Recently, Xuhui Holding Group (00884.HK) issued an announcement disclosing the latest progress of its overseas debt restructuring plan. The announcement stated that the company has formally signed a restructuring support agreement with a group of bondholders holding 47% of the size of foreign bonds.

At this point, Xuhui's overseas debt restructuring has ushered in substantial progress. In the current context of multiple benefits such as the Federal Reserve's interest rate cuts and the continued increase in financial and real estate policies, this announcement is of great significance to Xuhui, so we might as well interpret it.

1. Gobble down “hard bones” and promote the debt conversion process with pragmatic and flexible restructuring plans

Looking back at Xuhui's debt conversion process this year, it can be said that it has made breakthroughs one after another.

According to the announcement, on January 3 of this year, Xuhui Holdings proposed a new comprehensive solution to the Foreign Debt Coordination Committee and the Bondholders' Group. The goal is to reduce foreign debt by about 3.3 billion US dollars to 4 billion US dollars.

According to the announcement, on January 3 of this year, Xuhui Holdings proposed a new comprehensive solution to the Foreign Debt Coordination Committee and the Bondholders' Group. The goal is to reduce foreign debt by about 3.3 billion US dollars to 4 billion US dollars.

Immediately after that, on April 29, Xuhui Holdings issued an announcement stating that it had agreed on a comprehensive plan in principle with the group of bondholders holding about 43% of the company's senior notes, perpetual bonds and convertible bonds.

By May, Xu Hui further announced that negotiations with the Coordinating Committee had progressed, and the two sides agreed to advance to the next stage to negotiate and agree on official documents based on the terms of the April 29 announcement. The Coordinating Committee's loan banks hold a total of about 59% of Xuhui's overseas loan financing capital.

Now, with the disclosure of this latest announcement, it is easy to see that Xuhui's foreign debt has reached a more substantial stage of progress.

Xuhui entered into a restructuring support agreement with the creditor panel for overseas debts. This also means that Xuhui's debt restructuring process is expected to be further accelerated.

Judging from this round of housing companies' debt crisis, overseas debt restructuring can be described as a “hard bone” in the housing companies' debt conversion process. This is mainly because overseas debt restructuring not only involves complex cross-border legal, financial, and regulatory factors, but also requires negotiations with a large number of international creditors, who often have different demands.

From this, it can also be discovered that many housing companies' overseas conversion debt is still in the midst of a “tug-of-war.”

From Xuhui's progress in promoting overseas debt restructuring, it is easy to see that the company has shown the sincerity of active communication and negotiation with creditors, provided a flexible restructuring plan, and received support from creditors.

It can be said that Xuhui has made continuous efforts to actively deal with liquidity challenges and market changes since the venture, and now it has finally opened up a new situation for it.

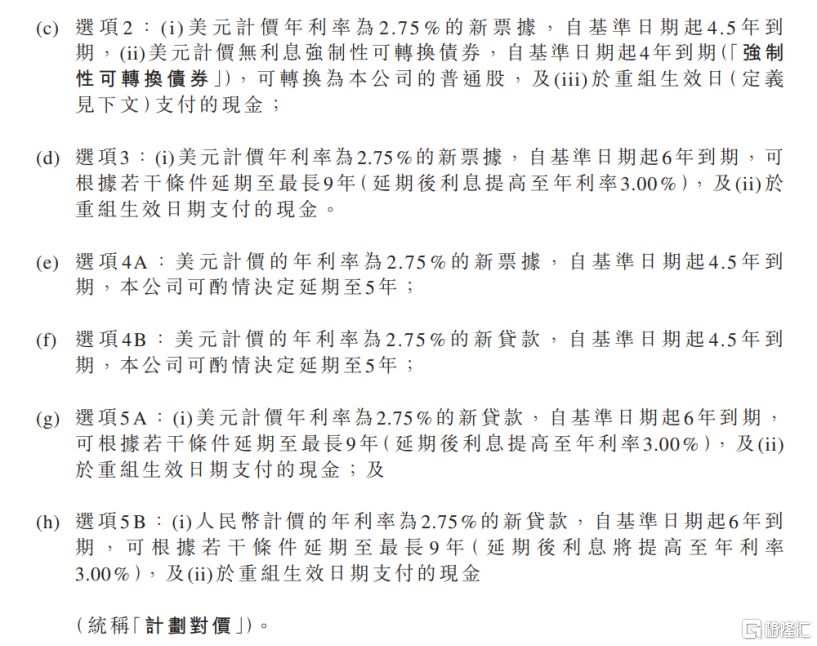

Looking specifically at the restructuring plan, Xuhui provided creditors with a variety of “short, medium, and long” options, including short term notes and loans, zero coupon notes+compulsory convertible bonds+middle-age notes, new long-term notes, etc. Creditors can freely combine options; creditors can choose to convert to new bonds or new loans, or receive cash payments.

