Shenzhen New Nanshan Holding (Group) Co., Ltd. (SZSE:002314) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

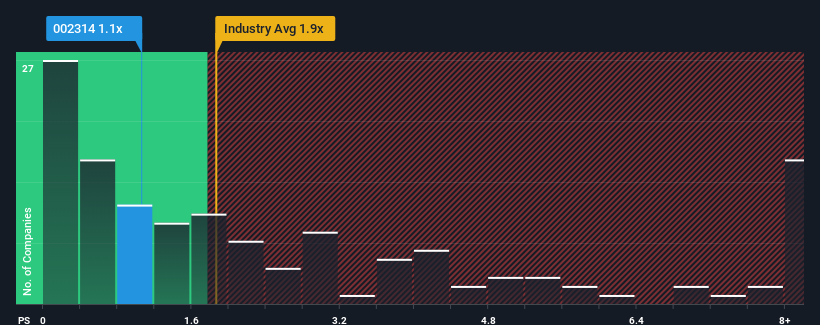

Even after such a large jump in price, Shenzhen New Nanshan Holding (Group)'s price-to-sales (or "P/S") ratio of 1.1x might still make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Shenzhen New Nanshan Holding (Group) Performed Recently?

For example, consider that Shenzhen New Nanshan Holding (Group)'s financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Shenzhen New Nanshan Holding (Group) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen New Nanshan Holding (Group) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Shenzhen New Nanshan Holding (Group)?

The only time you'd be truly comfortable seeing a P/S as low as Shenzhen New Nanshan Holding (Group)'s is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Shenzhen New Nanshan Holding (Group)'s is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 62%. The last three years don't look nice either as the company has shrunk revenue by 50% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

In light of this, it's understandable that Shenzhen New Nanshan Holding (Group)'s P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Despite Shenzhen New Nanshan Holding (Group)'s share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Shenzhen New Nanshan Holding (Group) confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Shenzhen New Nanshan Holding (Group) you should be aware of, and 2 of them are a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.