Six mainland tea and coffee brands have closed over 15 Hong Kong stores, indicating that the new mainland tea drinks in Hong Kong are not an easy path, as they not only have to face the relatively mature local tea and coffee brands, but also compete with international chain giants. Some industry insiders analyze that brand differentiation, precise market positioning, and efficient operation are key to surviving in the Hong Kong market.

According to the 'Star Daily News' on September 30th, mainland new tea and coffee brands are intensively entering the Hong Kong market.

Reporters from 'Star Daily News' learned that the first store of Luckin Coffee Princess in Hong Kong officially opened in the K11 Shopping Art Gallery on September 28th. It has been in business for two days, with an accumulated sales volume of nearly 0.01 million cups. It is reported that Luckin Coffee Princess has received invitations to open stores from various shopping malls in Hong Kong.

The first store of Tea Ba Dao in Mong Kok officially began trial operation on September 30th.

The first store of Tea Ba Dao in Mong Kok officially began trial operation on September 30th.

In fact, a large number of mainland coffee and tea brands have opened stores in Hong Kong. Since 2023, at least 10 tea drink brands have opened their first stores in Hong Kong. However, the new mainland tea drinks in Hong Kong are not an easy path, as six mainland tea and coffee brands have closed over 15 Hong Kong stores.

According to analysts in the industry, the Hong Kong market is known for its high level of internationalization and intense brand competition. For mainland tea and coffee brands, not only do they have to confront traditional brands in Hong Kong and international chain giants, they also face high operating costs. Brand differentiation, precise market positioning, and efficient operation may be the key to survival in the Hong Kong market.

Luckin Coffee Princess and Tea Ba Dao are actively expanding in the Hong Kong market.

According to local sources in Hong Kong, the first store of Luckin Coffee Princess is located next to popular tea stores like Heytea and Nayuki Tea, creating quite a hype with long queues.

Reporters from the Star Market Daily found that when they logged into the Hong Kong mini-program of Heytea on September 29th, around 4:00 pm, there were 1405 cups in production ahead of their order, with an estimated waiting time of more than 5 hours.

