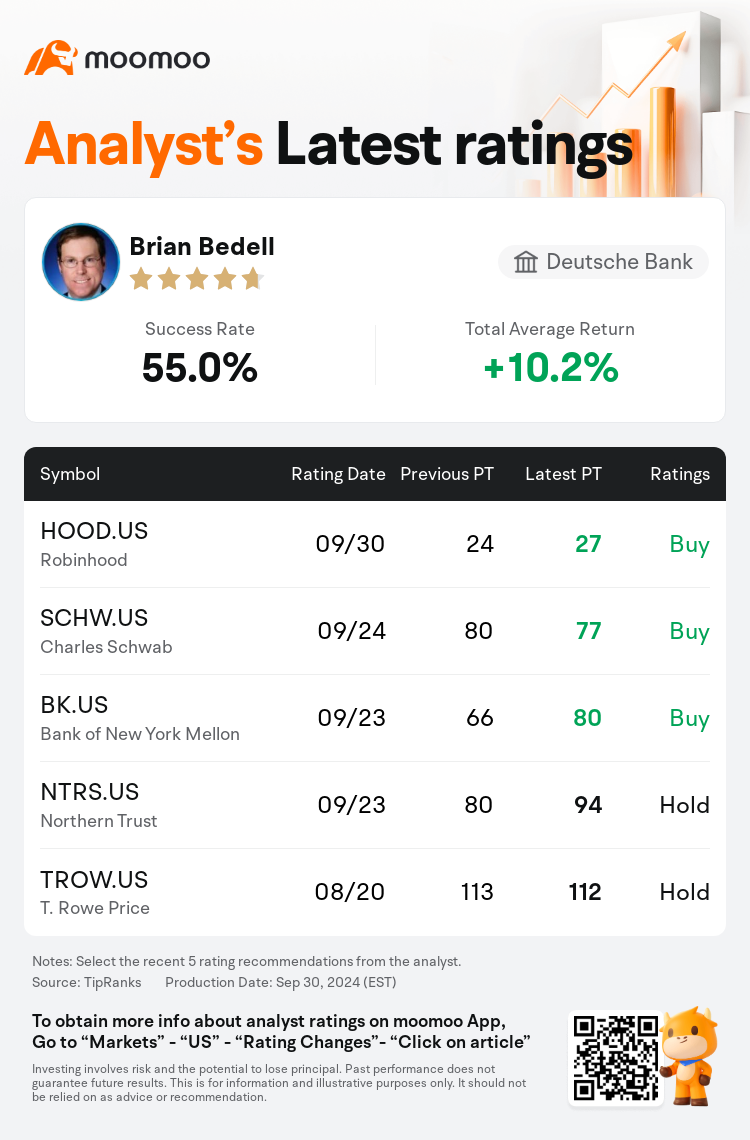

Deutsche Bank analyst Brian Bedell maintains $Robinhood (HOOD.US)$ with a buy rating, and adjusts the target price from $24 to $27.

According to TipRanks data, the analyst has a success rate of 55.0% and a total average return of 10.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

There is a positive outlook on Robinhood's revenue and earnings momentum, supported by various initiatives aimed at attracting more users, expanding market reach, and increasing engagement across their offerings. The expectation is for the company to sustain a significant annual growth in net new assets, surpassing 20% leading up to 2025, with a continued trend into 2026. This growth trajectory is anticipated to contribute to ongoing expansion in adjusted EBITDA margins and robust double-digit earnings growth in the mid-2020s.

The general outlook for the brokerage sector appears to be shifting towards a negative sentiment due to anticipated lower rate expectations, particularly for those that are asset sensitive, and ongoing concerns regarding sweep deposit pricing. Average earnings predictions for brokers have been lowered by approximately 6% for 2025 and 7% for 2026, with the exception of one company which has seen positive forecast adjustments. There are perceived risks to the consensus estimates for most firms in this space, with one particular company facing the highest level of risk. Meanwhile, positive sentiments are maintained towards another firm. Adjustments in estimates for one company have been made in light of notable net deposit trends and recent trading activities. While there is a growing optimism due to improved fundamentals, caution is advised due to potential declines in trading activities and longer-term uncertainties about organic growth.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

德意志银行分析师Brian Bedell维持$Robinhood (HOOD.US)$买入评级,并将目标价从24美元上调至27美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.0%,总平均回报率为10.2%。

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

在旨在吸引更多用户、扩大市场覆盖面和提高其产品参与度的各种举措的支持下,Robinhood的收入和收益势头前景乐观。预计该公司的净新资产将保持显著的年度增长,到2025年将超过20%,并将持续到2026年。预计这一增长轨迹将有助于调整后的息税折旧摊销前利润率的持续扩大,并在2020年代中期实现强劲的两位数收益增长。

由于预期的利率预期会降低,尤其是对资产敏感的经纪行业的利率预期,以及对大额存款定价的持续担忧,经纪行业的总体前景似乎正在转向负面情绪。经纪商对2025年的平均收益预测下调了约6%,2026年下调了7%,只有一家公司进行了积极的预测调整。该领域大多数公司的共识估计存在明显的风险,其中一家公司面临的风险最高。同时,对另一家公司的积极情绪保持乐观。鉴于明显的净存款趋势和最近的交易活动,对一家公司的估计进行了调整。尽管由于基本面改善,人们越来越乐观,但由于贸易活动可能下降以及有机增长的长期不确定性,建议谨慎行事。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of