Ningxia Orient Tantalum Industry's (SZSE:000962) stock is up by a considerable 8.8% over the past week. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Specifically, we decided to study Ningxia Orient Tantalum Industry's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ningxia Orient Tantalum Industry is:

7.3% = CN¥185m ÷ CN¥2.5b (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

Ningxia Orient Tantalum Industry's Earnings Growth And 7.3% ROE

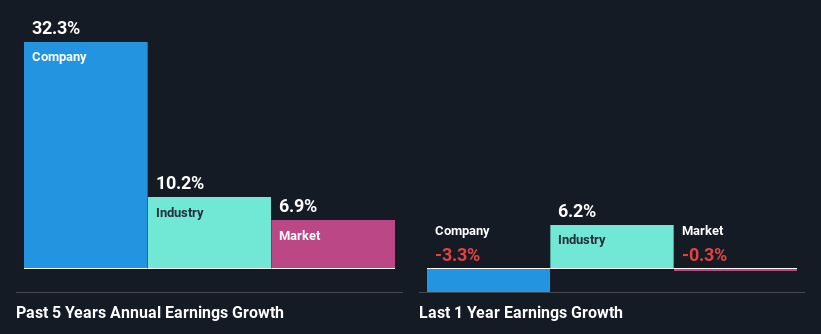

When you first look at it, Ningxia Orient Tantalum Industry's ROE doesn't look that attractive. However, given that the company's ROE is similar to the average industry ROE of 7.7%, we may spare it some thought. Looking at Ningxia Orient Tantalum Industry's exceptional 32% five-year net income growth in particular, we are definitely impressed. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Ningxia Orient Tantalum Industry's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 10%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is Ningxia Orient Tantalum Industry fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Ningxia Orient Tantalum Industry Making Efficient Use Of Its Profits?

Ningxia Orient Tantalum Industry doesn't pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Summary

Overall, we feel that Ningxia Orient Tantalum Industry certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.