Amidst industry pressure, some cement companies are still achieving positive profits, demonstrating good operational resilience.

The mid-year report release has passed, and the cement industry in the downturn is still waiting for signs of recovery. As the two major downstream sources of demand for the cement industry, the real estate market is sluggish, and the slowdown in infrastructure investment are both dragging down overall cement demand.

Data shows that in the first half of the year, the cement industry experienced a simultaneous decline in both quantity and price. The national cement production reached 0.85 billion tons, a year-on-year decrease of 10.0%, at its lowest level in the same period since 2012; during the same period, the national average cement price was 367 yuan per ton, a 12.8% decrease year-on-year.

However, looking at it quarterly, cement prices showed a trend of initial suppression followed by an upward trend, with a slight rebound in Q2 cement prices. It is understood that the second quarter is traditionally a peak season for cement industry demand, coupled with the industry actively promoting self-discipline and strengthening peak production changes, the national average cement price in Q2 was 369 yuan, a 1.6% increase compared to the previous quarter.

However, looking at it quarterly, cement prices showed a trend of initial suppression followed by an upward trend, with a slight rebound in Q2 cement prices. It is understood that the second quarter is traditionally a peak season for cement industry demand, coupled with the industry actively promoting self-discipline and strengthening peak production changes, the national average cement price in Q2 was 369 yuan, a 1.6% increase compared to the previous quarter.

Amidst industry pressure, some cement companies are still achieving positive profits, showing good operational resilience, and the high growth of non-cement businesses and overseas operations also add a touch of brightness to the fundamentals. Looking ahead to the second half of the year, can the market expect the cement industry to bottom out and recover?

Both revenue and net profit have dropped significantly, with further contraction in capital expenditure.

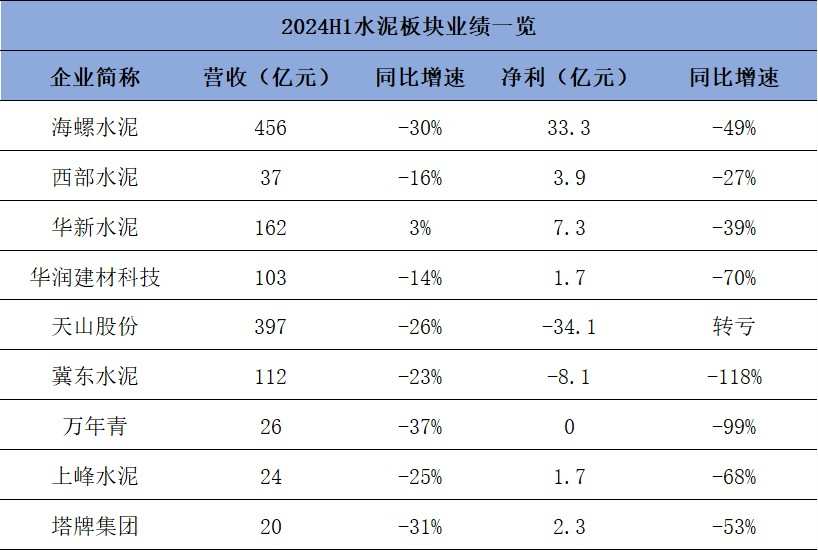

In the first half of 2024, the cement market demand continued to be weak, and the industry's business conditions lingered at the bottom, reflecting the overall pressure on operations, which is also evident in the performance of various listed companies. According to data from the China Building Materials Federation, the total profit of the cement industry in the first half of 2024 was -1.15 billion yuan, with over 50% of companies facing losses.

According to the Securities Times app, out of 9 representative top cement companies, 8 experienced a decline in revenue in the first half of the year. Only Huaxin Cement (06655) achieved revenue growth, with a year-on-year growth rate in the single digits. Net profits also saw a significant decline across the board, with Wannianqing (000789.SZ) having a net profit of only 1.51 million yuan, Tianshan Stock (000877.SZ) and Jidong Cement (000401.SZ) recording losses of 341 million yuan and 810 million yuan respectively.

In terms of production capacity and sales volume, Conch Cement (00914) and Tianshan Stock lead in market share. In the first half of the year, their sales volumes (mainly external sales of cement and clinker, excluding internal offset, with cement being the main component in actual data) were 12.6 billion tons and 1.06 billion tons respectively, with decreases of 3% and 13% year-on-year. Followed by Jidong Cement and Huaxin Cement, with sales volumes of 3.8 billion and 2.8 billion tons respectively, showing a year-on-year decline of 13% and 5% respectively.

