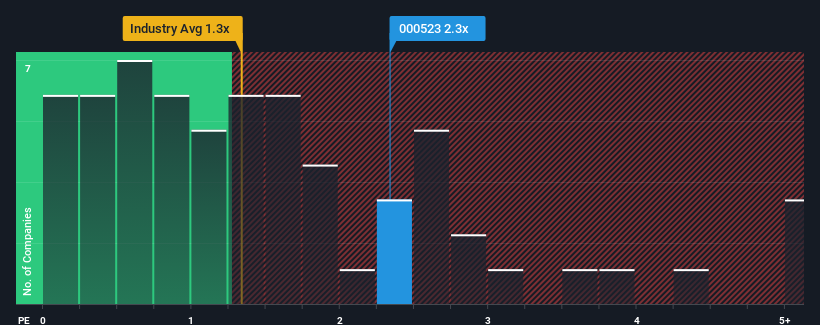

It's not a stretch to say that Hongmian Zhihui Science and Technology Innovation Co.,Ltd.Guangzhou's (SZSE:000523) price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" for companies in the Household Products industry in China, where the median P/S ratio is around 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou Has Been Performing

For instance, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's earnings, revenue and cash flow.How Is Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 232% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 232% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.