Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

华尔街最准确的分析师对三家科技和电信股票的高股息收益进行评价

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市场动荡和不确定的时期,许多投资者会转向股息收益股,这些通常是具有较高的自由现金流并以高红利派息奖励股东的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

本站读者可以通过访问分析师股票评级页面查看对自己最喜爱的股票的最新分析师观点。交易员可以筛选Benzinga的广泛分析师评级数据库,包括按照分析师准确度进行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

以下是通信-半导体行业三只高股息股票最准确的分析师评级。

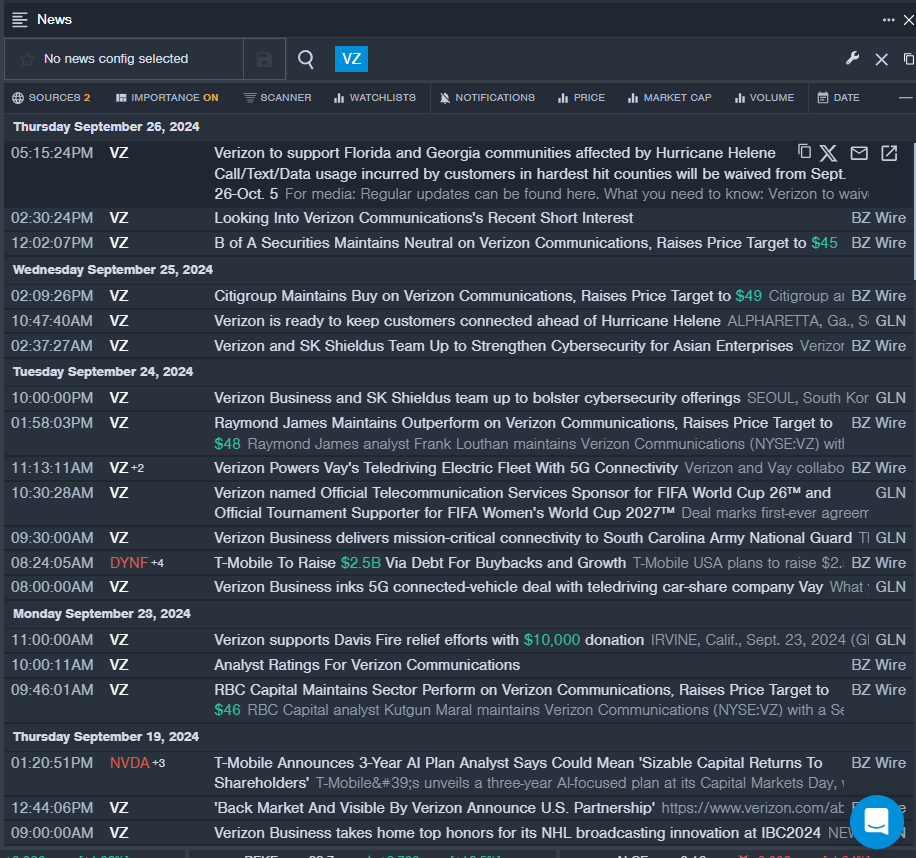

Verizon Communications Inc. (NYSE:VZ)

Verizon Communications Inc. (纽交所:VZ)

- Dividend Yield: 6.04%

- B of A Securities analyst David Barden maintained a Neutral rating and raised the price target from $41 to $45 on Sept. 26. This analyst has an accuracy rate of 65%.

- Citigroup analyst Michael Rollins maintained a Buy rating and increased the price target from $47 to $49 on Sept. 25. This analyst has an accuracy rate of 77%

- Recent News: Vay collaborated with Verizon Communications to integrate Verizon 5G connectivity into Vay's fleet of teleoperated electric vehicles.

- Benzinga Pro's real-time newsfeed alerted to latest VZ news.

