Performance fluctuations, cash flow is like a roller coaster.

Recently, Hong Kong construction company Wing Lee Construction Holdings Limited (hereinafter referred to as Wing Lee Construction) conducted a listing hearing on the main board of the Hong Kong Stock Exchange, with Same Person Finance Limited as its exclusive sponsor.

Performance fluctuations upward, cash flow is like a roller coaster.

The prospectus shows that Wing Lee Construction is a large-scale Hong Kong construction company engaged in civil and mechanical engineering as well as renewable energy projects. Its civil engineering focuses on site leveling projects and road and drainage works, while its mechanical engineering focuses on cable trenching, laying, and connection works. According to industry reports, Wing Lee Construction is the largest cable and civil pipe installation subcontractor in Hong Kong in 2023, with a market share of approximately 13.6% based on the company's 2023/24 fiscal year revenue. Since 2019, the company has also been involved in the design, installation, and maintenance of solar photovoltaic systems under the renewable energy division. In terms of renewable energy projects, the company focuses on solar photovoltaic engineering. Additionally, in a few projects the company participates in, it temporarily leases machinery and trades in building materials with contractors and subcontractors.

The prospectus shows that Wing Lee Construction is a large-scale Hong Kong construction company engaged in civil and mechanical engineering as well as renewable energy projects. Its civil engineering focuses on site leveling projects and road and drainage works, while its mechanical engineering focuses on cable trenching, laying, and connection works. According to industry reports, Wing Lee Construction is the largest cable and civil pipe installation subcontractor in Hong Kong in 2023, with a market share of approximately 13.6% based on the company's 2023/24 fiscal year revenue. Since 2019, the company has also been involved in the design, installation, and maintenance of solar photovoltaic systems under the renewable energy division. In terms of renewable energy projects, the company focuses on solar photovoltaic engineering. Additionally, in a few projects the company participates in, it temporarily leases machinery and trades in building materials with contractors and subcontractors.

During the period, all business segments of Wing Lee Construction participated in several major infrastructure projects in Hong Kong. In terms of the company's site leveling projects, the company is one of the subcontractors involved in the foundation infrastructure project of the third runway at Hong Kong International Airport; regarding the company's road and drainage works, the company is the main contractor for the rural sewage collection project in Mei Wo funded by government departments, with a contract amount of approximately 99.1 million Hong Kong dollars; as for the company's mechanical and electrical engineering, the company has a direct contract with CLP Group (a group company that provides electricity to over 80% of Hong Kong's population), to provide cable trenching, laying, connection works, as well as emergency and cable fault repairs under General Agreement A, covering the Sham Shui Po and Wong Tai Sin areas. The company also acts as a subcontractor for Gammon Construction (one of CLP Group's main contractors), providing cable trenching, laying, connection works, as well as emergency and cable fault repairs under General Agreement B, covering the Tsuen Wan area.

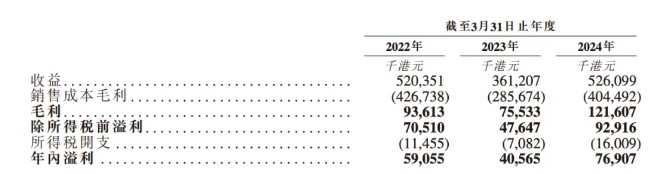

While the business steadily progresses, the company's performance shows a fluctuating growth trend. For the fiscal years 2021/22, 2022/23, and 2023/24 (hereinafter referred to as the reporting period), Wing Lee Construction's revenue was 0.52 billion yuan, 0.361 billion yuan, and 0.526 billion yuan respectively, with a compound annual growth rate of 0.55%; net profits for the year were 59.055 million yuan, 40.565 million yuan, and 76.907 million yuan respectively, with a compound annual growth rate of 14.12%. The company's performance fluctuates, with both revenue and net profit declining in the 2022-23 fiscal year.

Looking at the interest rate performance, the company's gross margin was approximately 17.99%, 20.91%, and 23.11% respectively during the period, showing a continuous increase; while the net margin was approximately 11.35%, 11.23%, and 14.62% respectively, stabilizing and slightly increasing overall.

