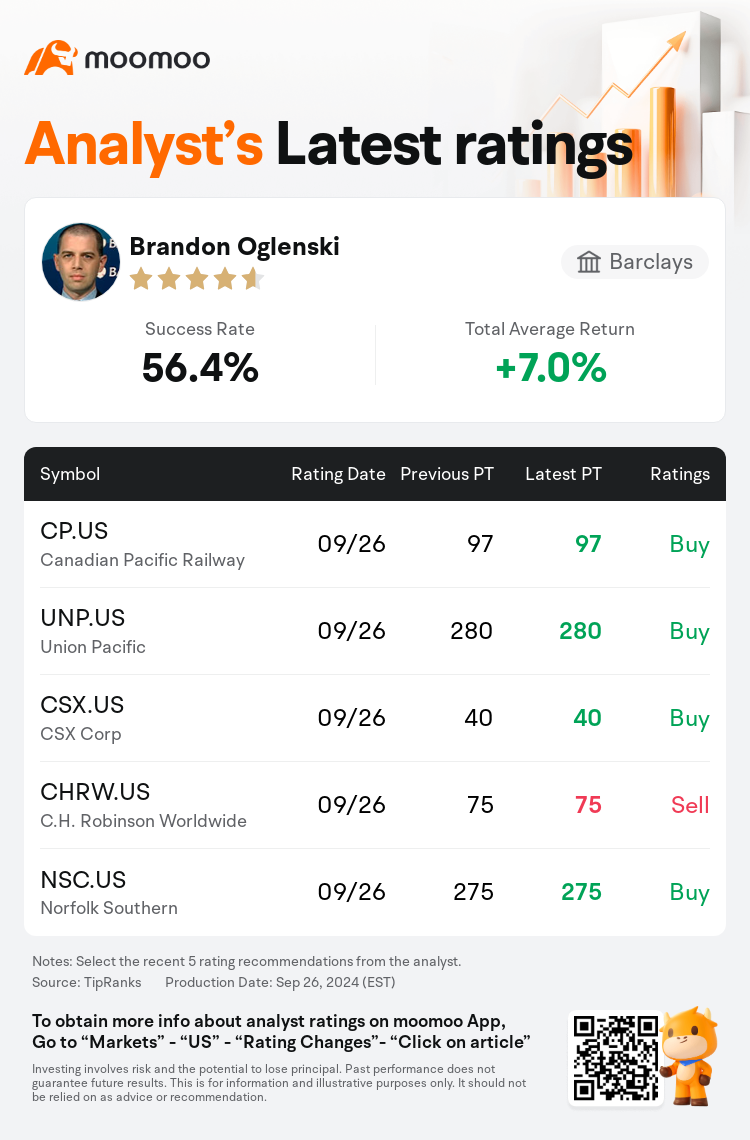

Barclays analyst Brandon Oglenski maintains $Canadian Pacific Railway (CP.US)$ with a buy rating, and maintains the target price at $97.

According to TipRanks data, the analyst has a success rate of 56.4% and a total average return of 7.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Canadian Pacific Railway (CP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Canadian Pacific Railway (CP.US)$'s main analysts recently are as follows:

It is anticipated that Q3 transport results may be slightly softer than earlier projections due to persistently weak industrial demand. Nevertheless, the scenario is expected to improve with increasing North American import activity and a probable reduction in trucking capacity, which may create a more favorable environment as attention shifts towards 2025 forecasts. Transport fundamentals are considered to be varied, with pricing outcomes not yet fully realized due to the surplus in trucking capacity. Despite this, there appears to be potential within the railroad and less-than-truckload carrier sectors.

The estimation for Canadian Pacific Kansas City's earnings per share in the third quarter is being revised downwards by analysts, to reflect a range of factors including softer yields and a less dynamic macroeconomic environment, particularly in relation to the trucking and broader transportation sectors. This reassessment also affects the projections for 2025 earnings per share. Adjustments have been made to long-term financial forecasts and minor changes to relative target multiples have been noted in a sector analysis.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Brandon Oglenski維持$加拿大太平洋鐵路 (CP.US)$買入評級,維持目標價97美元。

根據TipRanks數據顯示,該分析師近一年總勝率為56.4%,總平均回報率為7.0%。

此外,綜合報道,$加拿大太平洋鐵路 (CP.US)$近期主要分析師觀點如下:

此外,綜合報道,$加拿大太平洋鐵路 (CP.US)$近期主要分析師觀點如下:

由於工業需求持續疲軟,預計第三季度交通業績可能略低於先前的預測。儘管如此,隨着北美進口活動的增加以及卡車運輸能力的可能降低,這種情況預計將有所改善。隨着注意力轉移到2025年的預測,這可能會創造一個更有利的環境。人們認爲運輸基本面各不相同,由於卡車運輸能力過剩,定價結果尚未完全實現。儘管如此,鐵路和零擔運輸行業似乎仍有潛力。

分析師正在下調對加拿大太平洋堪薩斯城第三季度每股收益的估計,以反映一系列因素,包括收益率疲軟和宏觀經濟環境不那麼活躍,尤其是與卡車運輸和更廣泛的運輸行業相關的環境。這種重新評估還影響了對2025年每股收益的預測。對長期財務預測進行了調整,行業分析中注意到相對目標倍數略有變化。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$加拿大太平洋鐵路 (CP.US)$近期主要分析師觀點如下:

此外,綜合報道,$加拿大太平洋鐵路 (CP.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of