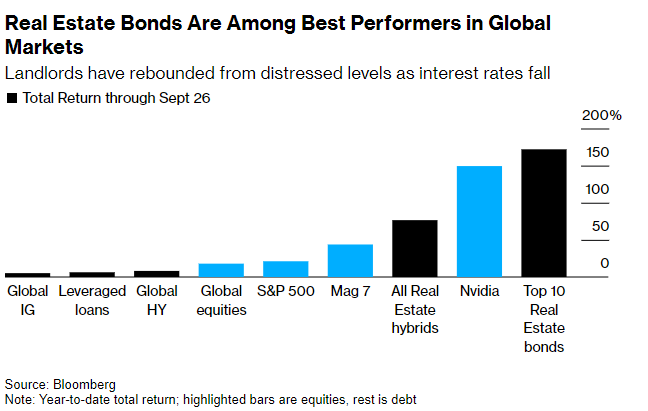

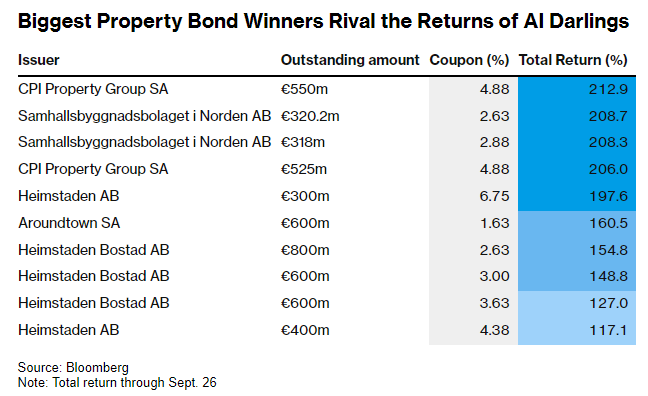

① What used to be an extremely bleak corner of the debt market has turned into one of the biggest winners in the global financial market this year, bringing rare returns in decades; ② Among a series of types known as subordinated bonds, the 10 best performing bonds had returns of about 170% during this period, which is even 20 percentage points higher than Nvidia's “darling” of the AI boom.

Financial Services Association, September 29 (Editor: Xiaoxiang) What used to be an extremely bleak corner of the debt market has turned into one of the biggest winners in the global financial market this year, bringing rewards that have been rare for decades.

Hybrid bonds are the riskiest type of real estate company bond, with an overall return of over 75% this year. Among a series of products known as subordinated bonds (subordinated bonds), the 10 best performing bonds had returns of about 170% during this period, which was even 20 percentage points higher than the annual return of Nvidia, the unrelenting “darling” of the AI boom.

Few people could have anticipated this rapid market reversal, especially at a time when global real estate owners are under pressure from rising interest rates and changes in post-pandemic work habits.

Few people could have anticipated this rapid market reversal, especially at a time when global real estate owners are under pressure from rising interest rates and changes in post-pandemic work habits.

Today, however, real estate debt is actually becoming an early winner when major central banks prioritize boosting the economy rather than fighting inflation and lowering interest rates.

Andrea Seminara, CEO of London-based Redhedge Asset Management, said, “I don't remember a similar situation happening in my career.”

Seminara began working in the financial industry at the height of the 2008 global financial crisis. He said, “Without considering the difficulties this field has faced before, the magnitude of the current returns is unprecedented.”

Undercut real estate subprime bonds

Subordinated bonds are debts that are repaid in a lower order when a company goes bankrupt. This means that if there is a problem with the company's finances, the holder of the subprime debt can only be repaid after the holder of the preferential debt. The collapse of subprime bonds was one of the main causes of the 2008 financial crisis. At the time, many investors and financial institutions failed to fully assess their risks, leading to a ripple effect in the credit market, which eventually triggered a global recession.

And after central banks around the world began to raise interest rates in 2022, subprime real estate bonds also plummeted by nearly 50%. Higher borrowing costs mean that the cost of replacing debt has soared, leaving investors concerned that repayments will be delayed indefinitely. Some companies sometimes choose to skip interest payments on bonds without triggering default, making these bonds less popular with investors.

Andreas Meyer, founder of Fountain Square Asset Management, headquartered in Hamburg, Germany, said these bonds have been penalized over the past few years due to technical factors. The field is bloody.

For Seminara, buying at a sluggish price is actually betting that these companies will be able to replace debts that are about to expire, and that falling inflation will allow the central bank to lower interest rates.

As it turns out, both of these points have now been confirmed.

As capital flows into the credit market, the so-called “maturity wall” faced by these debt issuers collapsed in a historic way this year, enabling them to issue new bonds to finance the repayment of old bonds. Meanwhile, the Federal Reserve joined the ECB and the Bank of England's easing ranks this month, cutting interest rates by 50 basis points in one go, leaving the possibility of further sharp interest rate cuts.

Meyer's event-driven fund is one of the funds benefiting from it, with hybrid bond yields as high as 80%. He is still investing in the field.

Risks still exist

Of course, one of the major risks facing this bond sector right now is that the profit margin for related transactions is probably running out.

Bank of America strategists Barnaby Martin and Ioannis Angelakis pointed out in a report last week that real estate credit's “valuation is clearly close to saturation.”

Despite this, many buyers and sellers are still quite confident that the commercial real estate market has bottomed out and is recovering. Many people want to start investing capital when interest rate pressure begins to ease.

“We just experienced a storm. “No one has experienced such aggressive monetary policy,” said Ron Dickerman, founder of commercial real estate securities firm Madison Real Estate Capital. “Although a few interest rate cuts alone do not create a market, market optimism clearly exists.”

这种迅速的行情反转是鲜有人能预料到的,尤其是在全球地产业主因利率上升和疫情后工作习惯的改变而倍感压力之际。

这种迅速的行情反转是鲜有人能预料到的,尤其是在全球地产业主因利率上升和疫情后工作习惯的改变而倍感压力之际。