By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Shenzhen Sunwin Intelligent Co., Ltd. (SZSE:300044) shareholders have seen the share price rise 76% over three years, well in excess of the market decline (25%, not including dividends).

Since the stock has added CN¥405m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

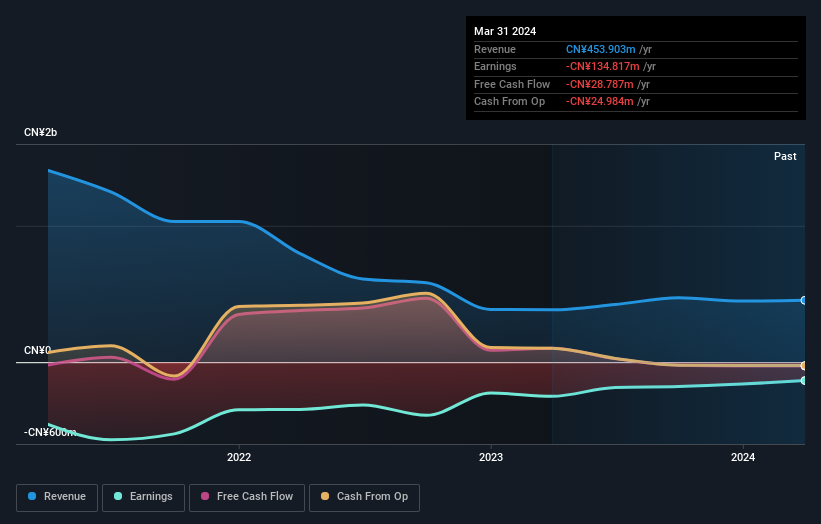

Given that Shenzhen Sunwin Intelligent didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Shenzhen Sunwin Intelligent actually saw its revenue drop by 46% per year over three years. Despite the lack of revenue growth, the stock has returned 21%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

Shenzhen Sunwin Intelligent actually saw its revenue drop by 46% per year over three years. Despite the lack of revenue growth, the stock has returned 21%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Shenzhen Sunwin Intelligent's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shenzhen Sunwin Intelligent shareholders are down 6.3% over twelve months, which isn't far from the market return of -6.0%. Worse still, the company has lost shareholders 7% per year over five years. Generally speaking we'd prefer see an improvement in the fundamental metrics before becoming enthusiastic about the stock. It's always interesting to track share price performance over the longer term. But to understand Shenzhen Sunwin Intelligent better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Shenzhen Sunwin Intelligent you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.