In recent years, the overall external environment has been complex and volatile, and market confidence has been hit. In this background, it increasingly tests the eyes of market investors. Compared to the well-known but no longer glorious old leaders, it is more meaningful to discover tomorrow's dark horses with greater expected differences. Expected difference means that companies meet the conditions for the "reversal of crisis" in the fundamental aspect, have great performance elasticity, high certainty, and a wide range of valuation repair space.

Based on this logic, why not take a "top-down" look at the opportunities in the lesser-known aviation leasing industry?

1. The prospect of the aviation leasing industry continues to improve.

With the Federal Reserve announcing its first interest rate cut in four and a half years, reducing the benchmark interest rate by 50 basis points to 4.75% to 5.00%, the rate cut exceeds market expectations. This means a decrease in the cost of capital borrowing, and capital-intensive industries are undoubtedly the primary beneficiaries. The aviation leasing industry, as a typical capital-intensive industry, has gradually become an important direction that the market is bullish on.

Especially in recent years, with the continued recovery of the global aviation industry, the supply-demand gap in the aviation market has gradually become apparent, bringing new development opportunities to the aviation leasing market.

Especially in recent years, with the continued recovery of the global aviation industry, the supply-demand gap in the aviation market has gradually become apparent, bringing new development opportunities to the aviation leasing market.

On one hand, the recovery of the aviation sector is evident. On the other hand, under the disturbance of multiple factors, the international aviation supply chain has not recovered as expected. While demand is recovering, there are significant bottlenecks in the supply chain, leading to a continuous increase in the supply-demand gap. Especially due to engine problems, frequent safety issues leading to aircraft delivery delays, as well as factors such as delayed capacity expansion plans of Airbus and Boeing, all exacerbate the tight state of aircraft supply. In this context, this also drives the continuous increase in aircraft value and rental rates, providing favorable conditions for the appreciation of assets and income growth on the asset side of aviation leasing companies.

As one of the industry benchmarks, Hong Kong-listed CALC has seized the opportunity of the industry's recovery, achieving steady operation and business expansion: in the first half of the year, it achieved revenue of 2.528 billion Hong Kong dollars, an 8.7% year-on-year growth. Core operating indicators also performed well, with evident asset advantages, a fleet asset portfolio mainly composed of narrow-body aircraft, and a high-quality global customer base. The overall rental recovery rate in the first half-year reached 101.3%; the adjusted leasing revenue rate reached 10.6%, consistently at an industry-leading level. With the industry entering a new growth cycle, it is believed that CALC's asset advantages on the asset side are expected to further expand, benefiting from it.

2. Amid the wave of interest rate cuts, Chinese aviation leasing shows more performance elasticity compared to its peers.

In addition to benefiting from the improvement in the industry on the asset and income side, the performance of China's aviation leasing industry is more worth watching compared to its peers, as the global interest rate environment changes.

From a profit perspective, it is not difficult to see that China's aviation leasing industry is more sensitive to US dollar interest rates compared to its peers. In the previous high-interest rate environment, the company's financial costs sharply increased, putting pressure on its performance. Now, with the arrival of the rate-cut cycle, the high sensitivity to interest rates is expected to help China's aviation leasing industry take the lead over its peers in benefiting more, driving further performance and valuation recovery.

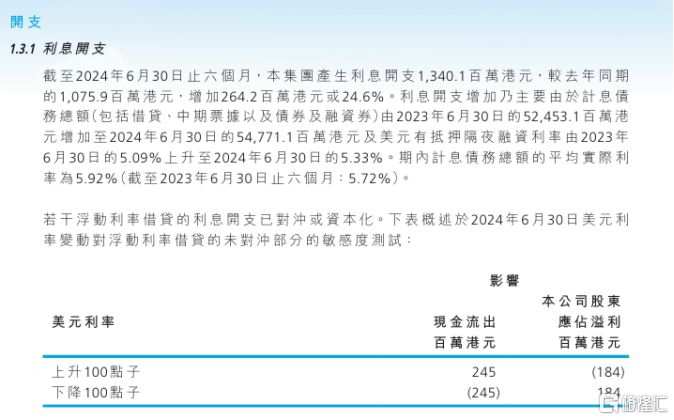

From the financial data perspective, based on sensitivity tests of the company's floating-rate borrowing unhedged portion to changes in US dollar interest rates as of June 30, 2024, a 100 basis point decline in US dollar rates would impact the company's net income by 0.184 billion Hong Kong dollars. After the Fed rate cuts, the low-rate trend combined with credit spread narrowing is expected to continue to manifest on the company's performance level.

