Hangzhou Raycloud Technology Co.,Ltd (SHSE:688365) shareholders have had their patience rewarded with a 35% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

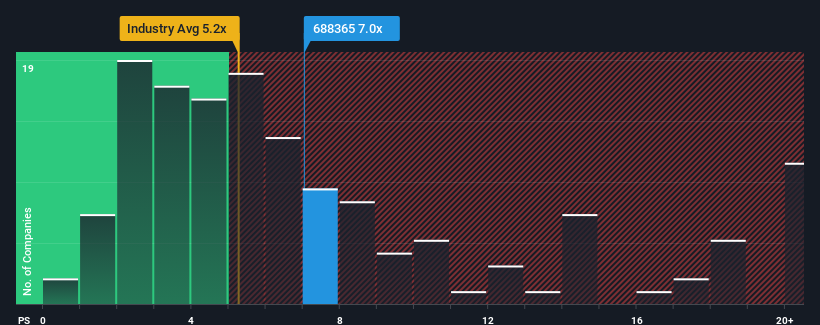

After such a large jump in price, given close to half the companies operating in China's Software industry have price-to-sales ratios (or "P/S") below 5.2x, you may consider Hangzhou Raycloud TechnologyLtd as a stock to potentially avoid with its 7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Hangzhou Raycloud TechnologyLtd's Recent Performance Look Like?

Recent times haven't been great for Hangzhou Raycloud TechnologyLtd as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hangzhou Raycloud TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Hangzhou Raycloud TechnologyLtd's is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as Hangzhou Raycloud TechnologyLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 12% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 16% over the next year. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

In light of this, it's alarming that Hangzhou Raycloud TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Hangzhou Raycloud TechnologyLtd's P/S?

Hangzhou Raycloud TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Hangzhou Raycloud TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 1 warning sign for Hangzhou Raycloud TechnologyLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.