Performance data

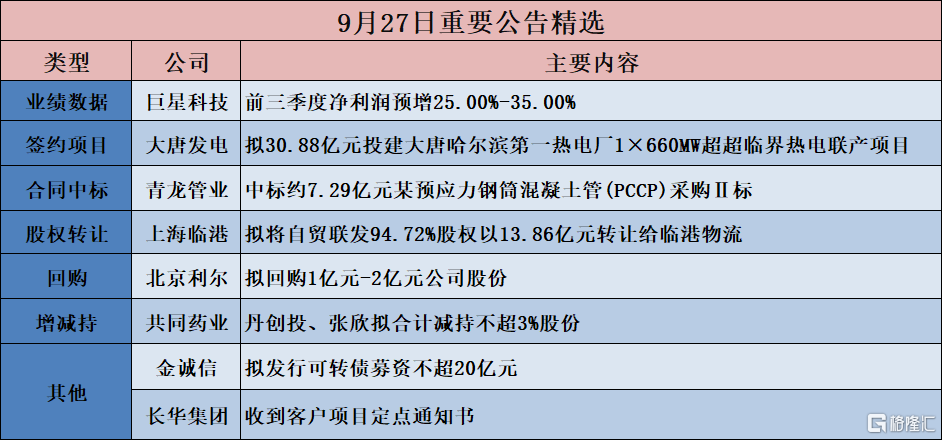

Hangzhou Great Star Industrial (002444.SZ): Net income for the first three quarters is expected to increase by 25.00% to 35.00%.

Signed Projects:

Anhui Xinke New Materials (600255.SH): Intends to participate in the investment and construction of a high-speed copper connection project

Datang International Power Generation (601991.SH): intends to invest in the construction of High Jing Heat and Power Subsidiary Zero Carbon Waste Heat Green Heating Transformation Project.

Datang International Power Generation (601991.SH): intends to invest in the construction of Datang Lusi Port Power Plant Phase II Coal-fired Power Expansion Project.

datang international power generation (601991.SH): plans to invest 0.272 billion yuan in the construction of the Benxi shared energy storage power station project

datang international power generation (601991.SH): plans to invest 3.088 billion yuan to construct the Datang Harbin First Thermal Power Plant 1×660MW ultra-supercritical thermal power and steam co-generation project

Contracts awarded:

ningxia qinglong pipes industry group (002457.SZ): won the bid for approximately 729 million yuan for the purchase of a certain prestressed steel cylinder concrete pipe (PCCP) section II.

Wangneng Environment (002034.SZ): Subsidiary signed a contract for a project in Thailand, with a total amount of approximately 0.394 billion yuan.

Chongqing Construction Engineering Group (600939.SH): Jointly signed a contract for the overall construction project of Block 2 of Deyang Guangkong Project Land.

Equity acquisition

To further focus on the marine communication business, Hengtong Optic-Electric (600487.SH) plans to acquire approximately 0.606 billion yuan of Hengtong Huahai's 7.8223% stake held by Xiamen Yuanfeng.

huafu fashion (002042.SZ): The controlling shareholder intends to transfer 5.90% of the shares held to Xingjianqinglong Fund.

Ouke Technology (001223.SZ): intends to acquire a total of 39.25% equity of Youze New Materials for 24.7066 million yuan.

Jointo Energy Investment (000600.SZ): plans to acquire a 50% stake in Qin Electric Company for 0.633 billion yuan.

Jointo Energy Investment (000600.SZ): Intends to acquire 50% equity of Zhuneng Company for 0.687 billion yuan.

Shanghai Lingang Holdings (600848.SH): plans to acquire 70% equity of Zhuanqiao Company for 0.631 billion yuan.

Shanghai Lingang Holdings (600848.SH): Intends to transfer 94.72% equity of Free Trade Joint Development for 1.386 billion yuan to Lingang Logistics.

Dian Diagnostics Group (300244.SZ): plans to sell a total of 40.565% equity interest in Guanhe Pharmaceutical.

Buyback.

Beijing Lirr High Temperature Materials (002392.SZ) plans to repurchase company shares worth 0.1 billion to 0.2 billion yuan.

zhejiang changsheng sliding bearings (300718.SZ): plans to repurchase company shares worth 20-40 million yuan

Nearshore Protein (688137.SH): Planning to spend 10 million yuan to 20 million yuan to repurchase shares.

【Increase and Decrease】

Shanghai Fullhan Microelectronics (300613.SZ): Controlling shareholder and concerted action person Jie Zhi Holdings plan to reduce their shareholding by no more than 1%.

Jointown Pharmaceutical (300966.SZ): Dan Venture Capital and Zhang Xin plan to jointly reduce their shareholding by no more than 3%.

Guangzhou Hangxin Aviation Technology (300424.SZ): The former controlling shareholder Huang Xin plans to reduce shareholding by no more than 1.98%.

Unilumin Vision (301042.SZ): Shareholders holding more than 5% and their concerted action parties plan to reduce the total shareholding by no more than 2.93% of the company's shares.

Yishitong (688733.SH): Shareholder new energy fund plans to reduce shareholding by no more than 1%.

Sands (688480.SH): The controlling shareholder plans to increase the company's shareholding by 20 million-30 million yuan.

Kangzhong Medical (688607.SH): Shareholders Changcheng and Junlian Chengyu plan to collectively reduce their shareholding by no more than 2%.

Milkyway Chemical Supply Chain Service (603713.SH): Shareholder Junlian Maolin intends to reduce shareholding by no more than 1.82%.

【Other】