(Source: Company financial report)

At the same time, the company clearly recognizes the weaknesses on the liability side and has therefore increased its investment in liability management in recent years, continuously optimizing its liability structure.

If the company redeems high-cost floating-rate US dollar perpetual bonds ahead of time at the end of 2023 and July 2024, and successfully completes the replacement by issuing RMB 2+N bonds with a coupon rate of only 2.7% on September 25, 2024, setting a new historical low. This demonstrates the company's flexible financing advantages on both domestic and foreign platforms, as well as its proactive debt management capabilities.

Looking ahead, calc has repeatedly emphasized the strategic goal of improving international credit ratings, and has indeed implemented it in action. With the continuous optimization of its capital structure through various measures, the company is moving towards a more stable and sustainable development path. Such strategic adjustments not only help improve the company's financial stability and market competitiveness, but also, if the company's international credit rating is further upgraded to investment grade, it is believed that it will greatly benefit calc by reducing overall financing costs and potentially unlocking greater profit margins.

This also means that calc will further enhance its attractiveness in the capital markets, lower financing costs, create a virtuous cycle, and provide a more solid financial support for its future development.

In conclusion, the results achieved in the first quarter demonstrate that AI capabilities have brought new opportunities to the company. With the continuous increase in the penetration rate of large models, continuous enhancement of product performance, diversification of landing scenarios, and further expansion of overseas business, Cheetah Mobile is expected to welcome a broader development space.

At the current trend of interest rate cuts, calc can be said to be facing favorable timing, favorable circumstances, and favorable opportunities.

In terms of timing, driven by the supply-demand gap in the global aviation market, the rental yield of aviation leasing companies is expected to further increase. This trend not only provides the company with an opportunity to increase revenue, but also brings higher return potential to its shareholders.

In terms of circumstances, against the backdrop of interest rate cuts, the potential boost to the liquidity of Hong Kong stocks is expected. Its long-standing ability to consistently deliver high dividends and high payouts will make it more attractive in the "tailwind" environment of the capital markets.

In fact, since 2020, the company has been continuously experiencing unprecedented impacts on the aviation industry due to the epidemic, the effects of the Russia-Ukraine war, and the unprecedented rate hike cycle by the Federal Reserve, resulting in a cumulative 60% decline in stock price. Compared to the performance of the Hang Seng Index, it has been significantly suppressed. Currently, the company's PB ratio is only 0.52 times, showing a significant undervalued trend compared to historical performance and industry standards. Against this backdrop, calc continues to deliver shareholder returns. As of September 19, calc's TTM dividend yield has reached 9.5%, indicating a significant dividend feature.

With all the bearish factors exhausted, calc is currently experiencing a comprehensive turnaround in factors such as the industry environment, interest rate environment, etc. Clear reversal signals have emerged. With the release and realization of performance, it is believed that the company's undervaluation and high dividend advantages will further attract market funds and support the accelerated recovery of valuation.

(Source: wind)

With the focus on operation, the company's global strategy is clear, actively optimizing its capital structure, strengthening financial management and operational capabilities, which will also help unleash greater performance potential.

With the continuous performance growth being realized later, calc is expected to deliver a 'Davies Market' scenario of performance and valuation double upgrade in the capital markets.

特别是近年来,随着全球航空业的持续复苏,航空市场供需缺口逐渐显现,为航空租赁市场带来新的发展机遇。

特别是近年来,随着全球航空业的持续复苏,航空市场供需缺口逐渐显现,为航空租赁市场带来新的发展机遇。