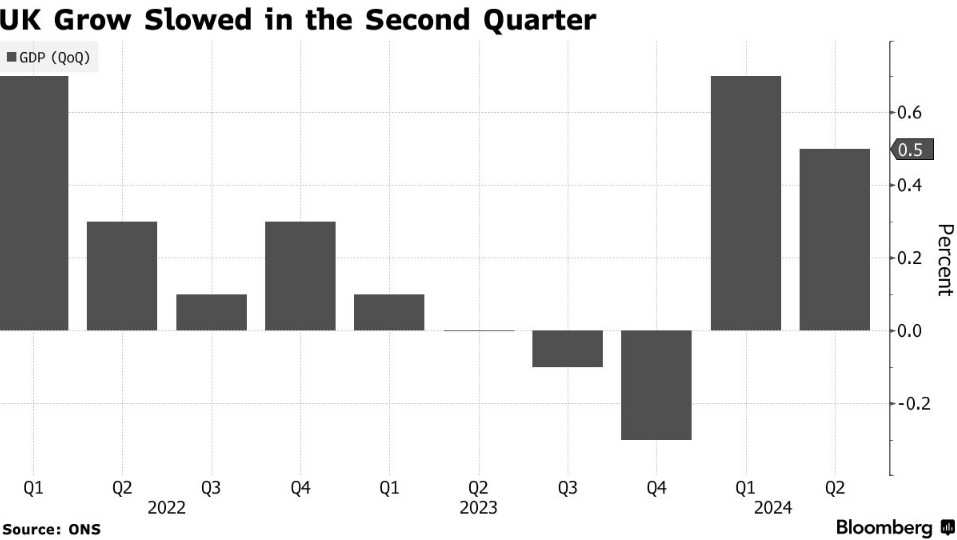

In the second quarter, the United Kingdom's economy grew by 0.5%, lower than the expected 0.6%, indicating a weakening momentum in economic growth since the Labour government took office.

According to the Intelligence Finance APP, the UK economy grew by 0.5% in the second quarter, lower than the expected 0.6%, indicating a slowing momentum in economic growth after the Labour government came to power. This growth rate has slowed compared to the 0.7% in the first quarter, posing a challenge for Prime Minister Keir Starmer, who had promised to raise the economic growth rate to 2.5%. Currently, market confidence is diminishing, with further expected slowdown to 0.3% per quarter in the future.

Data released by the UK National Statistics Office shows that the GDP growth in the second quarter was 0.5%, lower than the previous forecast of 0.6%, and also lower than the 0.7% growth rate in the first quarter. This poses pressure on the new Prime Minister Keir Starmer, who pledged to improve public services through economic growth. Starmer's goal is to raise the growth rate to 2.5%, a target significantly higher than the average level since the financial crisis and expectations for the coming years.

Since the Labour Party took office in July, there have been signs of further economic sluggishness, partly due to Labour's warnings about the state of public finances. Output remained flat in July for the third time in four months, market confidence declined, and there are concerns that Chancellor Rachel Reeves will announce tax increases and budget cuts on October 30th to address the fiscal deficit left by the Conservative Party. Recent surveys indicate an expected slowdown in economic growth to 0.3% per quarter.

Since the Labour Party took office in July, there have been signs of further economic sluggishness, partly due to Labour's warnings about the state of public finances. Output remained flat in July for the third time in four months, market confidence declined, and there are concerns that Chancellor Rachel Reeves will announce tax increases and budget cuts on October 30th to address the fiscal deficit left by the Conservative Party. Recent surveys indicate an expected slowdown in economic growth to 0.3% per quarter.

In addition, there have been historic revisions to national account data, and a relative reweighting of various sectors for the first time since the pandemic. The economy grew by 0.3% last year, higher than the previously estimated 0.1%, but remained in recession in the second half of the year.

The savings rate has risen to 10%, the highest level since 2021, reflecting a cautious attitude among consumers. Although disposable income per capita increased by 1% this quarter, wage growth exceeded the inflation rate, but the savings rate remains higher than the inflation rate, indicating consumer reservations about future economic prospects.

自7月份工党执政以来,有迹象表明经济进一步失去动力,部分原因是工党对公共财政状况的警告。7月份产出持平,为四个月来的第三次,市场信心下降,人们担心财政大臣雷切尔·里夫斯将在10月30日宣布增税和削减预算,以应对保守党留下的财政缺口。最近的调查显示,经济增长预计将放缓至每季度0.3%。

自7月份工党执政以来,有迹象表明经济进一步失去动力,部分原因是工党对公共财政状况的警告。7月份产出持平,为四个月来的第三次,市场信心下降,人们担心财政大臣雷切尔·里夫斯将在10月30日宣布增税和削减预算,以应对保守党留下的财政缺口。最近的调查显示,经济增长预计将放缓至每季度0.3%。