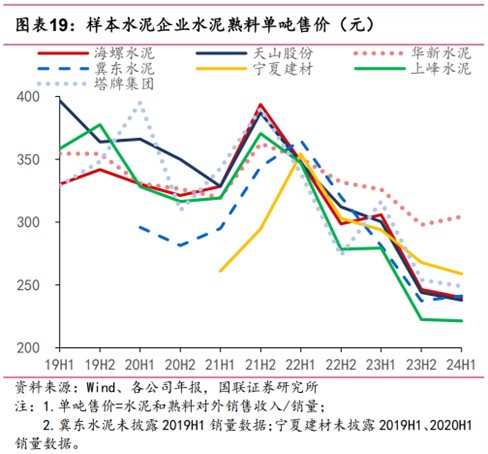

Looking at the price per ton of cement, in the first half of the year, the average price per ton decreased for most cement companies. However, the average price per ton for Huaxin Cement and Jidong Cement increased by 6 yuan and 4 yuan respectively, mainly due to higher overseas prices for Huaxin Cement and increased efforts to stagger production in Northeast China in the second quarter leading to an early recovery in cement prices.

In terms of net profit per ton of cement, most companies saw a year-on-year decline in the first half of the year. Conch Cement, Tapai Group (002233.SZ), and Ningxia Building Materials had relatively high net profits per ton, at 29, 29, and 27 yuan respectively, with year-on-year decreases of 31, 35, and 14 yuan. As a leading national enterprise, Conch Cement still retains significant cost advantages, with profits consistently higher than the industry average.

Against the backdrop of sustained pressure on profits, most cement companies have continued to reduce capital expenditure, leading to a decline in net cash flow. Conch Cement, Tianshan Stock, and Huaxin Cement rank high in terms of capital expenditure, with capital expenditures in the first half of the year amounting to 57 billion, 47 billion, and 14 billion yuan respectively, all showing a slight decrease year-on-year.

According to the CITIC Financial App, in addition to being used for cement clinker production capacity replacement projects or merger and acquisition expenditures, in recent years, many enterprises have used capital expenditures to expand new businesses, new markets, or complete the layout of the industry chain, such as Conch Cement expanding aggregates, commercial mixing, and photovoltaic new energy businesses, Huaxin Cement layout overseas cement capacity, and so on.

While the operating cash flow of most cement companies has decreased year-on-year, Conch Cement's net inflow of operating cash flow has increased against the trend. In the first half of the year, the net cash flow from operating activities was 6.9 billion yuan, an increase of 1.8 billion yuan or 35% year-on-year.

Overall, although most enterprises faced significant operating pressure in the first half of the year, due to the rebound in cement prices in Q2, coupled with the cement industry strengthening cost control and contracting capital expenditures, the gross margin and net margin levels of most cement enterprises in Q2 have shown some recovery on a quarterly basis, easing the marginal operating pressure. In addition, non-cement businesses and overseas businesses are also expected to contribute new performance increments.

Non-cement businesses and overseas businesses may become opportunities for recovery.

Despite overall operating pressure, cement companies have actively sought new ways out in recent years. Non-cement businesses and overseas businesses are bringing growth opportunities to the industry. For example, Huaxin Cement achieved rare revenue growth in the first half of the year, mainly due to the company's overseas cement sales and rapid growth in non-cement businesses such as aggregates and commercial mixing.

In the first half of 2024, Conch Cement and Huaxin Cement's non-cement business performance was impressive, with Conch Cement aggregates and commercial mixing both achieving double-digit growth, with revenues increasing by 29.8% and 20.6% year-on-year, and capacity increasing by 16.2% and 33.9% respectively.

Since 2022, Conch Cement has begun to increase the capacity of aggregates and commercial mixing. By the end of 2023, the company's aggregate capacity was 0.149 billion tons, and the commercial concrete capacity reached 39.8 million cubic meters. Based on the 2023 data, the gross margin for aggregates and manufactured sand is as high as 48.32%, the highest among all products, with potential for significant profit margins. However, the revenue proportion of these two businesses is relatively small, with aggregates and commercial mixing revenue accounting for only 6.4% and 3.5%, respectively.

In contrast, Huaxin Cement's progress in aggregates and commercial mixing businesses in H1 2024 was faster, with business income increasing by 37.0% and 24.2% year-on-year, and total income proportion increasing by 8.8 percentage points to 42.5% year-on-year.

