Crypto Weekly: Harris Shows Support, ETF Options Approved, Bitcoin Hits $65K - New Era?

Crypto Weekly: Harris Shows Support, ETF Options Approved, Bitcoin Hits $65K - New Era?

This week, market optimism continued to spread. As of press time, $Bitcoin (BTC.CC)$ strongly surpassed the $65,000 mark, while $Ethereum (ETH.CC)$ broke through $2,600.

本週,市場樂觀情緒繼續蔓延。截至目前, $比特幣 (BTC.CC)$ 強勢突破了65,000美元關口,而 $以太幣 (ETH.CC)$ 突破了2,600美元。

This Week's Hot Topics

本週熱門話題

SEC Approves Options Trading for BlackRock's Bitcoin ETF

美國證券交易委員會(SEC)批准貝萊德比特幣etf的期權交易

Last weekend, the U.S. Securities and Exchange Commission (SEC) approved Nasdaq Inc.'s application on Friday, allowing the exchange to list options contracts related to the $iShares Bitcoin Trust (IBIT.US)$ ETF.

上週末,美國證券交易委員會(SEC)在週五批准了納斯達克公司的申請,允許該交易所上市與 $iShares Bitcoin Trust (IBIT.US)$SPDR歐元50ETF。

Major Milestone! U.S. Bitcoin ETFs Have Purchased Over 300,000 Bitcoin Since Launch

美國比特幣etf自推出以來已購買超過30萬比特幣,取得重要里程碑!

Data: 94.09% of Total Bitcoin Supply Has Been Mined

數據顯示,已挖掘出比特幣總供應量的94.09%。

On September 24th, according to monitoring data from HODL 15Capital, 19.7579 million out of the total 21 million Bitcoin have been mined, leaving only 5.91% of the remaining Bitcoin supply to be mined.

9月24日,根據HODL 15Capital的監測數據,已挖掘出總量2100萬枚比特幣中的1975.79萬枚,僅剩下未挖掘的比特幣供應量的5.91%。

Hong Kong Stock Exchange: Currently Ten Virtual Asset ETPs Available for Selection

香港交易所:目前可選擇的十種虛擬資產etp。

With the listing of Asia's first six virtual asset spot ETFs in Hong Kong in April, along with Asia's first three virtual asset futures ETFs listed in December 2022 and January 2023, the market value of Hong Kong's virtual asset ETF market had grown to over HK$3.2 billion by the end of August. Currently, there are ten virtual asset ETPs available for selection on the Hong Kong Stock Exchange.

2022年4月,亞洲首批六隻虛擬資產現貨etf在香港上市,此外,亞洲首批三隻虛擬資產期貨etf分別於2022年12月和2023年1月上市,截至8月底,香港虛擬資產etf市值已攀升至超過32億港幣。目前,香港交易所可選擇的虛擬資產etp數量達到十種。

Binance CEO: Binance's Historical Trading Volume Surpassed $100 Trillion in Early September

幣安ceo:幣安歷史成交量在9月初突破了1萬億美元。

On Wednesday, Binance CEO Richard Teng posted on X platform, stating that

週三,幣安CEO理查德·滕在X平台上發帖稱

Binance's historical trading volume surpassed $100 trillion in early September.

幣安歷史交易量在九月初超過100萬億美元

PayPal Now Allowing U.S. Merchants to Buy, Hold, and Sell Cryptocurrencies Directly from Their PayPal Accounts

PayPal現在允許美國商家直接從他們的PayPal帳戶購買、持有和出售加密貨幣

On September 26th, according to market news, $PayPal (PYPL.US)$ is now allowing U.S. merchants to buy, hold, and sell cryptocurrencies directly from their PayPal business accounts. At the launch of this feature, this business account function is not available in New York State.

根據市場消息,9月26日 $PayPal (PYPL.US)$ 現在允許美國商家直接從他們的PayPal業務帳戶購買、持有和出售加密貨幣。此功能推出時,在紐約州不可用。

PayPal has also provided a feature for business accounts to transfer cryptocurrencies externally.

PayPal還爲業務帳戶提供了一項功能,用於外部轉移加密貨幣

Kamala Harris Says U.S. Should Take "Leading" Position in Blockchain, Reaffirms Support for Digital Assets

賀錦麗表示美國應在區塊鏈領域佔領"領先"地位,重申支持數字資產

On September 26th, according to The Block, U.S. Vice President Kamala Harris stated during a speech at the Economic Club of Pittsburgh on Wednesday that under her leadership, the United States will recommit to maintaining global leadership in defining the fields of the next century, maintaining dominance in artificial intelligence and quantum computing, blockchain and other emerging technologies. Until last weekend, Harris had remained silent on cryptocurrencies during her campaign. Recently, at a Wall Street fundraising event in Manhattan, Harris stated that artificial intelligence and cryptocurrencies are part of her vision for an “opportunity economy”.