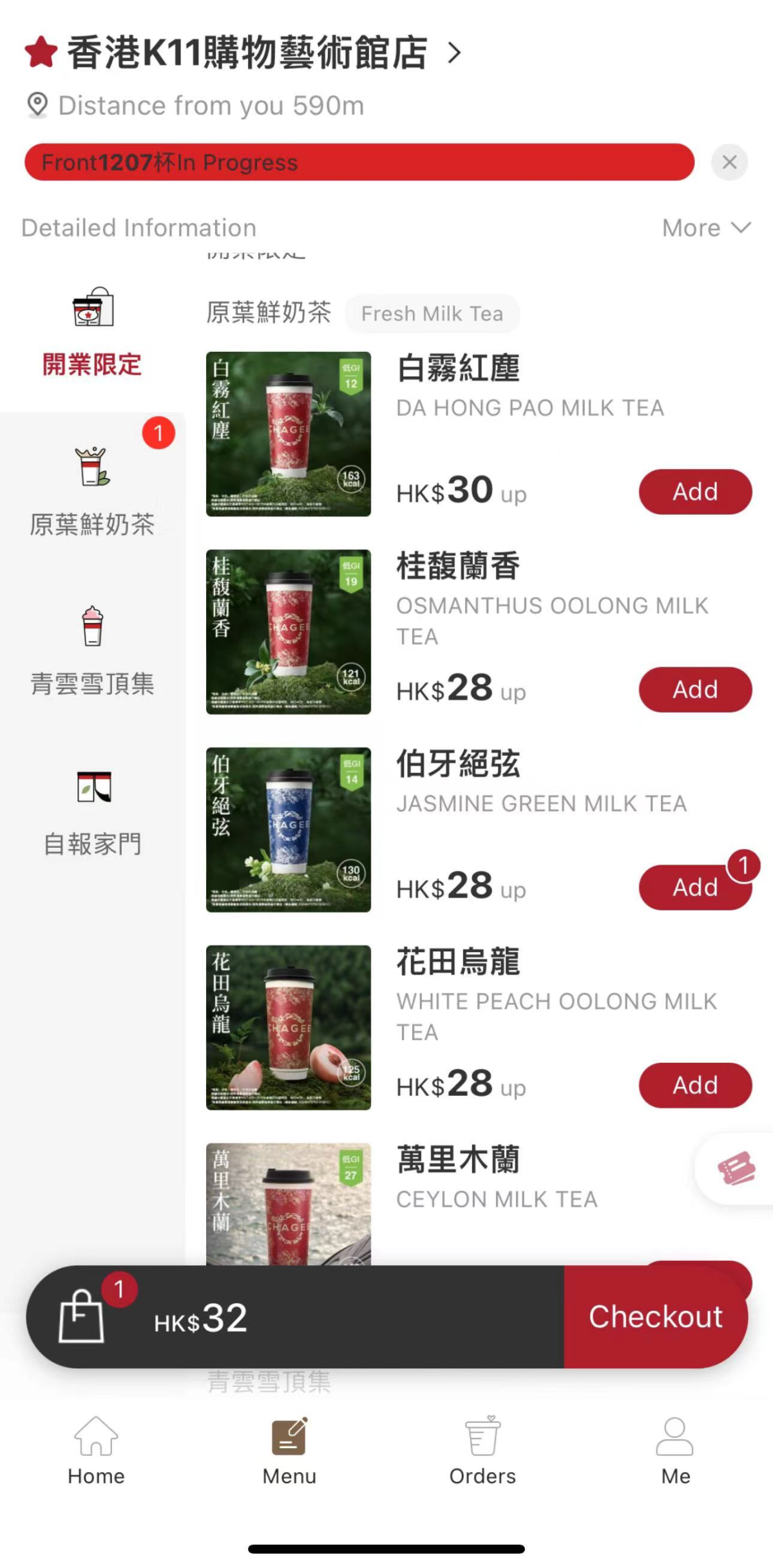

Currently, Heytea Hong Kong's first store has launched 6 products, including Boya Jue Xian and Wanli Mulan, priced between 28-34 Hong Kong dollars. The rest of the products will be gradually launched at a later time. He Yaoxiang, the person in charge of Heytea, revealed that "all products will be pushed to meet Hong Kong consumers as soon as possible."

Reporters from the Star Market Daily noticed that the signature tea drink of Heytea, "Boya Jue Xian", is priced at 28 Hong Kong dollars for a medium cup and 32 Hong Kong dollars for a large cup at the Hong Kong store.

In addition to Heytea, reporters from the Star Market Daily learned that Chabidao has also entered the Hong Kong market.

Recently, Chabidao has opened an "Chabidao Hong Kong" account on Xiaohongshu (Red) and officially announced that Chabidao will soon open its first store in Hong Kong, located at Shop 30, Lower Basement, View Mansion, 1 Sai Yeung Choi Street South, Mong Kok, Kowloon.

According to the photos shared by Chabidao Hong Kong, the store has started fence decoration, with the poster saying, "Leave your story with Chabidao, looking forward to meeting you in Hong Kong."

Chabidao Hong Kong's first store officially started trial operation on September 30th.

"In Hong Kong, cost-effectiveness is a major advantage of mainland tea beverage brands." Moons, who has been starting a business in Hong Kong for many years, shared with the Star Daily reporter.

She told the Star Daily reporter that brands like MX, with affordable prices, offer a stark contrast to Hong Kong's local milk tea and coffee priced at 30-40 Hong Kong dollars. Even a common sugar water shop on the street charges around 30 Hong Kong dollars for a cup of bubble milk tea, which has helped mainland tea beverage brands attract a wide consumer base in the Hong Kong market.

Taking MX as an example, its iconic low pricing strategy in the mainland is also effective in the Hong Kong market. In the mainland, a cup of pearl milk tea for 7 yuan, a Snow King Frost for 7 yuan, and a Strawberry Pops for 10 yuan, are respectively adjusted to 16 Hong Kong dollars, 14 Hong Kong dollars, and 20 Hong Kong dollars in Hong Kong. Despite the price increase, it is still quite affordable compared to the generally priced 30-40 Hong Kong dollars of local brands, attracting a large number of consumers.

Chinese food industry analyst Zhu Danpeng told the Star Daily reporter that due to the trend of mainland people going north to consume in Hong Kong, many brands already have a certain audience base. Therefore, expanding in Hong Kong plays a vital role in enhancing international recognition and acceptance.

