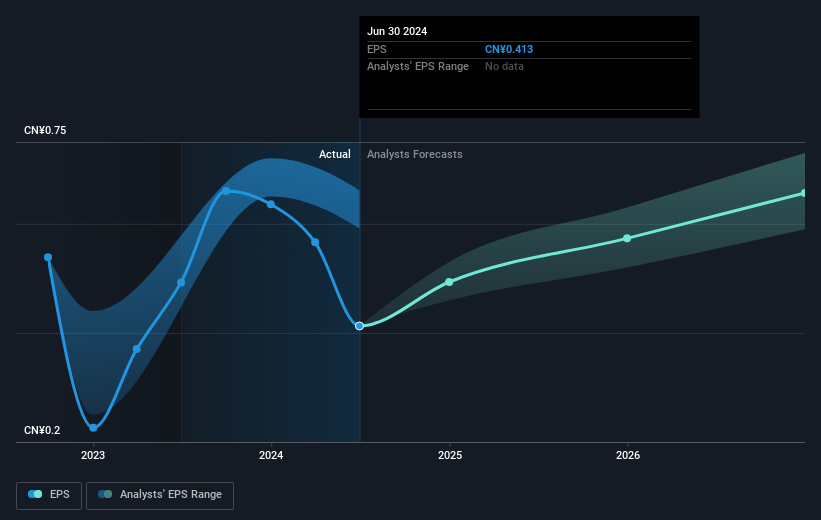

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Guangdong Tapai Group saw its EPS decline at a compound rate of 35% per year, over the last three years. In comparison the 14% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

Guangdong Tapai Group saw its EPS decline at a compound rate of 35% per year, over the last three years. In comparison the 14% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Guangdong Tapai Group, it has a TSR of -25% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Although it hurts that Guangdong Tapai Group returned a loss of 5.6% in the last twelve months, the broader market was actually worse, returning a loss of 14%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 0.7% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Guangdong Tapai Group better, we need to consider many other factors. Take risks, for example - Guangdong Tapai Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.