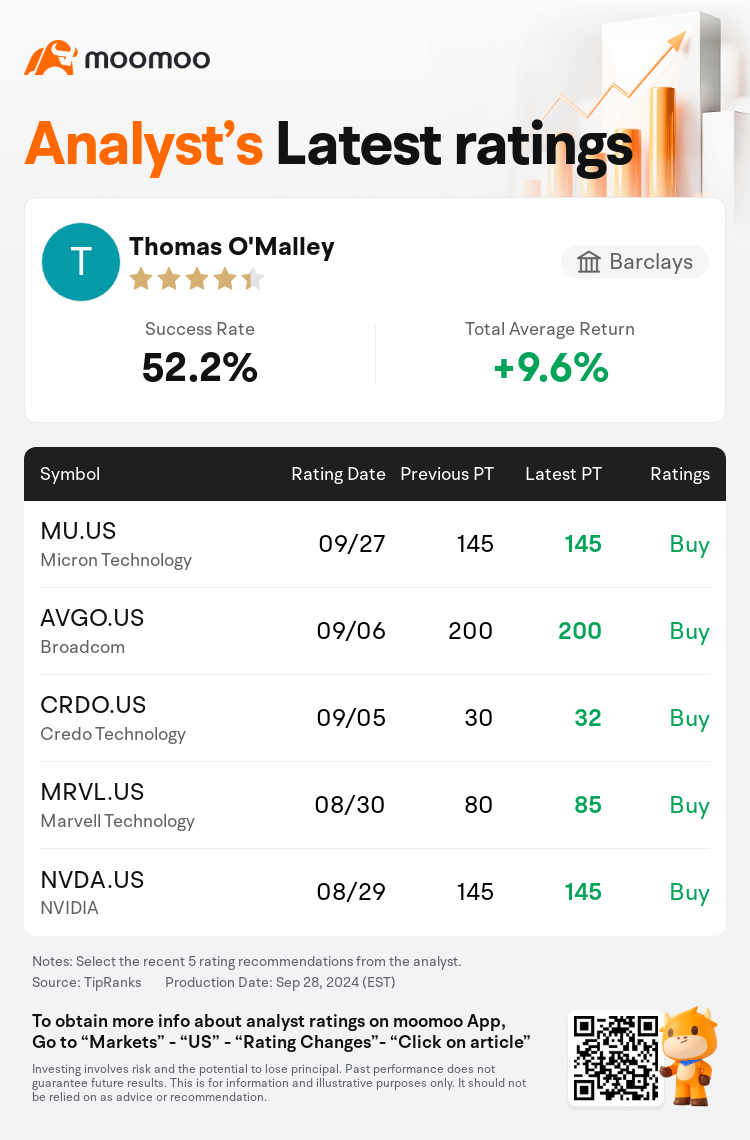

Barclays analyst Thomas O'Malley maintains $Micron Technology (MU.US)$ with a buy rating, and maintains the target price at $145.

According to TipRanks data, the analyst has a success rate of 52.2% and a total average return of 9.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Micron Technology (MU.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Micron Technology (MU.US)$'s main analysts recently are as follows:

Micron delivered a robust quarter and outlook, particularly considering the dampened recent expectations, with EPS guidance aligning with consensus prior to the negative revisions. The company has met its sales goal in HBM for FY24, persisting in its projection to achieve several billion in sales next year and aiming to secure a mid-20s percentage in DRAM market share for HBM. However, there are concerns that the market forecast may be overly optimistic. Despite Micron's strong execution, concerns about the stock's valuation persist, suggesting there might be more favorable risk-reward opportunities in other AI and memory segments.

Micron's recent financial outcomes surpassed expectations, an achievement accentuated by prevailing macroeconomic challenges, driven by robust demand from data centers. This includes the company's advancement in AI-powered high-bandwidth memory sales. Despite anticipating a milder fiscal second quarter due to seasonal factors, projections for fiscal years 2025 and 2026 earnings per share have been notably increased.

Micron anticipates that its HBM share will align with its total DRAM market share by C2025, a key point underpinning the investment thesis for the stock, given the belief that HBM is capable of producing gross margins in the low-60% range and represents a 60% compound annual growth rate. It's still considered one of the top picks, with the valuation appearing attractive, and the market not fully accounting for the HBM opportunity.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Thomas O'Malley維持$美光科技 (MU.US)$買入評級,維持目標價145美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.2%,總平均回報率為9.6%。

此外,綜合報道,$美光科技 (MU.US)$近期主要分析師觀點如下:

此外,綜合報道,$美光科技 (MU.US)$近期主要分析師觀點如下:

美光公佈了強勁的季度及前景,特別是考慮到近期預期疲軟,在負面修正之前,每股收益指引與共識一致。該公司已實現其24財年hBm的銷售目標,堅持其明年實現數十億美元的銷售額的預測,並旨在確保hbM在DRAM市場份額中達到20年代中期的百分比。但是,有人擔心市場預測可能過於樂觀。儘管美光表現強勁,但對該股估值的擔憂仍然存在,這表明其他人工智能和存儲器領域可能會有更有利的風險回報機會。

美光最近的財務業績超出了預期,在數據中心強勁需求的推動下,當前的宏觀經濟挑戰突顯了這一成就。這包括該公司在人工智能驅動的高帶寬內存銷售方面的進展。儘管由於季節性因素,預計第二財季將溫和,但對2025年和2026財年的每股收益的預測已顯著增加。

美光預計,到 C2025,其 HbM 份額將與其 DraM 總市場份額持平,這是支撐該股投資論點的關鍵點,因爲美光認爲 hbM 能夠在-60%的低範圍內產生毛利率,複合年增長率爲60%。它仍然被認爲是首選之一,估值似乎很有吸引力,而且市場並未充分考慮HbM的機會。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$美光科技 (MU.US)$近期主要分析師觀點如下:

此外,綜合報道,$美光科技 (MU.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of