Crystal Clear Electronic Material Co.,Ltd (SZSE:300655) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

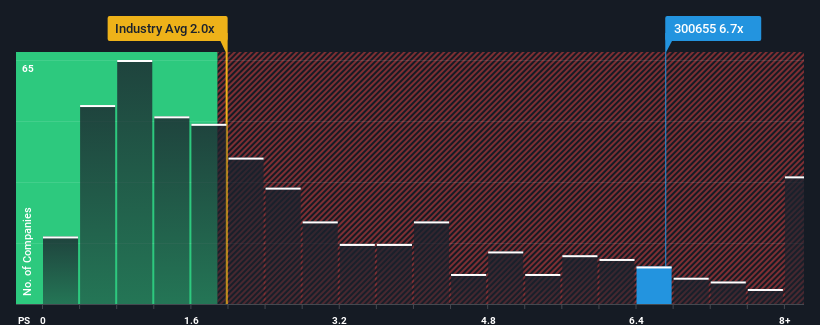

Since its price has surged higher, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may consider Crystal Clear Electronic MaterialLtd as a stock not worth researching with its 6.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Crystal Clear Electronic MaterialLtd Performed Recently?

Crystal Clear Electronic MaterialLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Crystal Clear Electronic MaterialLtd.Is There Enough Revenue Growth Forecasted For Crystal Clear Electronic MaterialLtd?

Crystal Clear Electronic MaterialLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Crystal Clear Electronic MaterialLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.6%. The last three years don't look nice either as the company has shrunk revenue by 6.3% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 23% as estimated by the four analysts watching the company. With the industry predicted to deliver 23% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Crystal Clear Electronic MaterialLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Crystal Clear Electronic MaterialLtd's P/S?

Crystal Clear Electronic MaterialLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Crystal Clear Electronic MaterialLtd currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with Crystal Clear Electronic MaterialLtd.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.