National Day big gift package continues to be released.

On the last trading day before the National Day, the market skyrocketed.

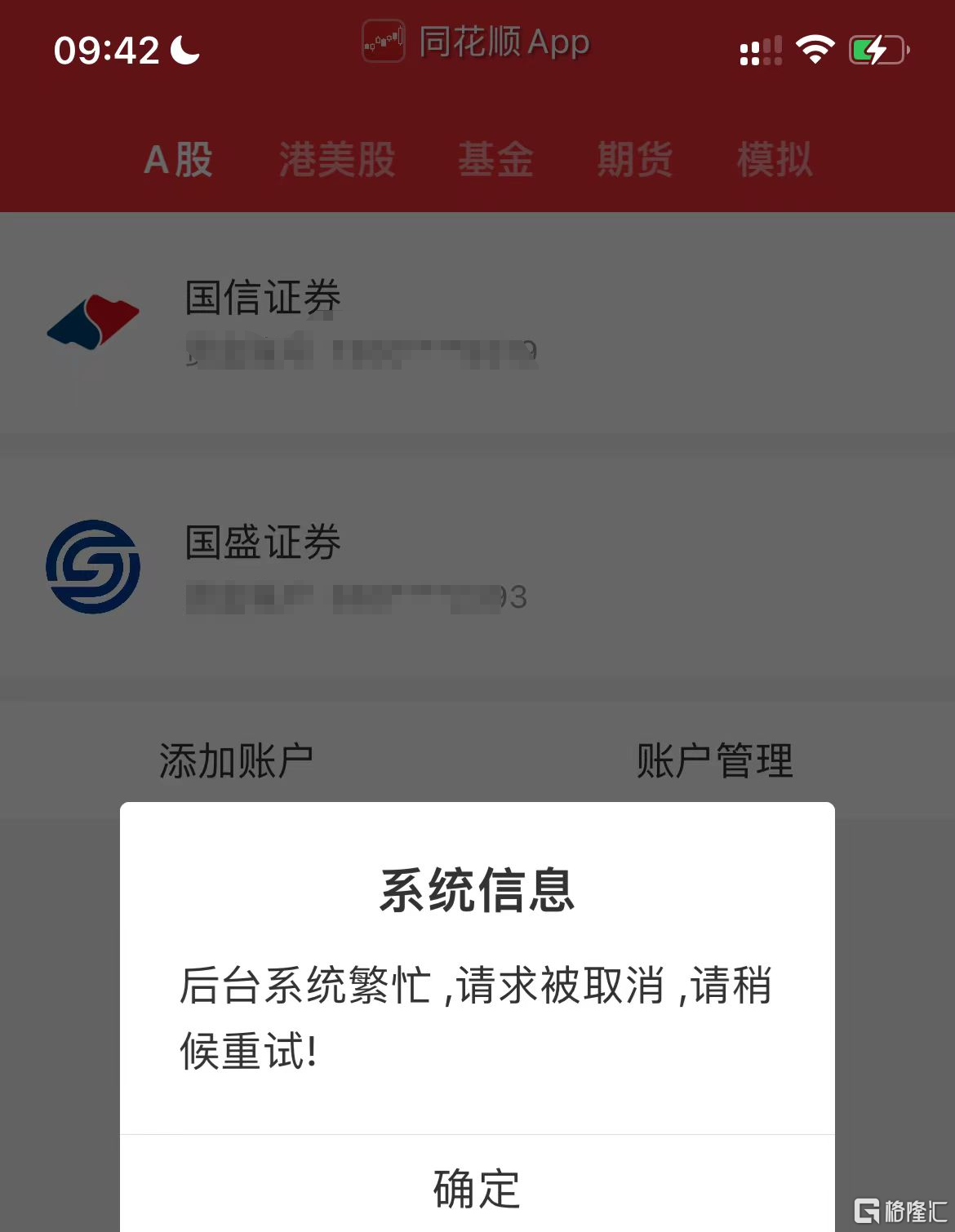

Trading software was "crashed" due to high activity.

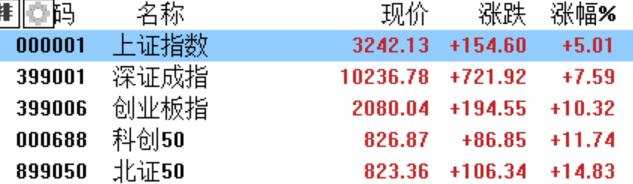

As of the time of publication, the Shanghai Composite Index rose by 5.01%, crossing the 3200-point mark, with a cumulative increase of over 18% in the past 5 trading days.

The Shenzhen Component Index rose by 7.59%, with a cumulative increase of over 27% in the past 5 trading days.

The Shenzhen Component Index rose by 7.59%, with a cumulative increase of over 27% in the past 5 trading days.

The ChiNext Price Index rose by 10.32%, reaching a new high in 1 year, with a cumulative increase of 36% in the past 5 trading days.

The SSE Science and Technology Innovation Board 50 Index surged by over 12%, marking a record increase.