Overseas cement sales and prices have both increased, bringing new performance growth to Huaxin Cement. In the first half of the year, the company's overall cement clinker sales volume decreased by 4.9%, with overseas sales increasing by 47.0%, offsetting a 15.7% decline in domestic sales. Overseas cement business total revenue was 3.578 billion yuan, a year-on-year increase of 55.41%, accounting for approximately 22.04% of total revenue, an increase of 7.5 percentage points year-on-year.

Also present in the overseas market is Westchina Cement (02233) listed on the Hong Kong Stock Exchange. In 2023, the company's overseas market revenue reached 2.77 billion yuan, a year-on-year increase of 145%, accounting for 31% of total revenue. Thanks to investments in Ethiopia, Congo, and Mozambique, the company's African business average selling price and profit are higher than domestic factories. In 2023, prices in Chinese factories were 292 yuan per ton, while in African factories they were 813 yuan; gross profit per ton in Chinese factories was 44 yuan, compared to 504 yuan, 509 yuan, and 358 yuan in Ethiopia, Congo (Gold), and Mozambique respectively.

The staggered reduction trend continues, and cement price expectations are positive in the second half of the year.

Despite the national cement market's continued weak performance, the cement industry in the second half of the year is still supported by multiple bullish factors at the policy and industry levels.

On the policy front, recent intensive policies from the People's Bank of China, the Hong Kong Monetary Authority, the China Securities Regulatory Commission, and other departments fully support the real estate market from both the supply and demand sides, which is expected to provide a positive boost to the fundamentals of the building materials industry. Tianfeng Securities released research reports stating that prices of building materials such as cement and glass fiber have shown some recovery, which may reflect that the sector has bottomed out and is expected to see a rebound opportunity.

Since September, the Ministry of Ecology and Environment has successively issued documents such as the 'National Carbon Emission Rights Trading Market Coverage Work Plan (Draft for Solicitation of Opinions)' covering the cement, steel, and electrolytic aluminum industries, the 'Guidelines for Corporate Greenhouse Gas Emission Accounting and Reporting in the Cement Industry,' and the 'Technical Guidelines for Corporate Greenhouse Gas Emission Verification in the Cement Industry,' indicating that the plan for the cement industry to be included in the carbon emission rights trading market in 2024 is taking shape.

It is understood that the cement industry is a major emitter of carbon emissions, and the implementation of carbon trading and related policies is expected to drive the industry towards rational development and accelerate the elimination of backward production capacity. Ping An Securities pointed out that with the industry being included in the national carbon emissions and trading market, the cost advantages of leading enterprises like Huaxin and Conch in recent years in improving energy consumption levels through alternative fuels and technological improvements will be further consolidated.

At the industry level, recent efforts to increase industry self-discipline and staggered production restrictions have also provided support for cement prices. According to reports, leading cement companies in the Yangtze River Delta region plan to halt production for around 10 days in July and August, reducing production by about 30%; Conch Cement, as a regional leader, will also join this round of staggered production halts.

In the recently released 2024 annual 'Quality Improvement and Efficiency Return' action plan, Conch Cement pointed out that the company will actively promote the government to introduce more rigorous staggered production or supply-side reform control policies in accordance with the overall idea of 'profit is the goal, market share is the foundation' and strictly comply with them to stabilize the basic profit base of the cement main business.

However, the implementation of the current staggered production restriction still needs further observation. If the supply-demand relationship improves, cement enterprises are expected to hedge the decline in demand by increasing profit per ton. In addition, with the peak season in September and October approaching, cement prices in various regions may also increase. It is reported that in September, major branded enterprises in multiple regions including Hunan, Shaanxi, Hebei, Henan, Jiangsu, Zhejiang, Liaoning, Jilin, Heilongjiang, Sichuan, Chongqing, and others have notified of raising cement quotes.

Overall, the industry consensus on staggered production limits helps support the stabilization of cement prices, and the cement prices in the second half of the year may see a certain degree of recovery. On the one hand, with the decrease in capital expenditure, the dividend nature of the cement sector remains prominent, and industry leaders with high dividend yields will have long-term allocation value; on the other hand, cement companies with outstanding performance in non-cement businesses and overseas cement operations are also expected to receive favorable catalysts.

不过,分季度来看,水泥价格呈现先抑后扬走势,Q2水泥均价出现小幅回升。据了解,二季度为水泥行业传统需求旺季,叠加行业积极开展行业自律和加强错峰生产,Q2全国水泥均价为369元,环比上升1.6%。

不过,分季度来看,水泥价格呈现先抑后扬走势,Q2水泥均价出现小幅回升。据了解,二季度为水泥行业传统需求旺季,叠加行业积极开展行业自律和加强错峰生产,Q2全国水泥均价为369元,环比上升1.6%。