The Shanghai Medicilon Inc. (SHSE:688202) share price has done very well over the last month, posting an excellent gain of 41%. But the last month did very little to improve the 53% share price decline over the last year.

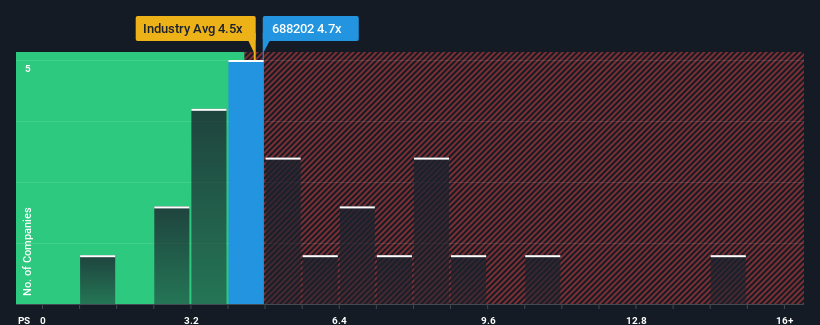

In spite of the firm bounce in price, it's still not a stretch to say that Shanghai Medicilon's price-to-sales (or "P/S") ratio of 4.7x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in China, where the median P/S ratio is around 4.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Shanghai Medicilon Has Been Performing

Recent times haven't been great for Shanghai Medicilon as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Medicilon will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shanghai Medicilon?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai Medicilon's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai Medicilon's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 119% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Shanghai Medicilon is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Shanghai Medicilon's P/S?

Its shares have lifted substantially and now Shanghai Medicilon's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Shanghai Medicilon's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 1 warning sign for Shanghai Medicilon that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.