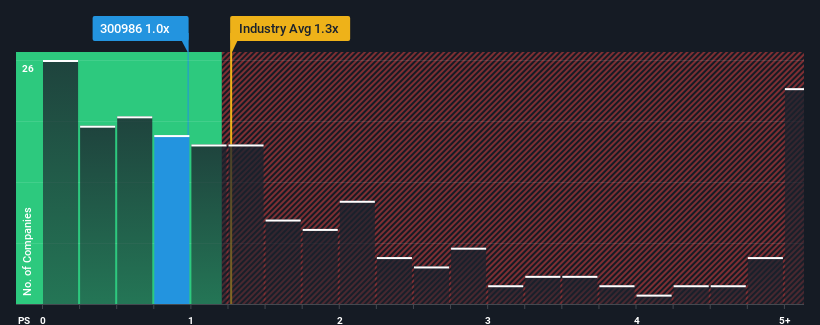

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Metals and Mining industry in China, you could be forgiven for feeling indifferent about Jiangxi GETO New Materials Corporation Limited's (SZSE:300986) P/S ratio of 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Jiangxi GETO New Materials Has Been Performing

Recent times have been advantageous for Jiangxi GETO New Materials as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Jiangxi GETO New Materials' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Jiangxi GETO New Materials' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. This was backed up an excellent period prior to see revenue up by 80% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. This was backed up an excellent period prior to see revenue up by 80% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's curious that Jiangxi GETO New Materials' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jiangxi GETO New Materials currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jiangxi GETO New Materials (of which 2 are concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.