據The Block消息,美國副總統賀錦麗於9月26日星期三在匹茲堡經濟俱樂部演講時表示,在她的領導下,美國將重新承諾在定義未來世紀領域、保持在人工智能和量子計算、區塊鏈等新興技術方面的全球領導地位。不過直到上週末,賀錦麗一直在競選中對加密貨幣保持沉默。最近在曼哈頓舉行的一場華爾街籌款活動上,賀錦麗表示,人工智能和加密貨幣是她對「機會經濟」的願景的一部分。

Bloomberg Analyst: Current Holdings of U.S. Bitcoin ETFs Have Reached 83% of Satoshi Nakamoto's (Bitcoin Founder)

彭博分析師:美國比特幣ETF的當前持有量已達到中本聰(比特幣創始人)的83%

On Thursday, Bloomberg analyst Eric Balchunas posted on X platform, stating that U.S. Bitcoin ETF year-to-date inflows have reached $17.8 billion, hitting a new high. They have achieved 92% of the goal of owning 1 million Bitcoin, and 83% of the goal of surpassing Satoshi Nakamoto to become the largest holder. According to data disclosed by Eric Balchunas, as of September 24th, Satoshi Nakamoto holds about 1.1 million Bitcoin, while U.S. Bitcoin ETFs hold over 916,000 Bitcoin.

彭博分析師埃裏克·巴爾丘納斯(Eric Balchunas)在X平台上發佈,美國比特幣ETF今年來的資金流入已達到178億美元,創下新高。他們已經達到擁有100萬比特幣的目標的92%,超越中本聰成爲最大持有者的目標的83%。根據埃裏克·巴爾丘納斯披露的數據,截至9月24日,中本聰持有約110萬比特幣,而美國比特幣ETF持有超過916,000比特幣。

Institutional & KOL Perspectives

機構投資者 & KOL觀點

About Bitcoin

關於比特幣

Arthur Hayes: Fed Rate Cuts Will Lead to a Weaker Dollar, Global Monetary Easing Wave Brings Opportunities for Crypto Market

亞瑟·海耶斯:聯儲局減息將導致美元疲軟,全球貨幣寬鬆浪潮爲加密市場帶來機會

According to BlockBeats, on September 26th, BitMEX co-founder Arthur Hayes stated on Substack that, based on the Federal Reserve's historical patterns, once they start cutting interest rates, they typically continue to lower them until rates approach 0%. Furthermore, the growth in bank credit must be accompanied by accelerated rate cuts. The Fed will continue to cut rates, and the banking system will continue to release more dollars. Regardless of who wins the U.S. presidential election, the government will also continue to borrow to ensure the fulfillment of certain policy promises. Meanwhile, banks in various countries will also issue more loans for local economic development to provide job opportunities and rebuild increasingly collapsing infrastructure.

據BlockBeats報道,BitMEX聯合創始人亞瑟·海耶斯於9月26日在Substack上表示,根據聯儲局的歷史模式,一旦他們開始減息,他們通常會繼續將利率降至接近0%。此外,銀行信貸的增長必須伴隨加速的減息。聯儲局將繼續減息,銀行體系將繼續釋放更多美元。無論美國總統選舉的勝出方是誰,政府也將繼續借款以確保某些政策承諾的兌現。與此同時,各國銀行還將發放更多貸款以提供就業機會,並重建日益崩潰的基礎設施。

Major global economies will once again suppress the volatility of their countries or economies by lowering the cost of capital and increasing the money supply. This global monetary easing environment is expected to create opportunities for the cryptocurrency market.

Major global economies will once again suppress the volatility of their countries or economies by lowering the cost of capital and increasing the money supply. This global monetary easing environment is expected to create opportunities for the cryptocurrency market.

Top Trader Eugene (X: @0xENAS): Bitcoin Won't Break $70,000 Before the Election

Top Trader Eugene (X: @0xENAS): Bitcoin Won't Break $70,000 Before the Election

On September 25th, top trader Eugene Ng Ah Sio posted on social media stating he won't blindly chase high prices. "For me, the $65,000 to $68,000 range is a reasonable profit-taking zone for early buyers. Many waiting funds will make their final entry at $65,000, which could also mean this is the last upward momentum. He doesn't expect it to break the $70,000 ceiling before the election, so I won't choose to increase my position here. If it reaches $68,000, I'd rather choose to clear my position and wait for the next entry opportunity."

On September 25th, top trader Eugene Ng Ah Sio posted on social media stating he won't blindly chase high prices. "For me, the $65,000 to $68,000 range is a reasonable profit-taking zone for early buyers. Many waiting funds will make their final entry at $65,000, which could also mean this is the last upward momentum. He doesn't expect it to break the $70,000 ceiling before the election, so I won't choose to increase my position here. If it reaches $68,000, I'd rather choose to clear my position and wait for the next entry opportunity."

CryptoQuant CEO (X: @ki_young_ju): Michael Saylor (MicroStrategy founder) proves Bitcoin is the best strategic asset for public companies. Bitcoin has risen 237% in two years, while $MicroStrategy (MSTR.US)$ stock price has increased by 669%. During the bear market, both experienced similar declines, but MSTR's rebound strength was three times that of Bitcoin. He noted that as of September 20th, MicroStrategy holds a total of 252,220 bitcoins.

CryptoQuant CEO (X: @ki_young_ju): Michael Saylor (MicroStrategy founder) proves Bitcoin is the best strategic asset for public companies. Bitcoin has risen 237% in two years, while $MicroStrategy (MSTR.US)$ stock price has increased by 669%. During the bear market, both experienced similar declines, but MSTR's rebound strength was three times that of Bitcoin. He noted that as of September 20th, MicroStrategy holds a total of 252,220 bitcoins.

