Jiangsu Sanfame Polyester Material Co.,Ltd. (SHSE:600370) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

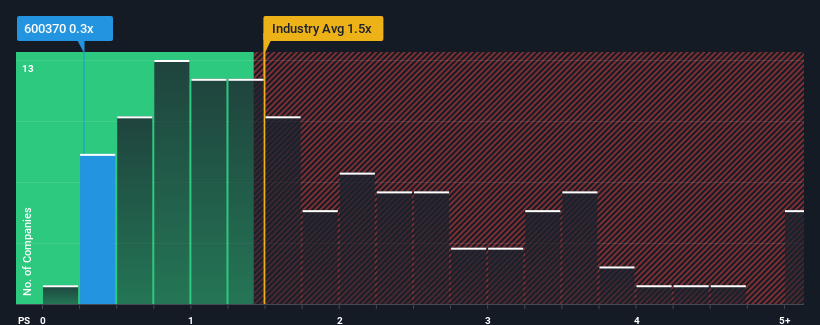

Although its price has surged higher, considering around half the companies operating in China's Luxury industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Jiangsu Sanfame Polyester MaterialLtd as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Jiangsu Sanfame Polyester MaterialLtd Has Been Performing

Revenue has risen at a steady rate over the last year for Jiangsu Sanfame Polyester MaterialLtd, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. Those who are bullish on Jiangsu Sanfame Polyester MaterialLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Sanfame Polyester MaterialLtd's earnings, revenue and cash flow.How Is Jiangsu Sanfame Polyester MaterialLtd's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jiangsu Sanfame Polyester MaterialLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jiangsu Sanfame Polyester MaterialLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.8% last year. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Jiangsu Sanfame Polyester MaterialLtd is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Jiangsu Sanfame Polyester MaterialLtd's P/S?

Jiangsu Sanfame Polyester MaterialLtd's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Jiangsu Sanfame Polyester MaterialLtd revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Jiangsu Sanfame Polyester MaterialLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.