- 股息率:6.04%

- 美银证券的分析师David Barden保持中立评级,并将价格目标从41万亿美元提高到45美元,时间为9月26日。该分析师的准确率为65%。

- 花旗集团分析师Michael Rollins保持买入评级,并将价格目标从47万亿美元提高到49美元,时间为9月25日。该分析师的准确率为77%。

- 近期资讯:Vay与Verizon通信合作,将Verizon的5g概念连接整合到Vay的远程操控电动车队中。

- Benzinga Pro的实时新闻通知了最新的VZ资讯。

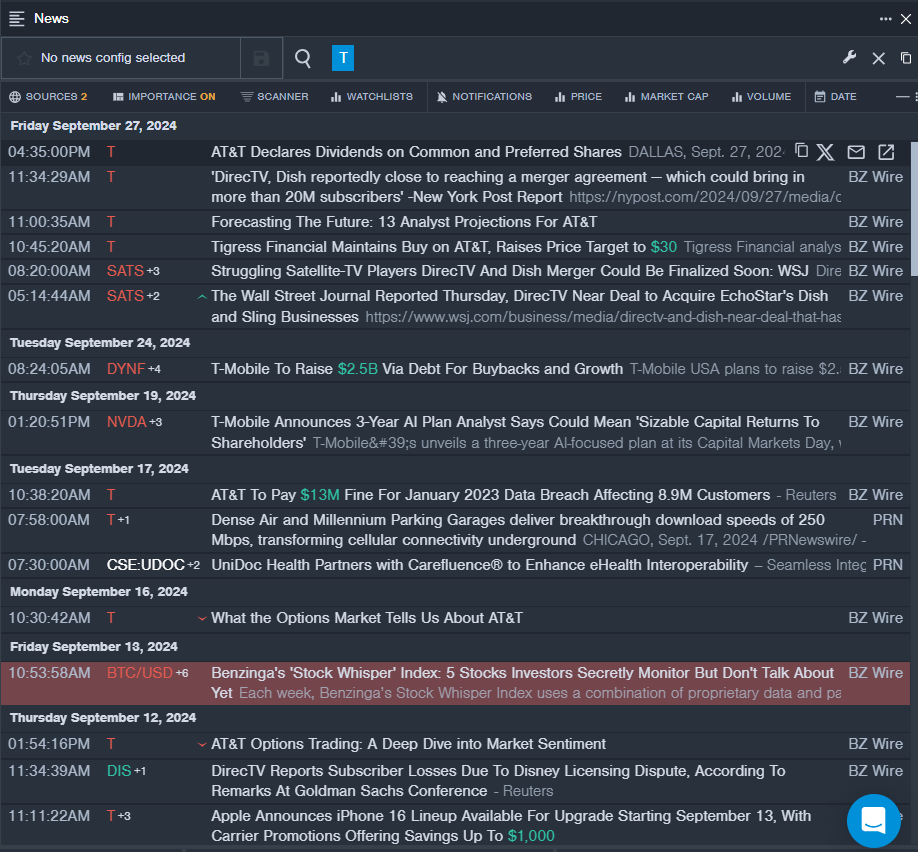

AT&T Inc. (NYSE:T)

AT&T Inc. (纽交所:T)

- Dividend Yield: 5.07%

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $29 to $30 on Sept. 27. This analyst has an accuracy rate of 73%.

- Citigroup analyst Michael Rollins maintained a Buy rating and increased the price target from $21 to $24 on Sept. 11. This analyst has an accuracy rate of 77%

- Recent News: The company's board of directors declared a quarterly dividend of $27.75 cents per share on common shares.

- Benzinga Pro's real-time newsfeed alerted to latest T news.

- 股息率:5.07%

- Tigress Financial的分析师Ivan Feinseth维持买入评级,并于9月27日将目标股价从29美元提高到30美元。该分析师的准确率为73%。

- 花旗集团分析师Michael rollins维持买入评级,并于9月11日将目标股价从21美元提高到24美元。该分析师的准确率为77%

- 近期资讯:公司董事会宣布普通股每股季度股息为27.75美分。

- Benzinga Pro的实时新闻提醒了最新的资讯。

The Interpublic Group of Companies, Inc. (NYSE:IPG)

埃培智(Interpublic Group of Companies, Inc.,纽交所:IPG)

- Dividend Yield: 4.17%

- Barclays analyst Julien Roch maintained an Equal-Weight rating and cut the price target from $35 to $34 on July 25. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst Benjamin Swinburne downgraded the stock from Equal-Weight to Underweight and cut the price target from $34 to $28 on July 22. This analyst has an accuracy rate of 76%.

- Recent News: On Sept. 18, Interpublic named Alex Hesz as Chief Strategy Officer.

- Benzinga Pro's charting tool helped identify the trend in IPG stock.

- 股息率:4.17%

- 巴克莱分析师Julien Roch维持Equal-Weight评级,将价格目标从35美元下调至34美元,时间为7月25日。该分析师的准确率为62%。

- 摩根士丹利分析师Benjamin Swinburne将该股票的评级从Equal-Weight下调至Underweight,将价格目标从34美元下调至28美元,时间为7月22日。该分析师的准确率为76%。

- 最新资讯:埃培智在9月18日任命Alex Hesz为首席策略官。

- Benzinga Pro的图表工具帮助识别了IPG股票趋势。

Read More:

阅读更多:

- Top 4 Materials Stocks That May Implode In Q3

- 可能在第三季度崩溃的前4家材料股