Glassnode Weekly Report:

Glassnode Weekly Report:

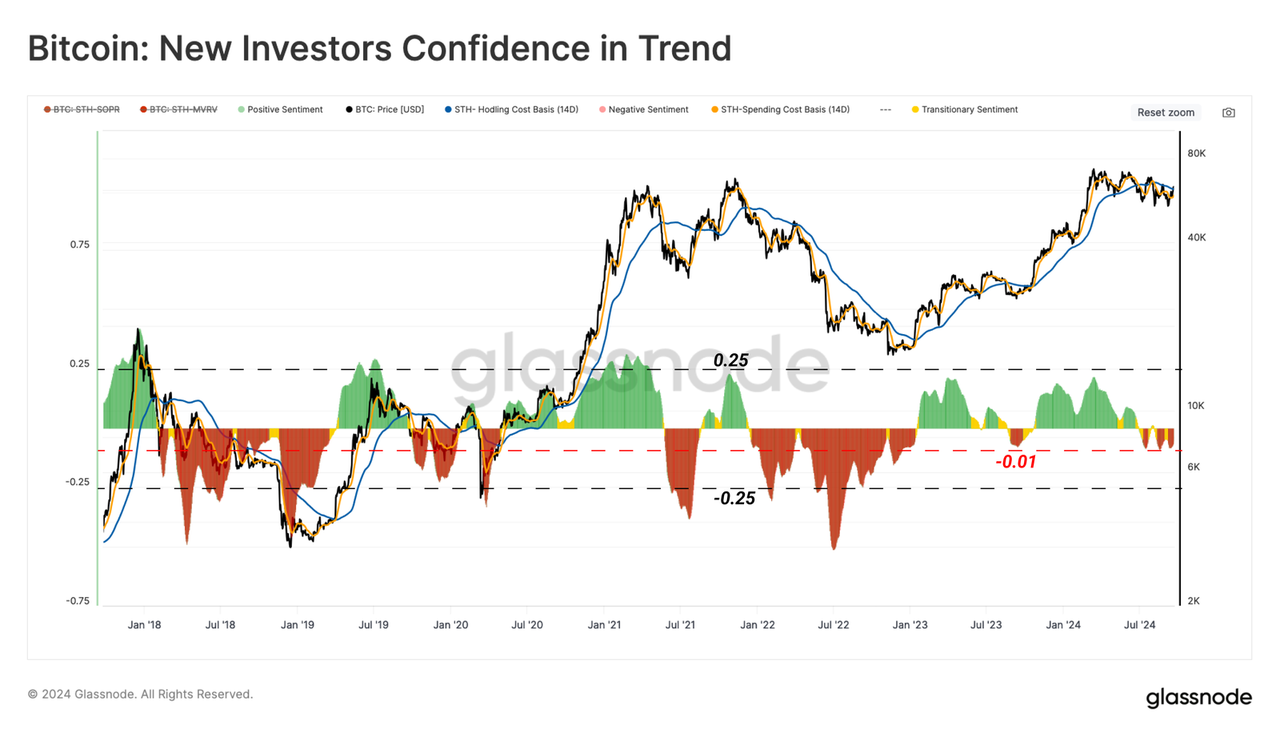

Retail Investors Continue to Enter the Market: As of September 25, 2024, so-called 'Crab' (1-10 BTC) and 'Shrimp' (less than 1 BTC) investors holding less than 10 BTC have accumulated a total of 35,000 BTC in the past 30 days. Confidence among small investors has significantly increased.

Retail Investors Continue to Enter the Market: As of September 25, 2024, so-called 'Crab' (1-10 BTC) and 'Shrimp' (less than 1 BTC) investors holding less than 10 BTC have accumulated a total of 35,000 BTC in the past 30 days. Confidence among small investors has significantly increased.

BTC Outflow from Exchanges Has Intensified: Approximately 40,000 BTC have been withdrawn from exchanges, accounting for 0.21% of the total circulating supply. The contraction in exchange supply may lay the foundation for future price increases.