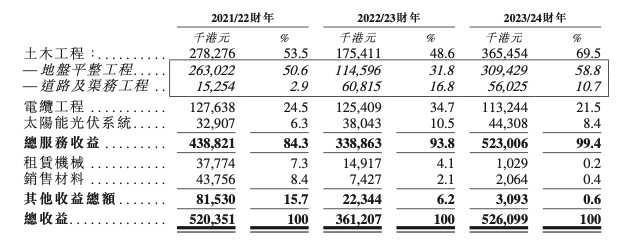

In terms of business segments, during the reporting period, the company's revenue from civil engineering business was 27.8 billion yuan, 17.5 billion yuan, and 36.5 billion yuan, accounting for 53.5%, 48.6%, and 69.5% of total revenue respectively; revenue from mechanical and electrical engineering business was 12.8 billion yuan, 12.5 billion yuan, and 11.3 billion yuan, accounting for 24.5%, 34.7%, and 21.5% of total revenue respectively; the revenue scale of renewable energy was 32.907 million yuan, 38.043 million yuan, and 44.308 million yuan, accounting for 6.3%, 10.5%, and 8.4% of revenue respectively. The company's revenue fluctuations mainly stem from the fluctuations in the largest business segment, which is civil engineering business.

More specifically, the third runway project has always been the main driving force behind the company's business and financial performance during the period. For example, in the 2021/22, 2022/23, and 2023/24 financial years, the third runway project contributed approximately 25.5 billion yuan, 92.7 million yuan, and 24.1 billion yuan in service revenue respectively, accounting for approximately 96.8%, 80.9%, and 80.0% of the corresponding land leveling engineering service revenue and approximately 48.9%, 25.7%, and 45.9% of total revenue. It is reported that based on the total contract amount, the third runway project is one of the largest public infrastructure projects in Hong Kong, worth around 141.5 billion Hong Kong dollars. As of the final feasibility date, the Group expects the third runway project to be completed by mid-2025. Once the entire project is completed, the company's revenue scale may shrink significantly.

In addition, in the 2022/23 financial year, revenue from land leveling engineering services created by Rongli Construction decreased by 56% to 11.5 billion yuan, mainly due to Project #0 (contract amount of approximately 0.573 billion yuan) and Project #08 (contract amount of approximately 0.189 billion yuan) starting only in December 2022 and July 2022 respectively. Therefore, most of the revenue from these two projects was not recognized in the 2022/23 financial year, but will be recognized in the 2023/24 financial year. It is evident that due to the different timing of revenue recognition from projects, the company's performance is not stable. This poses higher demands on its operational liquidity. At the end of each period, the company's cash and cash equivalents have shown a roller-coaster state, amounting to 13.343 million yuan, 5.47 million yuan, and 27.361 million yuan respectively.

Rongli Construction also stated that as projects progress, the company's cash flow generally transitions from net outflow in the early stages to cumulatively net inflow. This situation results in cash flow gaps. If more projects or customers withhold significant retention funds for various projects at any specific point in time during the initial stages, the company's working capital may suffer significant adverse impacts.

The income from the top five customers accounts for about eighty percent, with Hong Kong's infrastructure development slowing down and nearing the growth ceiling.

In the past periods, Rongli Construction mainly engaged in Hong Kong public projects. During the reporting period, the public projects mainly involved land leveling engineering and road and drainage projects, generating service revenue accounting for approximately 65.6%, 58.4%, and 73.2% of total revenue.

According to the WiseNews Financial APP, the nature, scope, and timing of obtainable public Works projects usually depend on a variety of interacting factors, including the Hong Kong government's policies on infrastructure and public facilities development, land supply and public housing policies, as well as the general economic situation and prospects of Hong Kong. Currently, in the face of challenges such as fiscal deficits and declining reserves, the government's ability to allocate funds for infrastructure development may be limited.

According to the Hong Kong 2024-2025 Budget, the Financial Secretary of Hong Kong predicts a budget deficit of 101.6 billion HK dollars for the 2023-24 financial year, nearly double the original estimate of 54.4 billion HK dollars. The Financial Secretary of Hong Kong expects the budget deficit for the financial year ending on March 31, 2025, to further increase from the earlier estimate of approximately 48.1 billion HK dollars.

According to Article 107 of the Basic Law, the Hong Kong government's budget should follow the principle of balancing income and expenditure, strive for fiscal balance, avoid deficits, and be consistent with the growth rate of the Gross Domestic Product. As the government may need to prioritize spending in areas such as education and medical care while reducing overall expenditures, infrastructure projects may face budget cuts or delays. This could affect the construction, maintenance, and expansion of infrastructure such as roads, bridges, ports, and public transportation systems.

