Lagarde said that inflation may temporarily rise in the fourth quarter, but the European Central Bank is more confident in achieving the 2% inflation target. She emphasized that the policy interest rate will continue to remain tight until the target is met.

Is a rate cut off the table? The European Central Bank stated that the policy interest rates will remain 'sufficiently restrictive' until the inflation target is achieved.

Today, the President of the European Central Bank, Lagarde, stated in a speech that looking ahead, the low levels of some survey indicators indicate headwinds for economic recovery.

She mentioned that the deceleration of inflation has accelerated in the past two months. However, 'the European Central Bank's policy interest rates will remain sufficiently restrictive until we reach our goals.'

She mentioned that the deceleration of inflation has accelerated in the past two months. However, 'the European Central Bank's policy interest rates will remain sufficiently restrictive until we reach our goals.'

She also mentioned that the labor market remains strong, with employment growth of only 0.2% in the second quarter, and recent indicators showing a further slowdown over the next few quarters.

Looking ahead, inflation may temporarily rise in the fourth quarter. However, the European Central Bank has more confidence in achieving the 2% inflation target on time.

'The latest data shows that inflation is moving towards the target direction, boosting market confidence. We will take this enhanced confidence into account in October.'

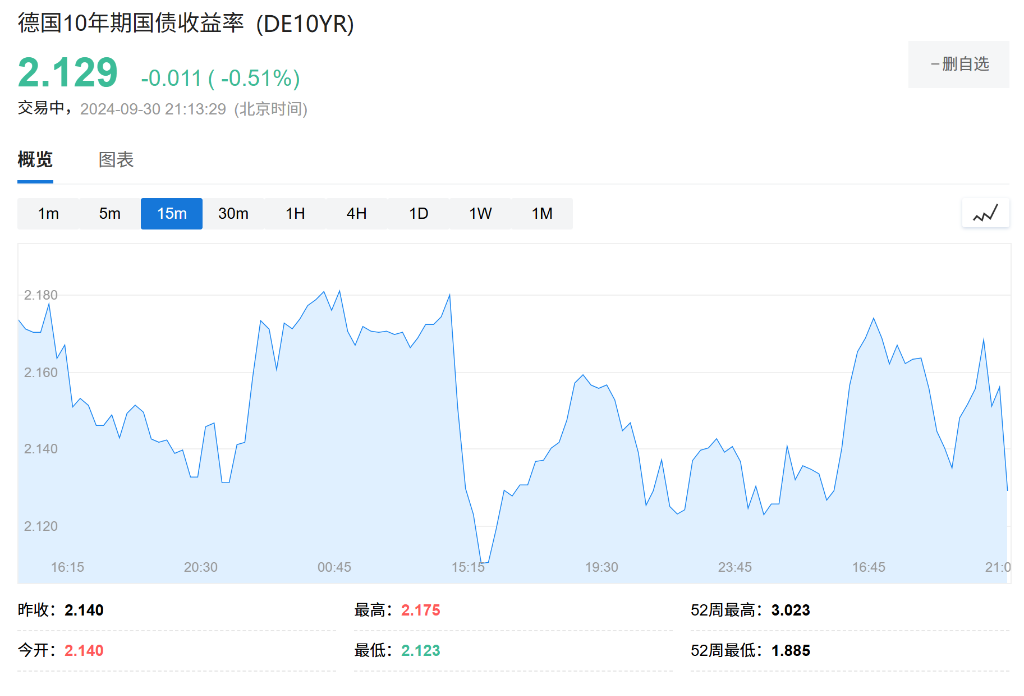

After the speech by European Central Bank President Lagarde, German bond yields rose, with the 10-year bond yield at 2.12%.

The Euro has made a slight increase against the US Dollar, reaching 1.1 Euros.

她表示,通胀回落在过去两个月中加速。但

她表示,通胀回落在过去两个月中加速。但