交易所的比特幣流出情況加劇:約有40,000比特幣已經從交易所提取出來,佔據了總流通供應量的0.21%。 交易所供應的收縮可能爲未來價格上漲奠定基礎。

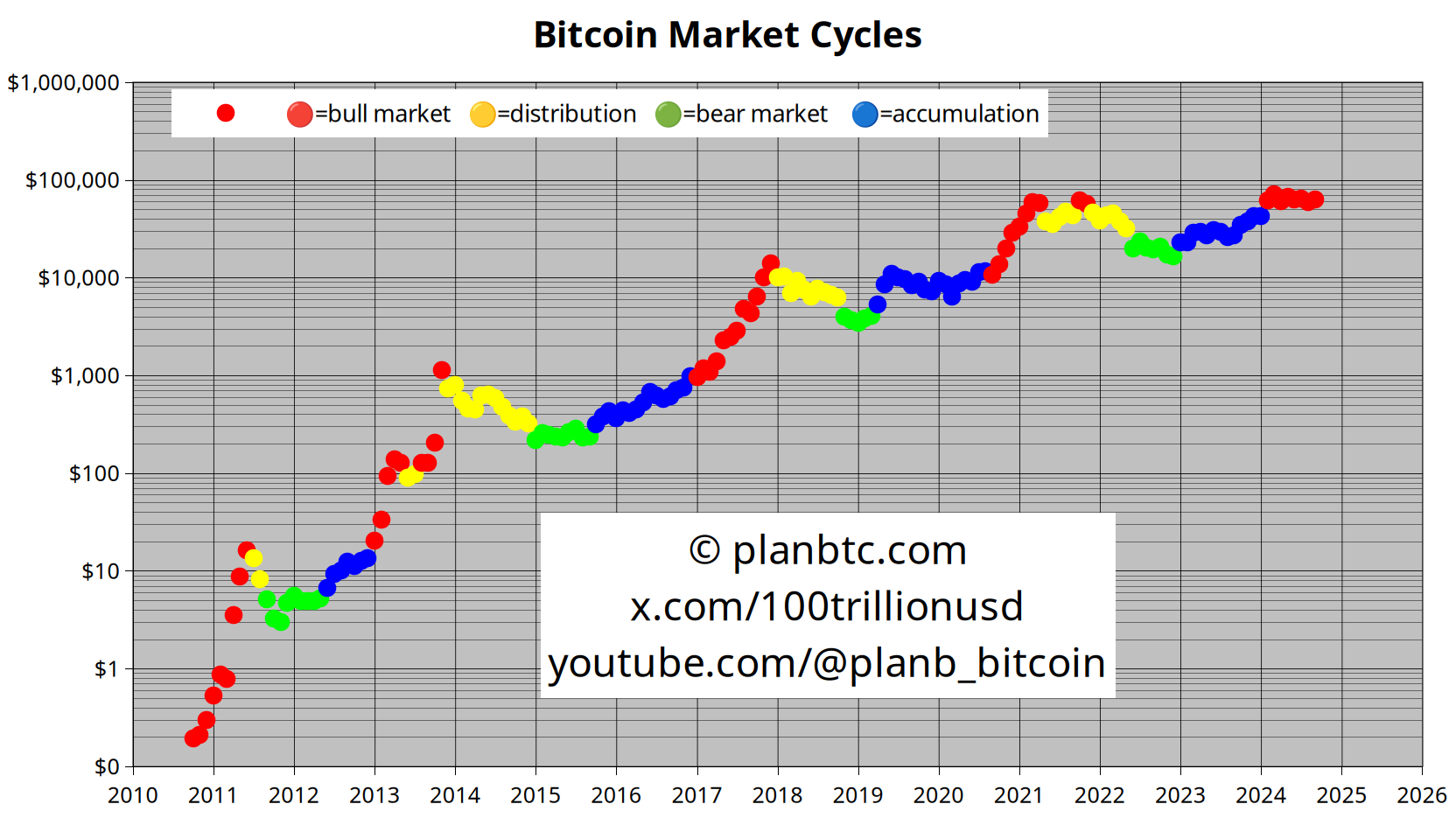

Plan B (X: @100trillionUSD) once again emphasizes that the "October Effect" is about to come into play, and outlines a Bitcoin price outlook:

Plan b(X:@100萬億USD)再次強調"十月效應"即將開始發揮作用,並概述了比特幣價格展望:

October: The classic surge month. BTC $70,000

November: Trump wins the election, ending the Democratic Biden/Harris/Yellen/Gensler oppression of cryptocurrencies. BTC $100,000

December: Massive ETF inflows. BTC $150,000

January: Crypto people/companies return to the USA. BTC $200,000

...

十月:經典的暴漲月份。比特幣$70,000

十一月:特朗普贏得選舉,結束了民主黨拜登/賀錦麗/耶倫/根斯勒對加密貨幣的壓制。 比特幣$100,000

十二月:大規模的ETF流入。 比特幣$150,000

一月:加密人士/公司回到美國。 比特幣$200,000

...

Greeks.live (X: @BTC__options) recently observed a large volume of big Bitcoin put options transactions, likely indicating major whale position transfers. As Q4 approaches, which includes the U.S. election, the election will be a massive betting pool. Currently, the overall implied volatility level is relatively low, with less than 30% of the time in the past year being lower than the current level. Whales are positioning for Q4, and trading is expected to be very active before and after the election.

Greeks.live(X:@BTC__options)最近觀察到大量的比特幣看跌期權交易,可能表明主要鯨魚頭寸轉移。 隨着第四季度的到來,其中包括美國大選,選舉將成爲一個龐大的投注池。 目前,整體引伸波幅水平相對較低,過去一年低於當前水平的時間不到30%。 鯨魚們正在爲第四季度做準備,並預計在選舉前後交易將非常活躍。