If the number of privately funded construction projects available significantly decreases, resulting in reduced demand for civil, mechanical, and renewable energy engineering related to this, the construction business, financial situation, and operational performance of Profit Glory Construction may be significantly adversely affected.

According to data from the Hong Kong Census and Statistics Department, the total value of civil engineering contracts undertaken by Hong Kong contractors had a compound annual growth rate of approximately 3.2% from 2019 to 2023. In the coming years, as projects such as the new development areas of Kam To North and Fanling North, the artificial island of Tomorrow Island under the Lantau Tomorrow Vision project, and the expansion of Tung Chung New Town are completed and launched, the demand for civil engineering will be sustained. It is estimated that the total value of civil engineering in Hong Kong will grow at a compound annual growth rate of 3.5% from 2024 to 2028.

In terms of competitive landscape, the civil engineering market in Hong Kong is relatively concentrated. It is estimated that the combined market share of the top three market participants in the Hong Kong civil engineering industry in 2023 is about 22.4%. The company's revenue accounts for approximately 0.6% of the overall Hong Kong civil engineering industry in 2023, which is not high. Therefore, expanding market share becomes the most important issue for the company.

To expand market share, it is necessary to acquire more projects and accumulate more customers. However, based on Profit Glory Construction's customer sources, the company heavily relies on a small number of key customers. During the reporting period, the revenue from the company's major customers was approximately 0.169 billion yuan, 86.1 million yuan, and 0.172 billion yuan, accounting for percentages of total revenue of approximately 32.4%, 24.0%, and 32.6%, respectively; the revenue from its top five customers was approximately 0.441 billion yuan, 0.221 billion yuan, and 0.387 billion yuan, with the combined revenue from the top five customers accounting for percentages of total revenue of approximately 84.6%, 61.0%, and 72.3%, respectively.

The revenue from the top five customers accounts for over 80%, making it difficult for the company to collect payments. The prospectus indicates that when the right to receive payment becomes unconditional (excluding the passage of time), any amount previously recognized as contract assets will be reclassified as trade receivables. As of March 31, 2022, March 31, 2023, and March 31, 2024, Rongli Construction recorded contract assets totaling approximately 0.127 billion yuan, 0.141 billion yuan, and 0.195 billion yuan respectively. The trade receivables remain high, worsening the liquidity of Rongli Construction. Perhaps this is also a major reason for Rongli Construction's public listing financing.

In conclusion, as a contractor mainly engaged in Hong Kong public projects, the business development of Rongli Construction depends on infrastructure investment in Hong Kong. Currently, the infrastructure growth rate in Hong Kong is low, and the company is nearing a growth ceiling. Moreover, focusing on its own business, although performance fluctuates positively in the period, it mainly relies on a single project to contribute nearly half of the total revenue. Once this project ends in mid-2025, the company's growth may be difficult to sustain. In addition, reliance on large customers, weak liquidity, has also become a constraint on its further market share expansion.

招股书显示,荣利营造为从事土木及机电工程以及可再生能源工程的具规模香港承建商。其土木工程专注于地盘平整工程以及道路及渠务工程,机电工程则专注于电缆挖沟、铺设及接驳工程。根据行业报告,荣利营造是2023年香港最大的电缆及民用管道安装分包商,以公司2023/24财年的收益计,市场份额约为13.6%。自2019年起,公司亦于可再生能源分部下进行太阳能光伏系统的设计、安装及维护工程。就可再生能源工程而言,公司专注于太阳能光伏工程。其次,在公司参与的少数项目中,会临时向承建商及分包商租赁机械及买卖建筑材料。

招股书显示,荣利营造为从事土木及机电工程以及可再生能源工程的具规模香港承建商。其土木工程专注于地盘平整工程以及道路及渠务工程,机电工程则专注于电缆挖沟、铺设及接驳工程。根据行业报告,荣利营造是2023年香港最大的电缆及民用管道安装分包商,以公司2023/24财年的收益计,市场份额约为13.6%。自2019年起,公司亦于可再生能源分部下进行太阳能光伏系统的设计、安装及维护工程。就可再生能源工程而言,公司专注于太阳能光伏工程。其次,在公司参与的少数项目中,会临时向承建商及分包商租赁机械及买卖建筑材料。