"Hong Kong plays a 'bridgehead' role in the international market. Establishing stores in Hong Kong can lay the foundation for brand globalization, which is also the reason why Ba Wang Cha Ji chose Hong Kong." Zhu Dan Peng told the Star Daily reporter.

However, there are differences in consumption habits between Hong Kong and the mainland, posing higher requirements for mainland tea and coffee brands. In Zhu Danpeng's view, for brands aspiring to internationalize, stable and efficient supply chains, along with continuous improvement in service quality, will be the key factors determining their ability to establish a foothold in the global market.

It's not easy for mainland tea and coffee brands to establish themselves in Hong Kong.

In fact, a large number of mainland coffee and tea beverage brands have opened stores in Hong Kong as their outpost for going global.

As early as the end of 2018, the first Xicha store in Hong Kong officially opened on the fourth floor of Phase 1 of Shatin New City Plaza. According to the Xicha mini-program, it has opened 9 stores in Hong Kong so far. According to relevant statistics, since 2023, at least 12 mainland tea and coffee brands have entered Hong Kong, opening 30 stores, with many choosing popular business districts such as Mong Kok and Tsim Sha Tsui.

The reporter from 'Star Market Daily' noticed a Luckin Coffee recruitment advertisement circulating on Xiaohongshu, listing work locations as 'Yau Tsim Mong, Central, and other areas'. The positions open for recruitment include full-time store managers, full-time assistant store managers, and full-time or part-time baristas, with monthly salaries ranging from 0.016 million to 0.03 million Hong Kong dollars, and an hourly wage of 65 Hong Kong dollars. This means that Luckin Coffee is also about to open stores in Hong Kong.

However, the complexity and high level of competition in the Hong Kong market have posed unprecedented challenges to these mainland tea and coffee brands. Taking Nayuki's Tea as an example, several netizens posted on social media platforms that Nayuki's Tea's Peak Galleria store in Hong Kong abruptly closed in July this year.

It is understood that this store was Nayuki's first store in Hong Kong, located at Shop G08, G/F, Peak Galleria, 118 Peak Road, covering an area of approximately 222 square meters. It officially opened in November 2019 and operated for less than 5 years.

With the closure of the Peak store, Nayuki's Tea now only has one store left in Hong Kong, which is at K11 Art Mall.

Although the reason for the closure was not disclosed, according to Nayuki's recent second-quarter operation report, while maintaining a stable increase in the number of stores, Nayuki has also increased adjustments to underperforming stores, including closing some directly operated stores to optimize resource allocation. The closure of the Peak store in Hong Kong may be a specific reflection of this strategic adjustment.

In fact, Nayuki's Tea is not an isolated case. According to statistics, since 2023, 6 mainland tea and coffee brands have closed more than 15 stores in Hong Kong, with tea drink brands accounting for over 50% of the closed brands.

Yu Yihong, the founder of Future Dining Global Strategy, analyzed this phenomenon from the perspective of operating costs. In an interview with a reporter from 'Star Market Daily', he stated that Hong Kong, as a high-consumption city, has significantly higher operating costs such as rent and labor compared to mainland China, undoubtedly bringing higher operating pressures to mainland tea and coffee brands. Coupled with intense market competition, if brands fail to achieve profitability or meet expected market response in a short period of time, closing stores to reduce losses becomes an inevitable choice.

Taking Heytea and Bawangchaji as examples, the salary level of their Hong Kong stores can be seen.

According to the recruitment poster previously released by Heytea's Hong Kong stores, the monthly salary for store managers/baristas is in the range of 15,000-22,000 Hong Kong dollars, part-time store employees at 50-60 Hong Kong dollars per hour. And according to the recruitment notice of Bawangchaji, the monthly salary for the "office manager" position is as high as 0.055 million to 0.09 million Hong Kong dollars; the monthly salary for the "site development manager" position also reaches 0.03 million to 0.07 million Hong Kong dollars.

In the eyes of Yu Yihong, the uniqueness of the Hong Kong market lies in its high degree of internationalization and intense brand competition. When mainland tea and coffee brands enter this market, they not only need to face the relatively mature local tea and coffee brands, but also compete with international chain giants. In this environment, brands need to have strong differentiated competitiveness, precise market positioning, and efficient operational management capabilities.

位于旺角的茶百道首店则于9月30日正式试营业。

位于旺角的茶百道首店则于9月30日正式试营业。