Italy's inflation rate fell below 1%, which has brought greater pressure on the European Central Bank, forcing it to accelerate the pace of interest rate cuts.

According to the Smart Finance APP, Italy's inflation rate fell below 1%, which has brought greater pressure on the European Central Bank, forcing it to accelerate the pace of interest rate cuts. Data released by the Italian National Institute of Statistics on Monday showed that the Consumer Price Index (CPI) in September only rose by 0.8% year-on-year, meeting market expectations. In comparison, CPI rose by 1.2% year-on-year in August. The slowdown in inflation is mainly due to the decline in energy, transportation, and communication costs.

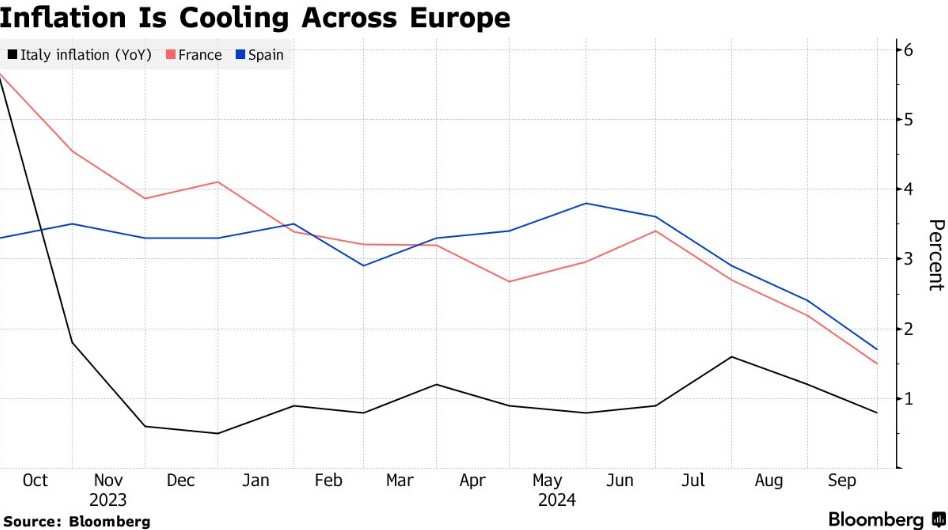

Italy's data aligns with the overall trend of inflation slowing down in the 19 eurozone countries, as data released last Friday from France and Spain fell below the European Central Bank's inflation target of 2%. As a result, investors are increasing bets that the European Central Bank will cut interest rates in October, marking the third time this year that borrowing costs will be reduced.

Inflation in Europe is cooling down.

Inflation in Europe is cooling down.

Market expectations are that the German data to be released later on Monday will also show a slowdown in inflation. The overall data for the eurozone will be released on Tuesday, with analysts expecting an inflation rate of 1.8%.

ECB President Lagarde will address EU lawmakers at 21:00 Beijing time on Monday, with this being her first opportunity to comment on investors strongly betting on another ECB rate cut on October 17. The current market expectation for an October rate cut is just under 80%.

Despite the cooling of the price rise, some hawks in the European Central Bank are still reluctant to support accelerating rate cuts, citing a service sector inflation of over 4% in August.

However, Italy will welcome a rate cut in October. Italian Prime Minister Meloni stated that a more accommodative monetary policy is needed to help European economic growth. The Italian government aims to achieve an economic growth of around 1% in 2024 but more measures are needed to reduce the debt burden.

欧洲通胀正在降温

欧洲通胀正在降温