The B Innovation 50 Index rose by nearly 15%, continuing to set a new record for the highest single-day increase in history.

Just 35 minutes after the opening of the market, the trading volume of Shanghai and Shenzhen stock markets exceeded 1 trillion yuan, more than 410 billion yuan higher than the same time yesterday, setting a record for the fastest trillion in history.

One and a half hours after the opening, the trading volume of Shanghai and Shenzhen stock markets exceeded 1.5 trillion yuan, more than 700 billion yuan higher than the same time yesterday.

Over 5300 individual stocks in the market are rising, with only 32 declining, 182 hitting the daily limit up and 3 hitting the daily limit down.

Due to the overly heated market, some brokerages and trading service providers experienced trading delays, login failures, and abnormal data display. By now, the related malfunctions have been gradually restored.

The Shanghai Stock Exchange is scheduled to conduct system boot-up connectivity tests on October 7 (Monday) after the National Day holiday, providing a connectivity test environment for relevant institutions.

The participating units include the Shanghai Stock Exchange Technology Company, the Shanghai Stock Exchange Information Company, relevant core institutions, and all market participants.

This test simulates one trading day of trading, mainly to verify that all relevant parties can log in to the Shanghai Stock Exchange trading systems such as bidding, multi-business, new bonds, options, fixed income, and carry out business such as announcement reception processing, order declaration, transaction feedback, market data reception display, etc.

Brokerage, real estate lead the gains in today's A-share sector.

Today, the A-share sector is all in the red, with brokerage and real estate being the absolute 'leaders' in this round of the market.

East Money Information achieved two consecutive trading days of 20% daily limit increases, with a total turnover exceeding 28.6 billion yuan, once again refreshing the turnover record.

Hithink Royalflush Information Network saw two consecutive daily limit increases of 20%, Shenzhen Infogem Technologies saw 7 consecutive daily limit increases over 8 days, Beijing Compass Technology Development, Shenzhen Fortune Trend Technology, Shanghai Amarsoft Information & Technology, Jiangxi Tianli Technology, Beijing Trust&Far Technology, and other stocks hit limit up.

Tianfeng Securities, Sealand, Minmetals Capital, Cofco Capital Holdings have hit the daily limit for 5 consecutive days, while BOC International, Guolian Securities have hit the daily limit for 3 consecutive days, and Citic Securities, China Securities Co.,Ltd., and more stocks have also hit the daily limit.

In this round of stimulus, the real estate industry is still the main focus at the policy level. As a result, real estate stocks and property management stocks have been on the rise.

Yang Guang Co., Ltd. has hit the daily limit for 5 consecutive days, Financial Street Holdings for 4 consecutive days, Shenzhen SDG Service, Gemdale Corporation, Seazen Holdings, China Vanke Co.,Ltd., 5i5j Holding Group, and Risesun Real Estate Development for 3 consecutive days, while China Overseas Property has hit the daily limit.

The big shots are all bullish.

As the market is doing well, prominent investors from both domestic and international markets are all expressing optimism towards Chinese assets.

Recently, well-known hedge fund guru and creator of the "dollar smile theory" Stephen Jen has stated that, driven by recent stimulus policies, Chinese stocks will continue to rise, the RMB will appreciate, and Chinese bonds will decline.

In his report, he wrote: "Investors have very low weightings on all Chinese stocks, which are severely undervalued, and there is a high possibility of a significant rebound."

He also pointed out that while the Federal Reserve is cutting interest rates, China is also increasing its efforts, and oil prices are still low, so risk assets "should perform well."

He predicts that after the US presidential election, global stock markets will rebound strongly until the end of the year.

Yesterday, well-known private equity guru Lin Yuan also stated that the center of the SSE Composite Index should be at 4200 points, and above 4200 points is considered "normal." The current position at 3000 points indicates that the market is not in a bubble.

He believes that the current situation is a small rebound after a decline, it is a correction of the market index, and the real bull market has not yet begun. He sees 4500 points as the starting point of the bull market.

In terms of allocation, Lin Yuan is bullish on "mouth business" (referring to food and beverage and pharmaceuticals).

He analyzed that once there is overcapacity in the food and beverage industry, adjustments can easily be made in the production process. In the pharmaceutical industry, in the next two to three decades, the aging population in China will definitely increase, and under aging, the pharmaceutical industry has huge space due to rigid demand. There is also corresponding market demand for elderly housewares.

Furthermore, there are opportunities for dividend assets and growth assets in the future, with the key factor being individual investment preferences.

UBS Group believes that Chinese stocks have more upside potential, especially in the short term, although the future trend largely depends on the intensity of fiscal support and the implementation of various policy stimuli.

UBS Group has raised the year-end target price of the MSCI Chinese Index to 70, 7% higher than the latest closing price.

In terms of allocation, continue to adopt a barbell strategy, but replace some defensive stocks with selected small-cap consumer stocks to increase the portfolio's beta.

深成指涨7.59%,近5个交易日累计涨超27%;

深成指涨7.59%,近5个交易日累计涨超27%;