Minmetals Land Limited (HKG:230) shareholders are doubtless heartened to see the share price bounce 54% in just one week. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 65% during that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

While the stock has risen 54% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Minmetals Land isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Minmetals Land saw its revenue increase by 4.1% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 11% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Minmetals Land. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

In the last half decade, Minmetals Land saw its revenue increase by 4.1% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 11% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Minmetals Land. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

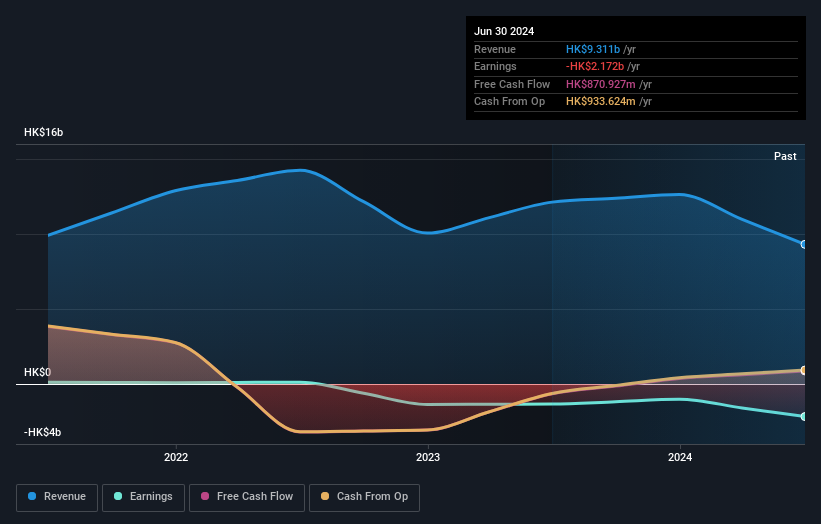

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Minmetals Land's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Minmetals Land's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Minmetals Land shareholders, and that cash payout explains why its total shareholder loss of 61%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Minmetals Land shareholders are up 2.8% for the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Minmetals Land better, we need to consider many other factors. For instance, we've identified 3 warning signs for Minmetals Land (2 shouldn't be ignored) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.