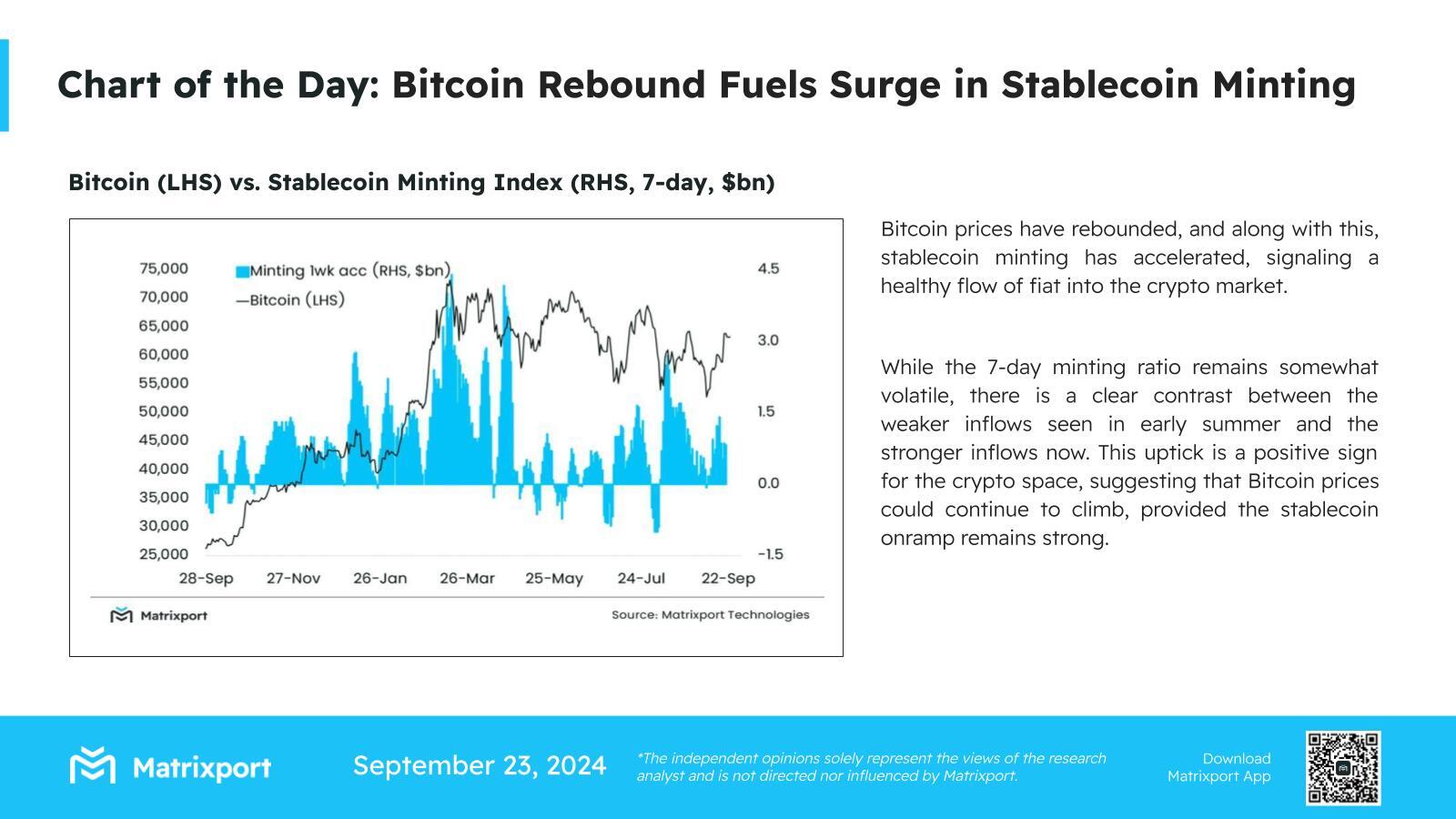

Matrixport released a report stating that over the past week, as Bitcoin prices rebounded, stablecoin minting has been steadily following suit, indicating that fiat currency is flowing into the crypto market.

