The Shenzhen MinDe Electronics Technology Ltd. (SZSE:300656) share price has done very well over the last month, posting an excellent gain of 26%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.8% over the last year.

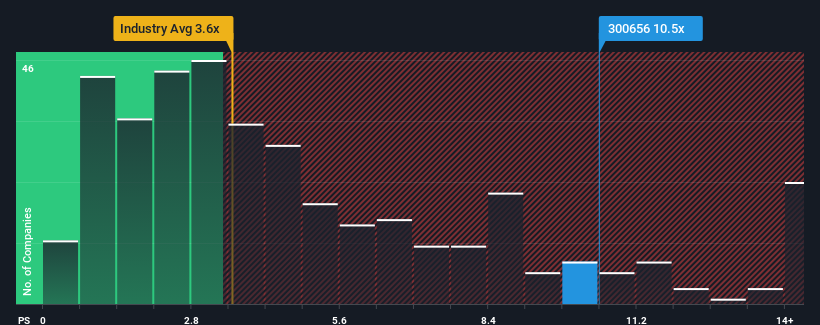

After such a large jump in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.6x, you may consider Shenzhen MinDe Electronics Technology as a stock not worth researching with its 10.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Shenzhen MinDe Electronics Technology Has Been Performing

As an illustration, revenue has deteriorated at Shenzhen MinDe Electronics Technology over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen MinDe Electronics Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Shenzhen MinDe Electronics Technology?

Shenzhen MinDe Electronics Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Shenzhen MinDe Electronics Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. As a result, revenue from three years ago have also fallen 23% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Shenzhen MinDe Electronics Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Shenzhen MinDe Electronics Technology's P/S?

Shares in Shenzhen MinDe Electronics Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shenzhen MinDe Electronics Technology revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you take the next step, you should know about the 2 warning signs for Shenzhen MinDe Electronics Technology that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.