Despite an already strong run, China Resources and Environment Co.,Ltd. (SHSE:600217) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

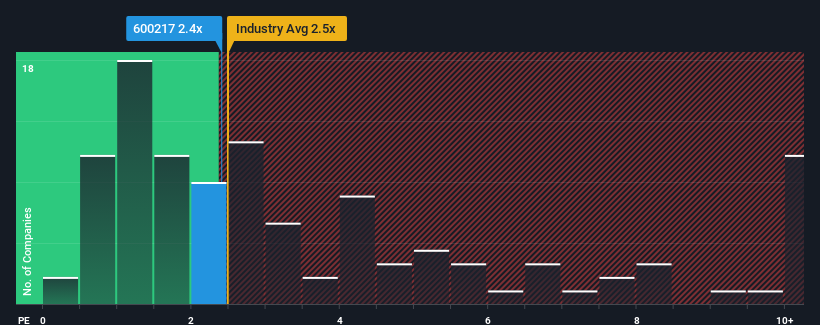

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Resources and EnvironmentLtd's P/S ratio of 2.4x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in China is also close to 2.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How China Resources and EnvironmentLtd Has Been Performing

The revenue growth achieved at China Resources and EnvironmentLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Resources and EnvironmentLtd's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For China Resources and EnvironmentLtd?

In order to justify its P/S ratio, China Resources and EnvironmentLtd would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, China Resources and EnvironmentLtd would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that China Resources and EnvironmentLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

China Resources and EnvironmentLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China Resources and EnvironmentLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for China Resources and EnvironmentLtd (2 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on China Resources and EnvironmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.