Matrixport發佈的一份報告指出,在過去的一週裏,隨着比特幣價格的反彈,穩定幣的鑄造一直在穩步增長,表明法定貨幣正在流入加密市場。

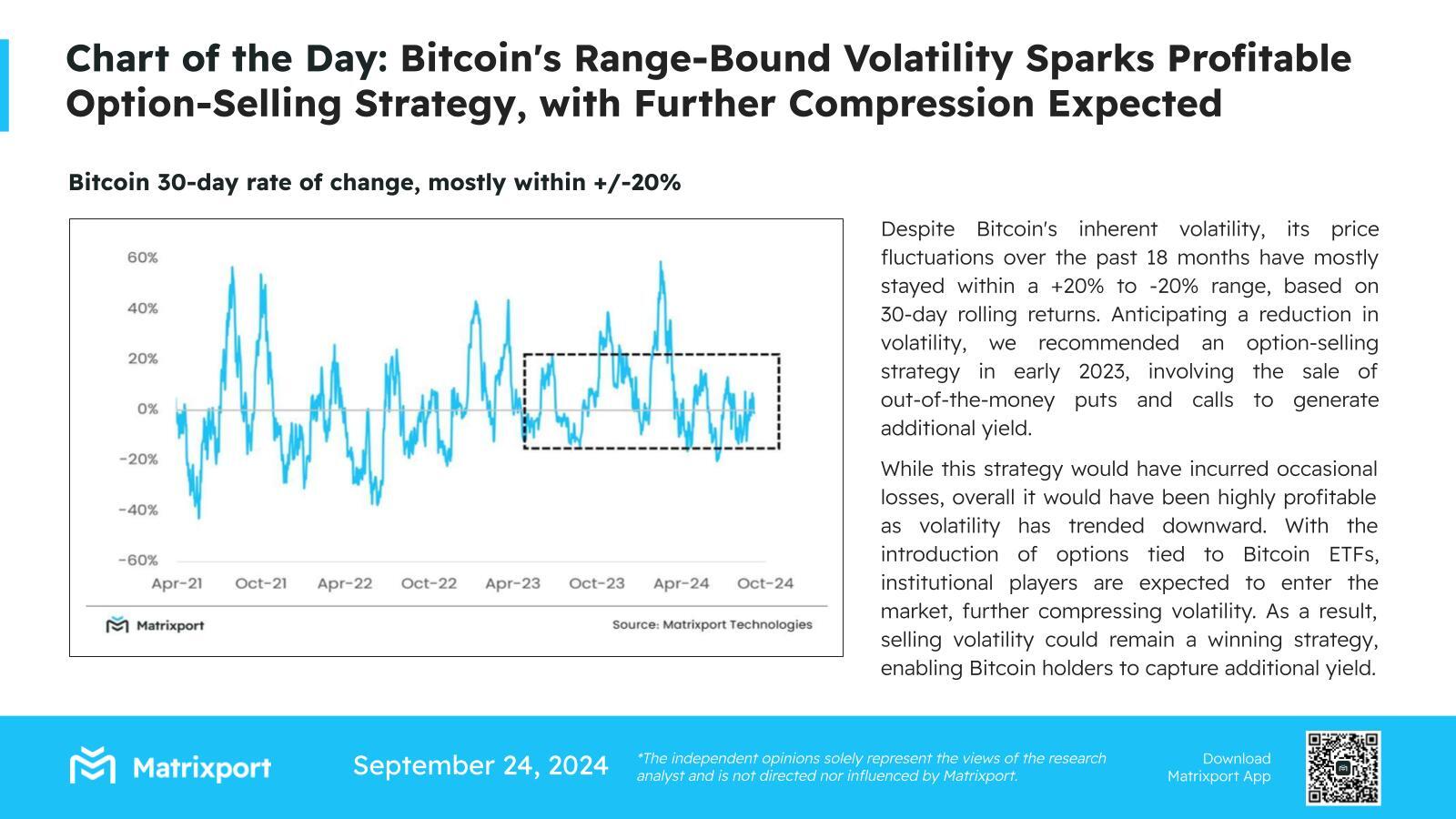

The institution also stated that the introduction of Bitcoin ETF options will attract more institutional participants, further reducing volatility:

該機構還表示,比特幣ETF期權的推出將吸引更多機構參與者,進一步降低波動性:

"Although Bitcoin has inherent volatility and short volatility cycles, recent price fluctuations have mainly remained within a range of ±20%. As the integration of Bitcoin and traditional financial derivatives deepens further, we believe that volatility will be further compressed, and option selling strategies will continue to be effective."

「儘管比特幣具有固有的波動性和短期波動週期,但近期價格波動主要保持在±20%的區間內。隨着比特幣與傳統金融衍生品的深入整合,我們相信波動性將進一步壓縮,期權賣出策略將繼續有效。」

