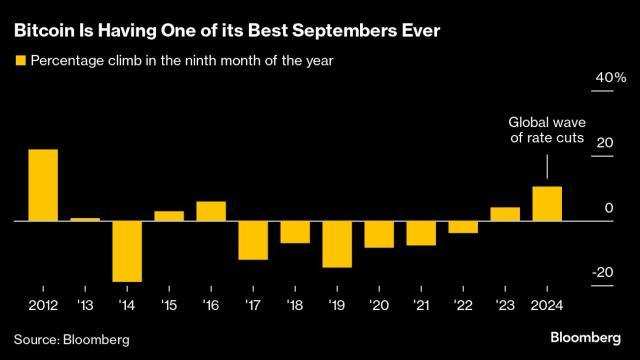

Bitcoin is expected to see one of the largest September gains in recent years, as the global interest rate cut led by the Federal Reserve helps the largest digital asset withstand seasonal downturns.

According to Tencent Finance, Bitcoin is expected to see one of the largest September gains in recent years, as the global interest rate cut led by the Federal Reserve helps the largest digital asset withstand seasonal downturns. Data shows that the token has risen by over 10% this month, while the average drop in September over the past decade has been 5.9%. The index of small cryptocurrencies has risen by over 20%, indicating that the loose financial environment has activated the riskier parts of the crypto market.

The Federal Reserve, European Central Bank, and People's Bank of China all lowered borrowing costs in September to support economic growth. Investors have responded to the loose monetary environment by pushing up all assets, from stocks to gold, expecting further stimulus measures in the future. Sean McNulty, trading chief at liquidity provider Arbelos Markets, said, "As far as the Federal Reserve is concerned, Bitcoin remains most closely related to monetary policy. Loose policies by other central banks are also helpful."

On Friday, Bitcoin rose by 1.2%, with a fill price of $65,334 at the time of writing. Fueled by funds flowing into the US Bitcoin spot ETF, Bitcoin has risen by 56% in 2024, but remains below the record high of $73,798 set in March.

On Friday, Bitcoin rose by 1.2%, with a fill price of $65,334 at the time of writing. Fueled by funds flowing into the US Bitcoin spot ETF, Bitcoin has risen by 56% in 2024, but remains below the record high of $73,798 set in March.

Caroline Mauron, co-founder of digital asset derivatives trading liquidity provider Orbit Markets, said that due to a large number of option contracts expiring on Friday, the level of $65,000 could be "sticky" within hours. According to a report from the cryptocurrency exchange Kraken, failure to decisively break through $65,000 could foreshadow a weak period for the token.

In addition to monetary policy, the digital asset industry is also awaiting the results of the US presidential election. Many executives expect clearer crypto regulations in the United States in the months following the election to boost market sentiment.

周五,比特币上涨了1.2%,截至发稿,比特币的成交价为65334美元。在流入美国比特币现货ETF的资金的推动下,比特币在2024年上涨了56%,但低于3月份创下的73798美元的纪录高位。

周五,比特币上涨了1.2%,截至发稿,比特币的成交价为65334美元。在流入美国比特币现货ETF的资金的推动下,比特币在2024年上涨了56%,但低于3月份创下的73798美元的纪录高位。