(Screenshot of the announcement plan)

According to the company's previous mid-term earnings data, as of June 30, 2024, Xuhui's share of foreign debt was about 54%. Therefore, the restructuring brought about a decrease in the size of overseas debt, which is of great significance to Xuhui's continued operation.

If the restructuring plan is successfully implemented in the end, Xuhui will not have large overseas capital expenses within the next two years, and the pressure on cash flow in the short term will be greatly alleviated. Furthermore, the restructuring will also help Xuhui reduce the overall debt size pressure and effectively promote structural leverage reduction. In other words, Xuhui has solved the debt dilemma and will also usher in a new phase of the positive cycle of business development.

2. Maintain steady business operations and welcome the arrival of an inflection point in the industry under the “strongest voice” of the policy

Although the industry is facing deep adjustments, Xuhui's overall business operations have remained stable and actively fulfilled its guarantee and delivery responsibilities. According to Xuhui's official Weiwei disclosure, Xuhui has delivered 0.0384 million new homes since 2024, and has delivered more than 0.248 million new homes since 2022.

Currently, relevant policies to support the property market are being continuously strengthened, such as measures such as reducing the down payment ratio and lifting purchase restrictions, all of which will help boost market demand.

In particular, at the recent press conference of the State Information Office, Central Bank Governor Pan Gongsheng announced five real estate finance policies in one go, which greatly boosted market confidence. From guiding banks to lower interest rates on existing mortgages, unify the minimum down payment ratio for mortgages to 15%, optimize reloan policies for affordable housing, and support the acquisition of existing land by housing enterprises, etc., along with the introduction of a new round of financial measures to support real estate, it has indicated the direction for the steady improvement of real estate in the future.

At the same time, with the wave of interest rate cuts by the Federal Reserve, domestic liquidity is expected to be supported, which will provide a more relaxed financing environment for real estate companies.

Furthermore, the policy level is also actively supporting housing enterprises to resolve debt difficulties. Real estate financing policies maintain a relaxed tone, local real estate financing coordination mechanisms continue to advance, and the number of “white lists” continues to increase.

According to the latest statistics previously released by the State Financial Supervisory Authority at the end of August, commercial banks have approved 5,392 “white list” projects, an increase from more than 4,000 at the end of June; the approval quota also increased from 1.2 trillion yuan at the end of June to nearly 1.4 trillion yuan.

It is worth mentioning that Xuhui also previously revealed that as of August 30, 72 of its projects have been shortlisted in the “white list” of real estate projects across the country, and 45 of these projects have improved project cash flow through financing and replacement, extended interest rate cuts, etc. In addition, five projects, including Taiyuan Jiangshan Yunyue, Wuhu Golden Impression, and Wushi Xuefu Shangpin, received approval for additional financing amounts of 0.61 billion.

It can be said that current policy support measures and improvements in the market environment are providing housing enterprises such as Xuhui with more operating space and possibilities. Now, as we enter a new cycle, Xuhui's value window will be further opened.

3. Conclusion

Overall, Xu Hui, who has experienced liquidity difficulties, has finally ushered in a new phase.

Currently, as the policy environment continues to support the steady development of the real estate industry from the supply and demand side, expectations for a positive market are also being strengthened. It is easy to judge that with the implementation of subsequent restructuring, the company will effectively reduce its overall debt size, effectively optimize its balance sheet, and help it successfully cross the industry cycle.

In fact, from a more profound perspective, Xuhui's progress in debt restructuring is not only important to the company itself, but also provides valuable experience for the entire real estate industry.

In response, a recent HSBC report mentioned that the financial situation of struggling developers provides clues to resolve the plight of the real estate industry. At the same time, it is believed that companies such as Xuhui and Agile, which are doing well, are more likely to get out of trouble when the real estate industry actually recovers.

In the report, HSBC stated that Xuhui has made significant progress in removing inventory and reducing total debt. From the end of 2021 to June 2024, Xuhui's inventory and total debt fell sharply by 42% and 22%, respectively, far exceeding the industry average. These indicators reflect Xuhui's efforts in real estate delivery, inventory removal, and deleveraging, and has made substantial progress.

With the approval of major international banks, this also added more confidence to Xuhui's subsequent performance.

据公告,在今年1月3日,旭辉控股向境外债务的协调委员会和债券持有人小组提出新一版全面解决方案,目标是削减约33亿美元至40亿美元的境外债务。

据公告,在今年1月3日,旭辉控股向境外债务的协调委员会和债券持有人小组提出新一版全面解决方案,目标是削减约33亿美元至40亿美元的境外债务。