About Ethereum

關於以太幣

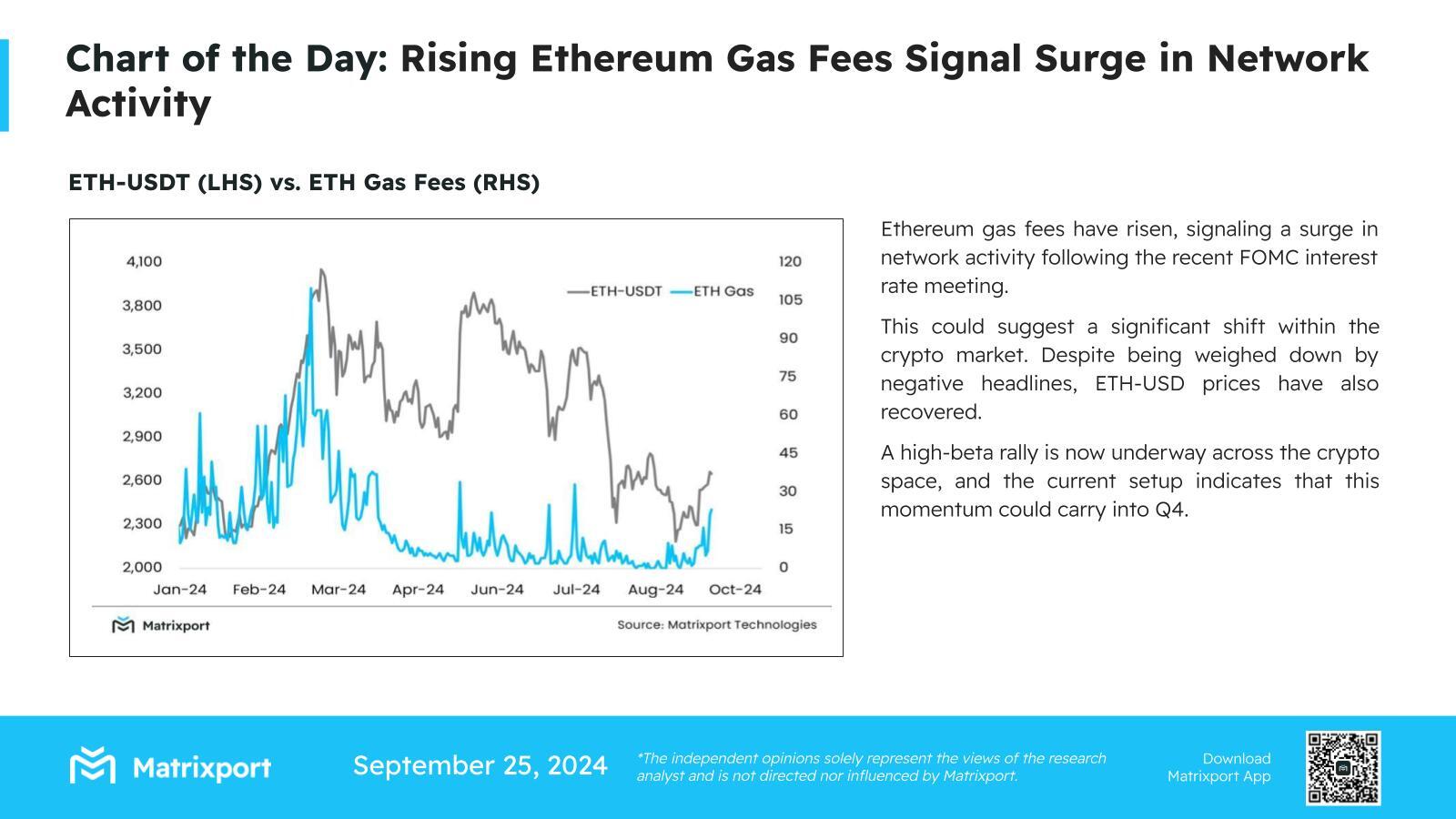

Matrixport released a report stating that since the FOMC, Ethereum gas fees have increased, indicating that network activity is recovering, which helps lay the foundation for higher Ethereum prices.

Matrixport發佈的一份報告指出,自聯儲局FOMC會議以來,以太幣燃氣費有所增加,表明網絡活動正在恢復,這有助於爲更高的以太幣價格奠定基礎。

Too idealistic? CoinShares released a report on Ethereum usage this week. The report states that transactions on Ethereum drive ETH prices far more than other factors such as staking yields, currency adoption, or use as financial collateral. Although the Ethereum ecosystem currently offers increasingly diverse functions, most of its uses still revolve around speculation and simple token transfers, rather than the originally envisioned diverse applications.

太理想化了嗎?CoinShares本週發佈了一份關於以太幣使用情況的報告。報告指出,以太幣上的交易對ETH價格的推動遠遠超過其他因素,如權益質押產量、貨幣採用率或用作金融抵押品。儘管以太幣生態系統目前提供了日益多樣的功能,但大部分用途仍圍繞於投機和簡單的代幣轉移,而不是最初構想的多樣應用。

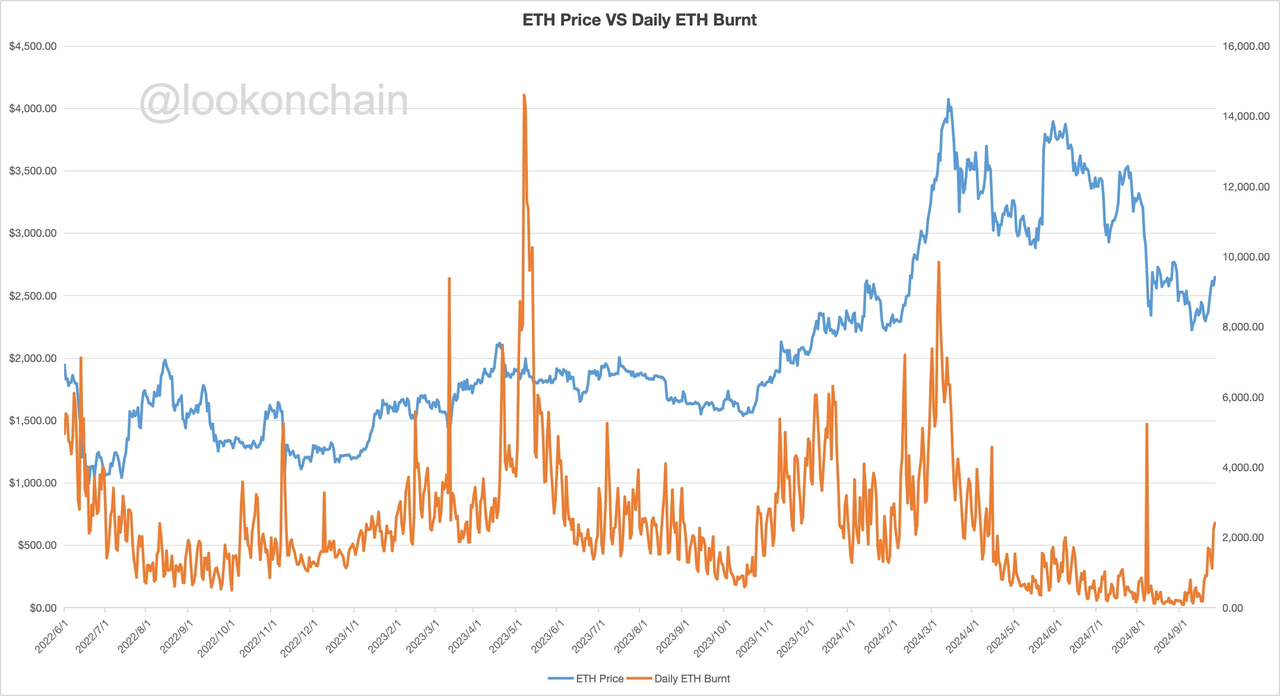

On September 25, Lookonchain reported that the amount of ETH burned in the past week increased by 163% compared to the previous week. Before ETH price increases in 2023, there were always surges in daily ETH burns.

9月25日,Lookonchain報告稱,過去一週燃燒的ETH數量較上週增長了163%。在2023年ETH價格上漲之前,每天都會出現ETH燃燒激增的情況。

Tracking Bull Stocks in the Crypto Sphere

追蹤加密領域的牛股

The Bitcoin mining company with the highest stock price increase this year is $Core Scientific (CORZ.US)$ , up 248%. The company has signed a 12-year contract with CoreWeave, with initial revenue expected to exceed $3.5 billion.

今年漲幅最大的比特幣挖礦公司是 $Core Scientific (CORZ.US)$ ,漲幅達248%。該公司已與CoreWeave簽訂了爲期12年的合同,預計初始營業收入將超過35億美元。

ETF Net Flow

ETF 淨流入

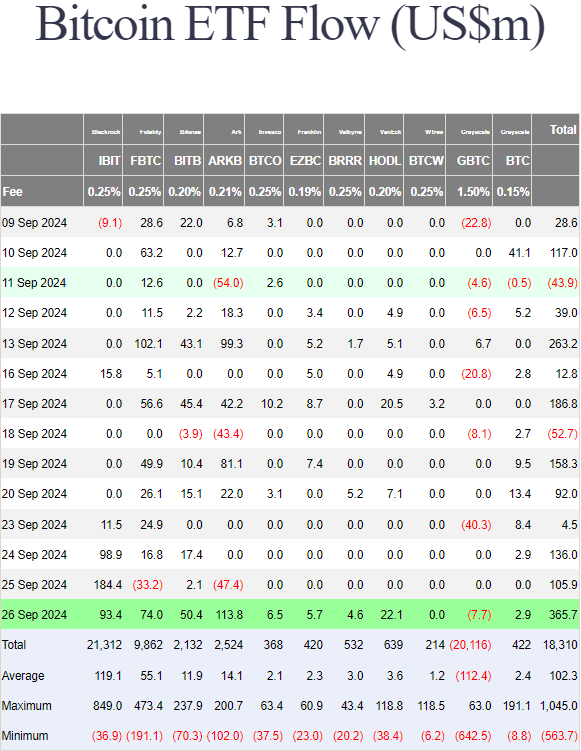

BTC Spot ETF Weekly Flow

比特幣現貨ETF每週流量

As of Thursday:

截至週四:

BTC spot ETFs had a total net inflow of $612.1 million this week.

IBIT had a net inflow of $388.2 million this week.

FBTC had a net inflow of $57.6 million this week.

BITB had a net inflow of $69.9 million this week.

本週比特幣現貨ETF總淨流入達61210萬美元。

IBIt本週淨流入38820萬美元。

FBTC本週出現了5760萬美元的淨流入。

BITb本週出現了6990萬美元的淨流入。

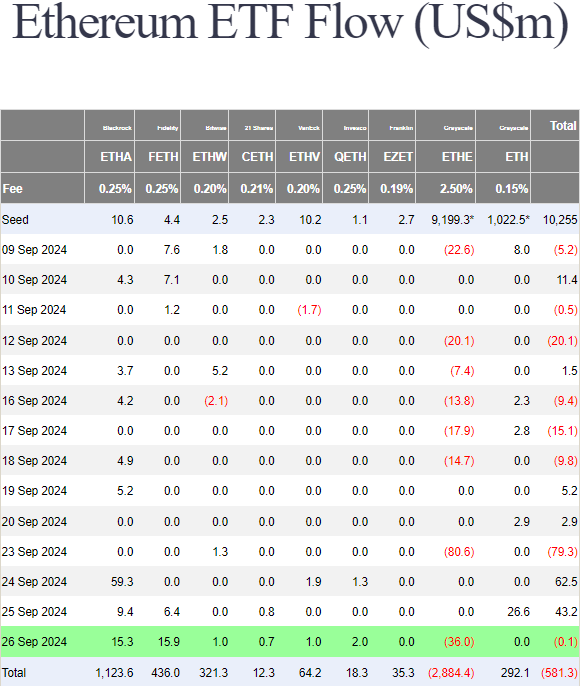

ETH spot ETF weekly flow

ETH現貨ETF每週資金流動情況

As of Thursday:

截至週四:

ETH spot ETFs had a total net inflow of $26.3 million this week.

ETHE had a net outflow of $116.6 million this week.

ETHA had a net inflow of $84 million this week.

FETH had a net inflow of $22.3 million this week.

ETH現貨ETF本週總共出現了2630萬美元的淨流入。

ETHE本週出現了11660萬美元的淨流出。

ETHA本週出現了8400萬美元的淨流入。

FETH本週出現了2230萬美元的淨流入。